Developing a Trend-Following System

Benefiting from Trading in Trending Markets One of the most famous quotes about stock market investing reportedly came from legendary investor Jesse Livermore – famous as a pioneer of day trading — who said, “the trend is your friend!” Years later what may be a matter of urban legend has it that Martin Zweig –…

Equal Weight Investing Strategies

Using Equal Weight Investing Strategies For investors looking for long term growth in their investments portfolio, diversification is universally lauded as one of the most fundamental approaches to achieving that goal. The idea is to build of portfolio of assets that adhere to the old adage – ‘Don’t put all your eggs in one basket.”…

Upcoming ASX IPOs – Floats to Watch Out For

Newcomers to share market investing during their search for “rules of the road” come across conflicting advice regarding the risk/benefit ratio of investing in companies looking to offer shares to the public. This article will try to illuminate the mystery behind the contradictory views, offering some guidelines for investing in IPOs. What is an IPO?…

What Are Safe Haven Investments?

Social and psychological explanations for investing behavior have seeped into the world of share market investing through the advent of the academic field of Behavioral Finance. Loss aversion is one of the most significant contributions behavioral finance has introduced into stock market investing. Simply put, loss aversion states investors feel more pain from a loss…

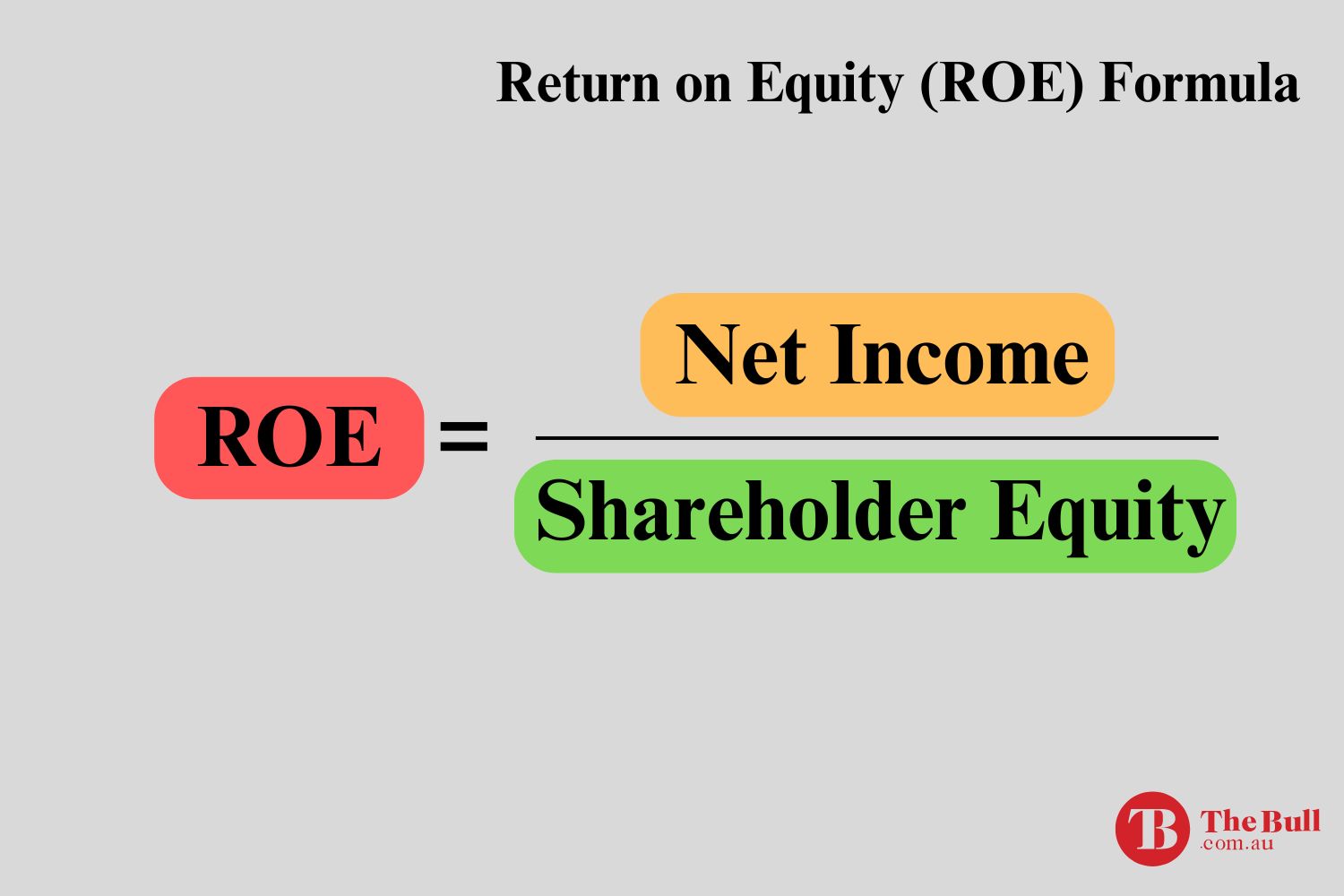

Return on Equity (ROE) – Is It the ‘Magic Number’ of Share Picking Tools?

For most share market investors around the world, fundamental analysis is the essential strategy for identifying worthy investment targets. In the long distant past, the process began with investors combing through a company’s financial statements reported to the investing public – the Balance Sheet, the Income Statement, and the Statement of Cash Flows – to…

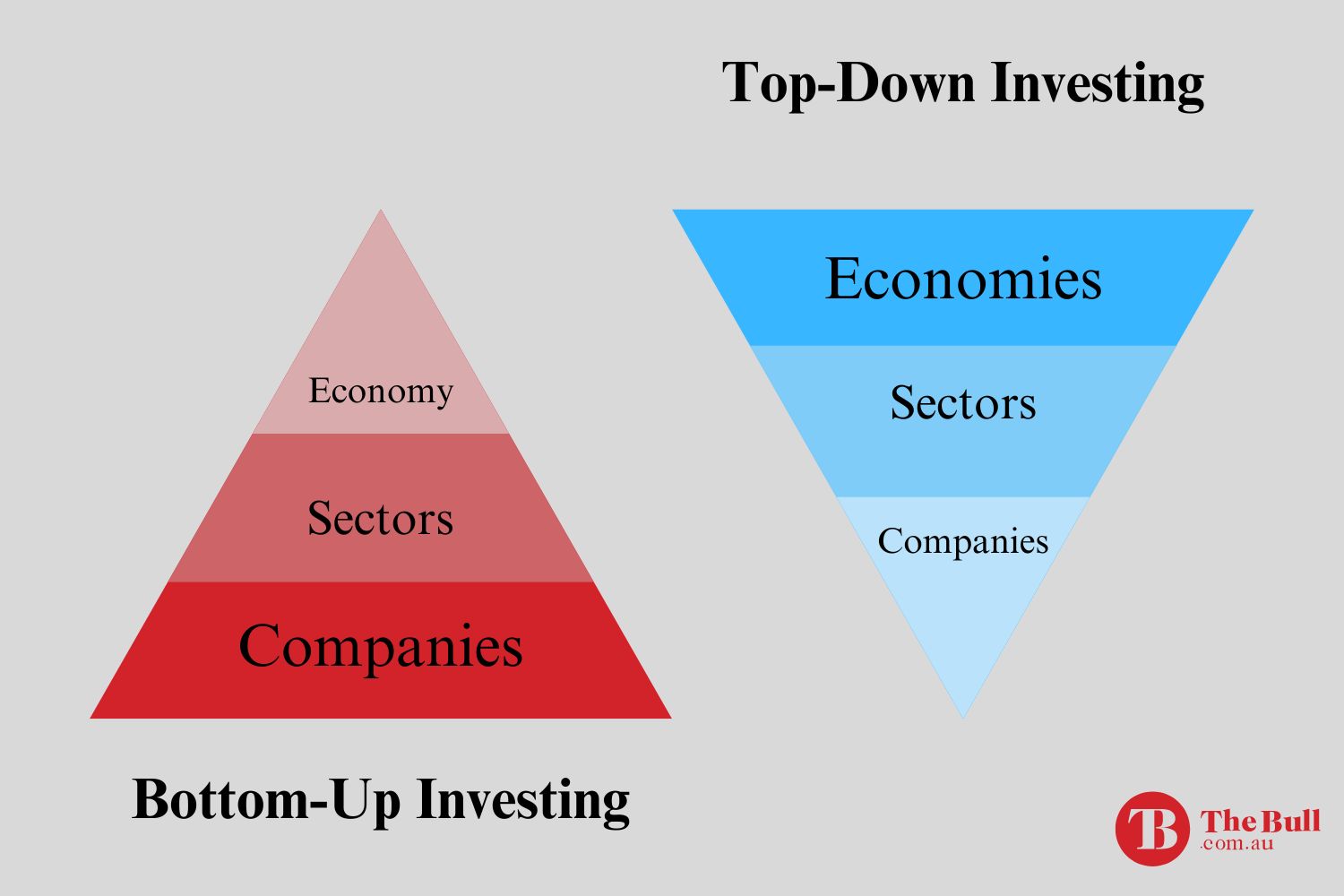

What’s the difference between top down and bottom up investing?

Top Down and Bottom Up Investing Strategies Newcomers to stock market investing surged during the COVID 19 Pandemic, but the trend preceded COVID and remains in place. Some jumped into markets without much investment analysis, relying on tips from friends and relatives or business news highlighting the hot stock of the day. Others approach investing…

How to Invest In Japanese Stocks in Australia

Diversifying Your Portfolio with Japanese Stocks Many newcomers to share market investing are tempted to restrict their initial investments to the “hot stocks” of the moment, but many experienced traders choose to invest in Japanese stocks as a way to diversify their portfolios. At the turn of the century, .com stocks were the place to…

How to Invest In US Stocks in Australia

Diversifying in the US Stock Market The COVID 19 Pandemic accelerated a trend already in place – the arrival of a new class of investors, largely young. Those investors while educating themselves soon learned the value of building a portfolio of diversified holdings. Diversification reduces investment risk by spreading investments across various assets with differing…

How to Invest In UK Stocks in Australia

Diversifying Beyond the ASX The Australian Stock Exchange may be small in size compared to the world’s behemoths like the US S&P 500 and the UK’s FTSE 100, but our national stock market index has features attractive enough to lure stocks from around the world as a launching pad for an initial public offering (IPO)….

BHP vs Rio Tinto – Which is the better investment?

Comparing BHP Group (ASX: BHP) and Rio Tinto (RIO) in 2025 and Beyond Australia has long been known as “the lucky country” due to our abundance of the natural resources needed for the rest of the twenty first century and beyond. The ASX has some of the best mining companies in the world, key among…