Is AMP Limited’s (ASX: AMP) Business Transformation Working?

A Royal Commission into the Financial sector uncovered damning practices by AMP Capital. The company responded with a plan to restructure its operations into two entities. A class action suit filed against AMP Capital has now been settled. Diversified financial services provider AMP Limited (ASX: AMP) saw its share price embark on a steady decline…

Alderan Resources (ASX: AL8) Stuns Investors

Metals explorer Alderan Resources listed on the ASX in 2017 The company closed its first day of trading at $0.47 per share Within months the share price hit an all-time high of $2.18 Alderan Resources joined the ASX with four prospective copper/gold assets in Utah in the US, with the flagship at the Frisco Project….

Insider Selling Creates a Buying Opportunity for Viva Energy (ASX: VEA)

Investors sold off shares of Viva Energy following news of insider selling by a major shareholder. Viva is diversified, supplying products to Australian consumers and industries. The company has infrastructure in place for domestic and international distribution. Viva Energy shares were in an upward trajectory over the last three months before the news of insider…

Chalice Mining (ASX: CHN) Loses Market Darling Status

Chalice Mining changed its focus from gold to battery minerals – nickel, copper, and platinum group elements. In 2020, the company excited investors with the discovery of the Gonneville deposit in Western Australia. In early 2020, gold miner Chalice Mining (ASX: CHN) caught fire on a gold strike at the company’s Pyramid Hill Gold Project…

James Bay Minerals (ASX: JBY) Joins Big Name Miners Developing Lithium Projects

ASX-listed mining companies Allkem Limited (ASX: AKE) and Rio Tinto (ASX: RIO) have lithium projects underway in the James Bay Region of Quebec, Canada. James Bay Minerals raised six million dollars in its recent IPO (initial public offering). The company’s share price shot up from its opening price of $0.20 per share to $0.52 per…

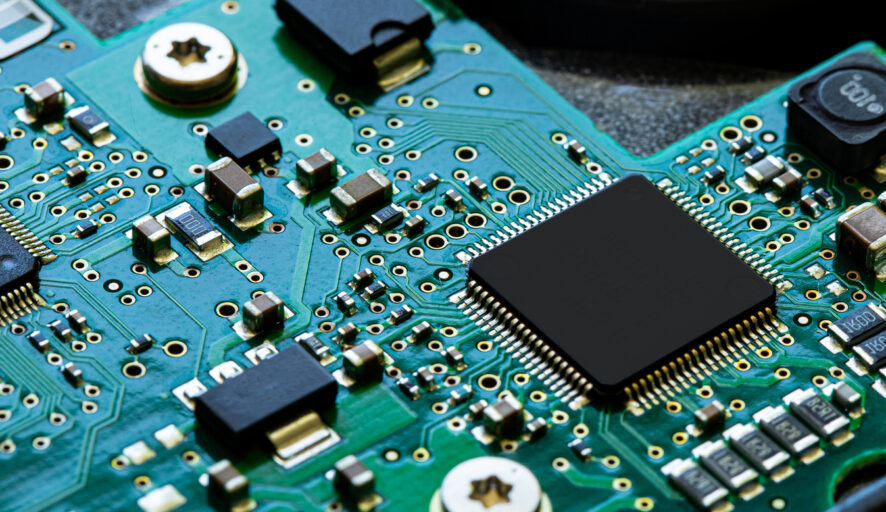

Altium Limited (ASX: ALU) Powered by Major Megatrends

Altium produces software used by designers of printed circuit boards (PCBs). The company’s Altium Designer is ranked as the world’s top PCB software design tool, according to Altium. Altium Designer is a product for PCB engineers. The company has added a cloud platform – Altium 365 – an electronic design platform allowing access and collaboration…

APA Group (ASX: APA) – High Dividends and High Growth Potential

Gas infrastructure entity APA Group already transports half of the natural gas used in Australia. The company’s current asset base includes pipelines, gas storage and processing facilities, and a gas power station. APA Group is increasing its renewable energy holdings. Despite taking a COVID-19-induced dip in APA Group’s financial performance in FY 2021, the company…

Analysts Bullish on Integrated Lottery Services Provider Jumbo Interactive (ASX: JIN)

Jumbo Interactive has grown both revenue and profit in each of the last four fiscal years. Jumbo has been creating lottery software programs for more than twenty years. The company has paid dividends every year since FY 2016. Jumbo Interactive serves global government and charitable lottery providers with integrated services, from lottery game design to…

Uranium Demand Driving Bannerman Energy (ASX: BMN)

The push to reduce carbon emissions has breathed new life into Nuclear Energy for electricity generation. The price of uranium has been steadily rising since January 2017. The Bannerman Energy share price began a volatile upward trajectory at the close of the 2020 calendar year. Nuclear energy is back in the mix of energy sources…

Taking Profits on Azure Minerals (ASX: AZS) – a Mixed View

Positive drilling results at the company’s Andover Lithium Project in Western Australia have sent the share price skyrocketing. The soaring share price of Azure Minerals has at least one analyst recommending investors consider taking profits. The positive drilling announcements continue, and Azure is now a potential takeover target. Year to date, the Azure Minerals share…