What Are Rights Issues and How Do They Work?

Rights Issues – What They Are and How They Work A Rights Issue – also known as a Rights Offering is one of several ways a company has raise capital needed for a variety of purposes. They are one form of capital raising under the umbrella of Equity Financing. What is a Rights Issue? Equity…

Is Capital Raising A Signal To Sell?

Capital Raising – A BUY, HOLD, or SELL Signal? In simple terms, capital raising is a company’s attempt to raise cash from outside sources. Taken at face value, it means the company needs more money than it has internally to achieve some strategic goal. To many investors, the nature of the goal is the determining…

5 Trading Psychology Tips to Improve Your Online Trading

Behavioral Finance Tips for Successful Trading In 1912, American author George Charles Selden pooled his decades of research into a book that would become ground breaking – the Psychology of the Stock Market. At the time, the prevailing view of market experts was that investor buying and selling behavior and the resultant ebb and flow…

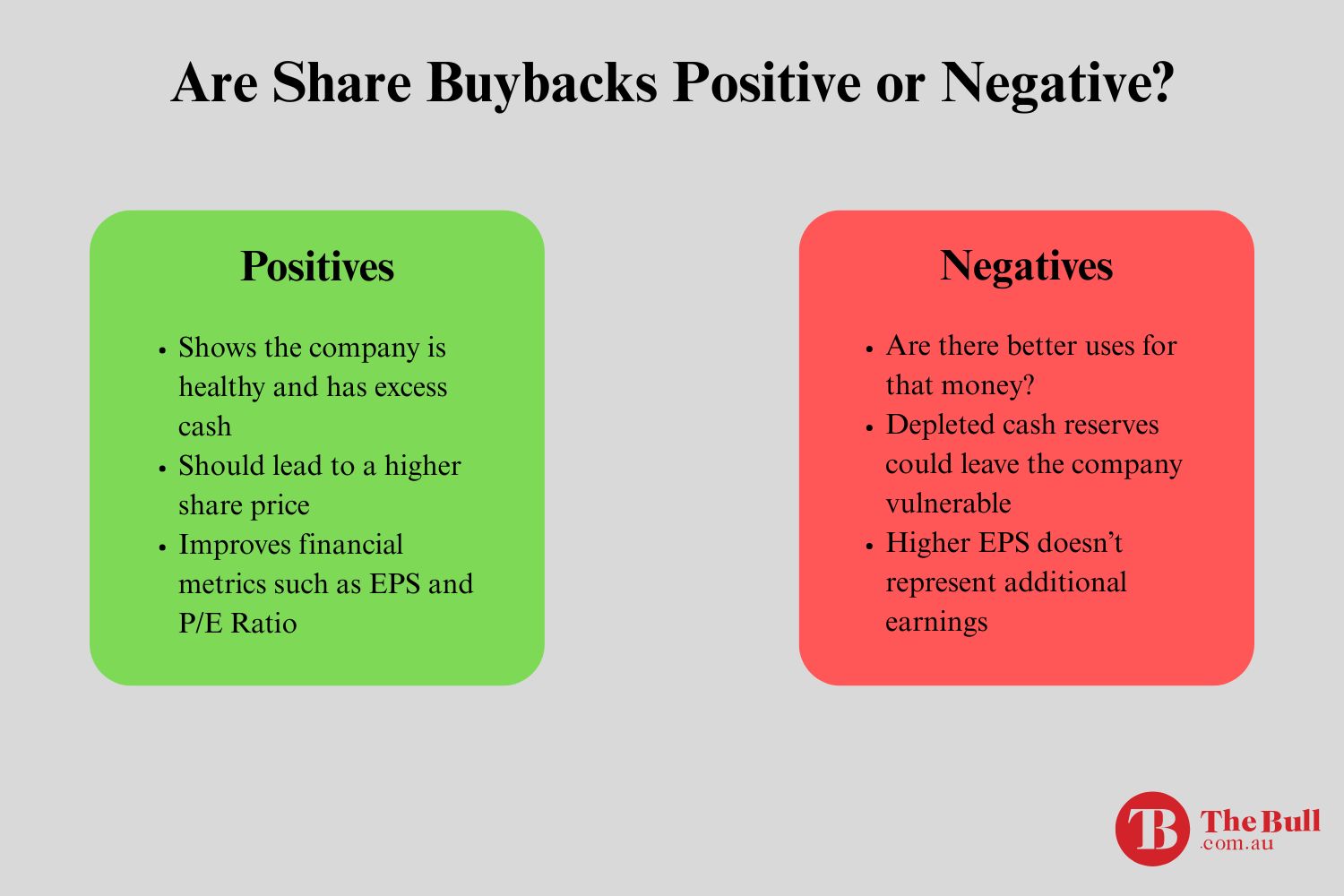

Share Buybacks: Are They a Positive or Negative Sign?

What Are Share Buybacks? Share Buybacks, or Share Repurchases, are one of two ways publicly traded companies can achieve one of their primary goals – to maximise shareholder value. Companies have two methods for potentially increasing the value of their stock and returning cash directly to their shareholders – dividend payments and share buybacks. Both…

Tips For Successful Long Term Investing

A Guide for Long-Term Investing Some newcomers to long term investing begin with one thought in mind – find a stock that will return a profit. With a deeper understanding of how markets work, these newcomers realize they need to have a framework for how much profit they are willing to accept and how long…

Deciphering Earnings Reports

What to Look for in Company Earnings Reports The “Do Your Due Diligence” mantra luring Aussie investors to spend time digging into the earnings reports ASX listed companies are required to report for the Full Year and the Half Year. US investors are faced with the task of deciphering US listed stocks financial reports released…

Due Diligence for Australian Shares

Due Diligence for Retail Investors With global stock markets in turmoil the recent influx of new, primarily young people looking to the markets as a place to get solid returns on their investment dollars may be ebbing. The challenge facing these investors is now more challenging – how do you pick a stock in which…

Understanding The Cash Conversion Cycle

The Cash Conversion Cycle – a Superior Liquidity Measure When it comes to picking a stock for investment investors typically have two strategies for evaluating worthy targets – fundamental analysis and technical analysis, with fundamental analysis being the most common. Technical analysis relies on historical stock price movement while fundamental analysis examines a company’s overall…

How Short Sellers Profit From Price Plunges

Making a Profit on Falling Stock Prices To some people unfamiliar with how stock markets operated, investing in stocks is nothing more than gambling. In a sense, that view has some truth in it but in reality for the vast majority of investors, the “bets” placed on individual stocks are educated bets. Picking stocks is…

Developing a Trend-Following System

Benefiting from Trading in Trending Markets One of the most famous quotes about stock market investing reportedly came from legendary investor Jesse Livermore – famous as a pioneer of day trading — who said, “the trend is your friend!” Years later what may be a matter of urban legend has it that Martin Zweig –…