Inflation and where to put your money

- Wage growth is inversely related to the stock market performance.

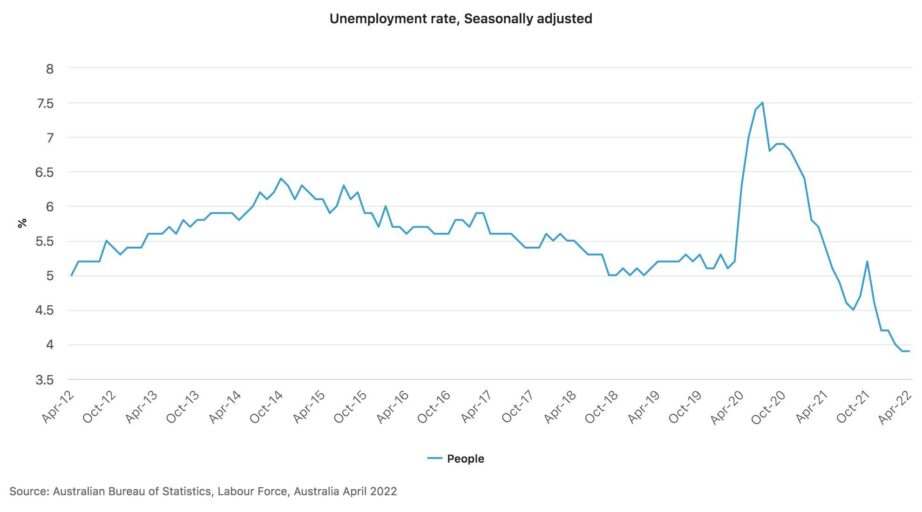

- Australia is currently experiencing record-low unemployment and rising wage inflation.

- Three investments to watch that historically buck the trend.

While rising prices at the pump, grocer, and home are taking directly from consumers’ wallets, employers are helping out a little by tacking on salary increases linked to inflation.

Those raises have to come from somewhere and that’s directly from the shareholders’ pockets by lowering net operating margins and decreasing shareholder returns.

When wage inflation goes up, share prices go down and vice versa.

A tight labour market is lifting wages

Right now we’re entering a period of high employment relative to past periods.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

With the difficulties in the movement of people in recent times, the unemployment rate amongst the workforce is at record lows and the tightness in the labour market is starting to be felt in wage inflation.

The average pay increase in the private sector grew by 2.2% since September 2021.

Traditional ways to select your investments in an inflationary environment

When prices are steadily increasing, here are some of the better portfolio allocation responses:

- Companies that are able to pass on price rises to consumers or have sales linked to market prices e.g. Non-discretionary retailers and resource companies

- Rising rates tend to hurt bonds, the response is to increase allocation to equity

- Shift to entities that have international operations, away from a tight Australian labour market

- Real estate tends to do well under gradually rising prices and interest rates

- Treasury Indexed Bonds

While the above responses work well under moderate inflation they should also be applied to a balanced portfolio.

When prices are rising sharply and wage inflation is heating up the following stocks could be worth considering.

BHP Billiton Limited (BHP:ASX)

BHP exhibits the lower end of a statistical relationship between wage inflation and share price.

BHP revenues are linked to international market prices that continually adjust for inflation. Combined with an international contractor workforce, the BHP share price movements are independent of fluctuations in Australian wage inflation.

A healthy dividend yield of 10.4% and a tight resource market provide support to valuations. As China exits lockdown the near-term outlook remains bullish.

BHP is up 14% year to date.

Woolworths Group Limited (WOW:ASX)

As the nation’s largest and most preferred supermarket some price hikes can be passed on to the consumer.

It’s not entirely shielded from wage inflation but a diverse supply chain and a semi-flexible workforce position WOW nicely to weather an inflationary storm.

A modest dividend yield of 2.3% compared to peers Coles Group (COL:AX) 3.8% is traded for market positioning and the security of your investment.

WOW is down 9% year to date.

BetaShares Global Energy Coms ETF – Currency Hedge (FUEL:ASX)

This ETF will thrive in an inflationary environment by exhibiting a positive relationship between valuations and price hikes.

As a basket of international energy companies, these ETF holdings expenditures are inoculated from Australian inflation and revenues adjust for any rises in the energy lifeblood of the economy.

FUEL is up 46% year to date.

Whether you’re looking to ride headlong into the inflationary storm or skirt around it, very few investments offer complete shelter but some are more forgiving than others. What we can be certain of is that high inflation is no longer transitory.