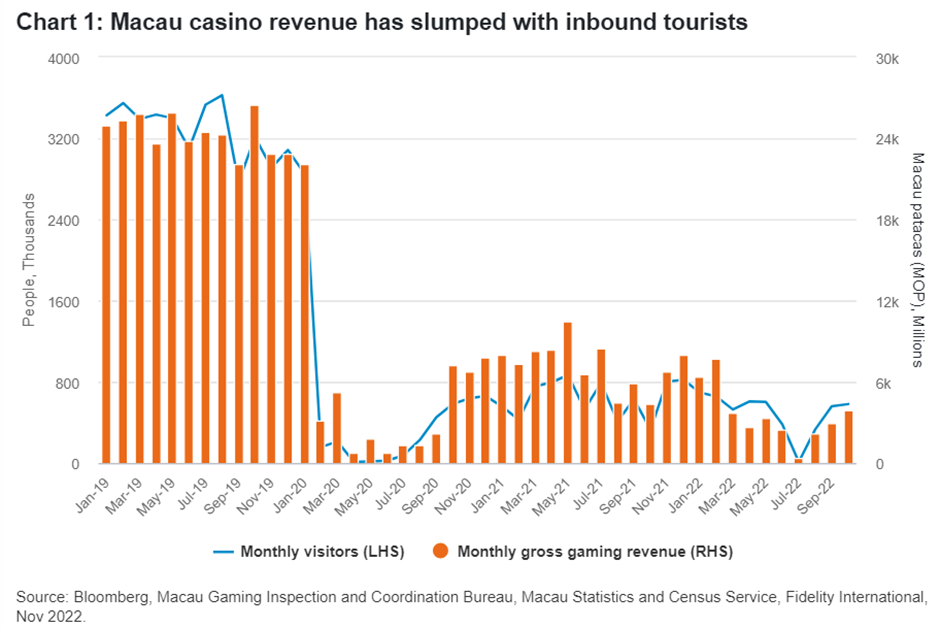

The chips are down for China’s casino capital. Macau’s tourist numbers have dwindled amid Covid restrictions, to the point that the city is about to hand back the crown it nabbed more than a decade ago from Las Vegas – a stunning reversal when you consider that at one point Macau’s casino revenues were more than six times higher than the Las Vegas Strip. But today, the city’s tourism-dependent economy is on track for a double-digit annual contraction after shrinking more than 30 per cent in both the second and third quarters.

Macau’s economic woes can be largely attributed to its high concentration on gambling and overreliance on visitors from China’s mainland. Attempts to diversify these two risks have had only modest amounts of success over the years.

That has brought Macau to today’s recessionary crossroads, and the city is seeking to turn a crisis into an opportunity to remake itself. The local government has just announced the renewal of gaming licenses for the city’s six existing casino operators, removing uncertainties over their business continuation. At the same time, policymakers and casino firms are working on plans to add non-gambling attractions and diversify the city’s source of tourists. And in the longer term, Macau may leverage its status as a Chinese special administrative region to pilot experiments in high tech or financial markets. But for now, our research suggests the focus is on drawing up plans to increase hotel rooms, convention space, entertainment venues, restaurants, retail facilities and cultural attractions.

As part of the license renewal deal, policymakers have yet to reveal the capital expenditure requirements of casino operators over the next 10 years. Casino firms that have already been running high-quality and non-gambling facilities are better positioned to thrive in a new era of diversification. We expect more details to emerge in the coming weeks when concession agreements are formally signed.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Doubling down on tourism

Despite the city’s plan to diversify its economy, we expect Chinese tourists to remain the cornerstone of Macau’s economy for the near term. The entire city is holding its breath for a large-scale return of visitors from the north, as China starts to ease restrictions on approving Macau-bound visas. In November, visa processing time for both individual and group tourists was shortened to less than a day from one to two weeks. More easing measures may follow.

Nevertheless, the expected tourism rebound isn’t a sure bet. The timing and pace of any broader rollback of China’s Zero-Covid-Policy remains uncertain; case numbers across the mainland have been climbing in recent weeks even as some targeted restrictions are being relaxed and authorities redouble vaccination efforts. Macau for its part has sometimes struggled to stay in line with China’s stringent Covid controls and lobbied mainland policymakers to ease border controls. But as casino revenue dwindles and the fiscal deficit widens, Macau is racing against time to bring back mainland visitors.

Test case for reopening

Casino hotel operators are counting on China’s pent-up demand for travel and entertainment, even as the country’s broader consumption indicators have weakened in recent months. In this sense, Macau’s reopening will provide a test case for the spending power of Chinese consumers, as it becomes the first “travel bubble” for China’s outbound tourists in months. New travel arrangements with Macau could potentially become a model for mainland China to reopen tourism with Hong Kong and other destinations.

Even with the easing of travel curbs, Macau will remain a long way off returning to its pre-Covid economic prosperity. The city’s best bet for reviving casino revenue growth seems to be attracting more mass-market gamblers, as the VIP segment shrinks in significance with cross-border promotion and money flows coming under greater regulatory scrutiny.

Macau’s makeover is a test for both the local economy and the multinational casino operators that the city relies on for the bulk of its tax revenues and jobs. But the record shows how diversification is easier said than done. In the current context, what happens in Macau matters beyond its borders, and the city’s tentative reopening to tourists from the mainland serves as a test case both for China’s eventual emergence from Covid restrictions, and a proxy measure for consumer confidence.

Originally published by Fidelity International investment experts