Just as humans have towns and cities, the living world has forests. They are nature’s melting pot – home to countless forms of animal and plant life. What’s more, they play a critical role in stabilising our climate. Trees, plants, and bushes absorb carbon dioxide, sunlight and water, then convert the water into oxygen and the carbon dioxide into glucose through a process known as photosynthesis .

Humans have a mixed relationship with the forest. For thousands of years, it provided food and shelter, but at the same time, we also cleared the land for crops and grazing. What has changed more recently is the pace of destruction. Rapid population growth and economic development have seen vast swathes of primary or original forest destroyed.

Deforestation is also a driver of climate change and increases biodiversity loss, which has significant economic consequences. Investors are increasingly aware that addressing deforestation is just as urgent as climate change. The United Nations supported Principles for Responsible Investment indicates that deforestation is a systemic risk for investors1 and notes that forests absorb 40 per cent of greenhouse-gas emissions.

Deforestation – damaging to the climate and economy

The economic drivers behind deforestation are often short term. People may want to use the forest for wood or crops, which will deliver some short-term benefits. Sadly, the land is often permanently altered or damaged, impacting weather patterns or increasing flood risk. The near-term benefits gained by deforestation are often outweighed by the longer-term impact caused to the environment, people, and the economy.

What are the leading causes of deforestation?

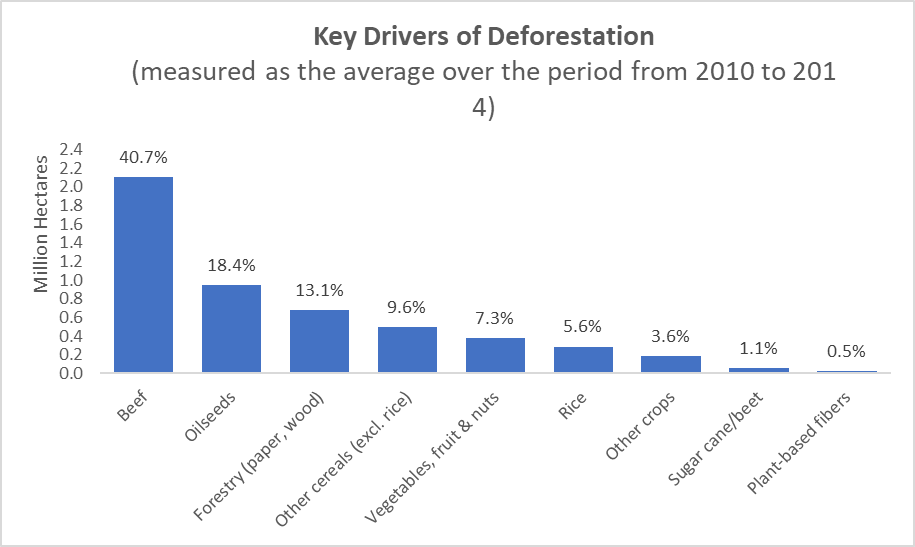

Not all tree loss is equal, and only certain types of deforestation are viewed unfavourably. The principal drivers of unsustainable deforestation are beef farming and oilseed production. At current levels, they account for nearly 60 per cent of destruction (as demonstrated in Graphic 1 below).

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Other causes include wildfires, urbanisation, and forestry. Of these, wildfires are difficult to control, but it is worth noting that they may be caused by climate change. Meanwhile, urbanisation and logging, although worrying if not appropriately contained, are somewhat less of a concern than rampant agricultural deforestation.

Source: Florence Pendrill et al. 2019. Deforestation displaced: trade in forest-risk commodities and the prospects for a global forest transition.

How can consumers help reduce tropical deforestation?

Buying power can lead to positive change. It can be as simple as reading food labels and choosing not to purchase products that contain contentious ingredients. Similarly, people may opt to avoid using paper by printing only what is needed and storing everything else in the cloud.

Indeed, when consumers became aware of the damage caused by palm oil production, the industry made a concerted effort to reduce its environmental impact. Similarly, soya bean producers and traders in Latin America agreed to work together and reduce deforestation caused by their activities.

Also, consumers who buy alternatives to beef are letting companies know they have a choice. In turn, this could stimulate further investment in developing meat-free products.

How the supply chain can be monitored

In pursuing net-zero carbon emissions and being mindful of the United Nations’ sustainable development goals (SDGs), Fidelity International has joined forces with other investors to pledge to work to eliminate unsustainable commodity-driven deforestation from its investments by 2025.

The aforementioned palm oil sector has a notoriously long and complex supply chain that spans multiple stakeholders. As such, our sustainable investment policy is to engage down the supply chain to promote new and less damaging production methods.

Highlighting the reputational risks for companies

Rising consumer awareness also means companies face real financial risks if people believe that firms are not doing enough to halt deforestation. Coupled with this are the technological advancements noted above that allow us, as investors, to identify businesses with deforestation in their supply chains.

When deforestation is brought to light, the subsequent reputational damage could be severe and lead to a swift loss of market share. And if anti-deforestation policies become more strictly enforced, the profitability of associated sectors, like mining, could also be affected. From an investment perspective, if your portfolio holds such businesses, then its performance may be at stake.

Uncovering whether companies in your investment portfolio contribute to deforestation is not always straightforward. Therefore, investors may wish to identify financial firms with environmental, social, and governance (ESG)-focused products that seek out innovative businesses actively addressing the deforestation challenge.

Originally published by Fidelity International investment experts