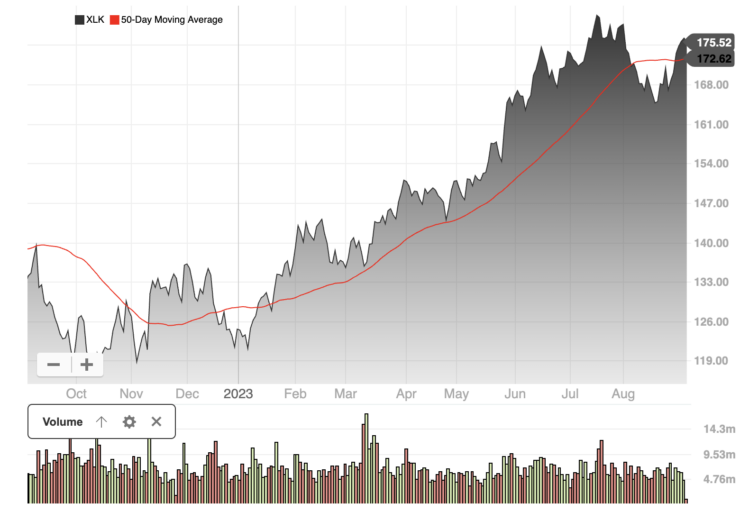

Although the lacklustre performance of tech stocks in 2022 disappointed investors, the sector jet-propelled in 2023. This resulted in 33% growth year on year (as of 5th September 2023) based on the Technology Select Sector SPDR ETF (ticker: XLK) versus the S&P 500, reflecting less than half that metric for the same period.

Source: money.usnews.com

This year’s upward trajectory of US tech stocks is unsurprising, considering that the sector’s extraordinary long-term buying opportunities emerge after stubborn underperformance lapses. So, one might say that the uptrend was foreseeable, and 20/20 vision confirms it as typical. However, it isn’t quite so straightforward.

In Q4 2022, the economy’s future was murky (to say the least), with the Feds reiterating that a recession was probably on the cards. Indeed, inflation headwinds were buffeting every country globally, energised by supply chain disruptions and spiralling gas prices. In addition, the Fed pushing interest rates to a 21-year high (i.e., not witnessed since 2002) was not something to take lightly.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The Best US Tech Stocks

In light of the above, the boomerang comeback of US tech stocks reflected exceptional resilience. However, just because an asset is in the tech arena doesn’t mean that it’s a slam-dunk opportunity. Caution is the watchword, and a researched selection is critical to uncover the best tech stocks in 2023 with sustainable returns going into 2024 and beyond. They’re undoubtedly in the wings and will probably lead all the investment categories. So, we left no stone unturned in uncovering the US tech stocks that are head and shoulders above the rest.

Avoiding an investor’s liquidity crunch is vital. Consequently, we only focus on large caps that one can transact instantly. Secondly, our vision was to identify five outstanding entities at the cutting edge of the technology revolution, shaping our future with mind-boggling mobile devices or digital services so integrated with our lifestyles that progressing without them is inconceivable. Our selected candidates, as follows, are all-rounders with the power to sustain long-term upward momentum:

- Apple Inc. (AAPL)

- Microsoft Corp. (MSFT)

- Salesforce Inc. (CRM)

- Cisco Systems Inc. (CSCO)

- Broadcom Inc. (AVGO)

The observations and conclusions below circle back to CFRA – a globally recognised research think-tank serving financial advisors with independent intelligence solutions and underscoring ‘buy’ recommendations with reliable verification. Its analysts provide valuable insights into US tech stocks, as shown below.

Apple Inc. (AAPL)

It would be a travesty not to include this iconic company with a market cap of approximately $3tn in the best tech stocks list. Apple, the innovator of a universally demanded brand, has successfully delivered the iPhone, iPad, Apple Watch, Mac computers (with consistent periodic upgrades) and other related personal computing devices to millions of loyal followers. Alongside the latter are its aligned services, including its App Store, Apple Music, iCloud and licensing businesses.

As only one example, in 2022 the App Store represented around 1.6 million apps – significantly below Google Play Store Android entries. Conversely, it’s the dominant player measured by the metric ‘app consumer spending’. Moreover, Apple’s high customer retention rate and expansive product/services ecosystem, according to CFRA’s Angelo Zino, spearheads growth strategies in every global addressable market. Zino highlights the following as outstanding Apple characteristics:

- Continuous stable free cash flow.

- Impeccable new product or brand line execution.

- A willingness to take calculated risks – backing initiatives with eye-popping capital allocations.

It’s no wonder that the tech giant demands a premium valuation versus its peers. Furthermore, Zino projected a CFRA ‘buy’ rating and a $220 price target in 2024, a more than 30% growth rate from $175 on 5th September 2023.

APPLE

Source: money.usnews.com

Microsoft Corp. (MSFT)

When software enters the picture for almost every business on Earth, Microsoft will likely be in the mix as the world’s category leader and deserving of a place on the best tech stocks list. Indeed, the company has impacted the administrative functions of every industry, from enterprise-scale operations to SMBs, with its unmatchable Windows and Office offerings.

However, according to Zino, Microsoft’s Azure cloud services – innovating a snowballing cloud transformation integrated with artificial intelligence technologies – are setting it up to exceed past successes. This tech-centric hub embraces Office 365, Dynamics 365, 365 Teams, Xbox Live, web search engine Bing, and a robust LinkedIn connection that serves both parties well. The icing on the cake is a sizable investment in ChatGPT maker OpenAI. CFRA’s ‘strong buy’ rating and projected 2024 $407 price target for MSFT indicate an expected 22% growth over the closing price of $333.74 on 5th September.

MICROSOFT

Source: money.usnews.com

Salesforce Inc. (CRM)

Since the trend toward customer journey mapping – following customer experiences touchpoint by touchpoint – cloud-based customer relationship management (CRM) has taken off like a rocket ship. Salesforce is the leader far ahead of the competition, delivering state-of-the-art software to sales enablement divisions worldwide.

Zino emphasises CFRA’s viewpoint that Salesforce is one of the blockbuster US tech stocks that will likely widen its market share substantially in the coming months. Why? Because years of strategic acquisitions are ready to pay off without gaps in the company’s offering. Therefore, the open sales revenue growth path is as close to ‘in the bag’ as one can get in a volatile environment.

With ongoing growth on the top and bottom line around an average of 10%, CFRA registers a ‘strong-buy’ rating, projecting $256 in 2024 for CRM, 17% up on the $214.59 value reflected on 5th September.

Source: money.usnews.com

Cisco Systems Inc. (CSCO)

Cisco Systems, founded in 1984, dominates the networking, cloud/cybersecurity hardware (and software) solutions markets. Notably, investors benefit from a 3% forward dividend, thus surpassing every other company on this best tech stocks list.

Analyst Keith Snyder underlines that the company faces supply chain shortages. However, he believes that these bumps in the road won’t be there in 2024, and Cisco is primed and ready for the Wi-Fi 6 upgrade cycle and global 5G deployments.

Furthermore, another massive booster is the burgeoning bandwidth secular consumption growth that impacts cloud networking and data centre usage – all adding to the revenue stream, keeping it in double-digit expansion.

CFRA pinpointed Cisco as a good buy on 4th August, when the price closed at $52.63, projecting it to $60. It immediately leapt close to that before settling back at $57.40 (where it stands on 5th September). We recommend watching this one for any slippage to below $55, remembering the hefty 3% dividend (mentioned above), setting this up as a solid tech investment in 2023.

Source: money.usnews.com

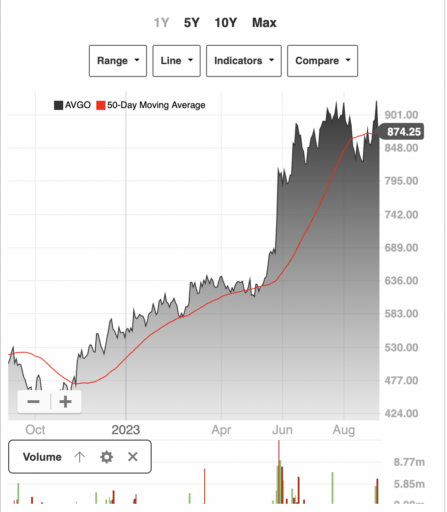

Broadcom Inc. (AVGO)

Rounding off the best tech stocks for 2023, we have Broadcom, the highly reputable diversified global analogue semiconductor supplier.

What exactly does ‘diversified’ mean? It extends AVGO’s operations to cover networking, switcher and application-specific integrated circuit businesses in the centre of the AI infrastructure boom. Moreover, in May, Apple extended its established chip supply deal with AVGO (accounting for around 20% of the latter’s sales revenue), creating a solid foundation to springboard other initiatives.

Zino points out that the planned acquisition of the quoted entity VMware Inc. (VMW) should result in two significant profit-support events:

- Improved margins.

- Recurring software sales.

CFRA has a 2024 price target of $975 for AVGO stock, significantly up by 11.5% over the closing value of $874.25 on 5th September.

Source: money.usnews.com

Summary

The five stocks above enter the US tech stocks markets from different angles, showing dominance in their selected niches and resilience in the face of 2023 economic headwinds. In addition, as Large Caps, their liquidity benefits remove transactional obstructions from the equation.

Finally, the recommended combination offers risk-balanced opportunities for investors to allocate a sizable percentage of their portfolios to tech opportunities, embracing mobile devices, the chip industry, specialised hardware, and the lead juggernauts in software space verticals.

So, when we selected our five best tech stocks for 2023, it converged on broad diversification to create a compelling combination of growth, stability and Cisco’s 3% dividend thrown in for good measure.