Making your fortune on penny stocks

There is a reason penny stocks are often referred to as penny dreadfuls. Yet many average retail investors simply cannot resist the delightful prospect of massive percentage gains in a matter of days, and sometimes in a matter of hours. These investors ignore the plentiful advice to avoid using anything other than excess disposable cash…

If deflation hits – run for cash

Rather than inflation, if there’s one thing that investors should be worried about, it’s deflation. It’s when prices decline, asset prices fall, incomes shrink and no amount of Government stimulus can get the economic machine powering again. Deflation is regarded by economists as a curse, and if the rot sets in it can last decades….

The Dingoes of the ASX 50

In 1602 a Dutch company instituted the practice of issuing ownership shares in the company in exchange for capital needed for expansion. The practice caught on and in 1611 the world’s first stock exchange was formed in Amsterdam. Approximately 15 minutes after the market opened for business, some Dutch math wizards began a search that…

Billionaire says middle class is being decimated

By Ron Hera, Hera Research, LLC Please find below an interview with Mexican billionaire Hugo Salinas-Price, Founder, Director and Honorary President of Grupo Elektra, which owns businesses in the television industry, the telecommunications sector, banking and financial services, and other industries. Born in 1932, Mr. Salinas-Price became a follower of Austrian economics at a young…

The most profitable stocks in Australia

When you screen for stocks it’s natural to gravitate to using metrics like the price to earnings ratio, the price to book ratio, debt levels and net income. Those are all important metrics to consider, but you’re forgetting about one of the most important ratios of all – return on equity, or ROE. ROE can…

How the US is becoming a 3rd world country

By Ron Hera, Hera Research, LLC The United States is increasingly similar to a 3rd world country in several ways and is accelerating towards 3rd world status. Economic data indicate a harsh reality that obviates mainstream political debate. The evidence suggests that, without fundamental reforms, the U.S. will become a post industrial neo-3rd-world country by…

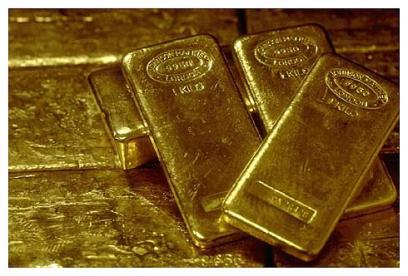

Gold entering strongest time of the year

Gold has just entered its strongest time of the year, embarking on a major seasonal rally. Naturally this is very bullish for not only this metal, but the companies that wrest it from the bowels of the Earth. Gold’s well-established seasonality is important for speculators and investors to understand, as it offers many great insights…

Why LICs Find Favour In Times Like Now

To make profits in this market you need darn good stock picking skills combined with a modicum of good luck – or else, you need a well-diversified portfolio, and listed investment companies (LICs) are one way to achieve this. They’re well diversified, cheap, and the oldest LICs have track records spanning back to the early…

The Best Performing Market Over The Past 10 Years

How much would you have made over the last 5 or 10 years if you had invested in the US, Europe, emerging markets or Canada? And how do these market returns compare to Australia? Investing in the USA If you’d invested your money in the US sharemarket over the past ten years, it’s likely that…

Broker Buys On The Dip

Despite yet another volatile week for global stocks, with US and European markets swinging wildly, the Australian market was relatively calm and actually finished the week 1.64% higher. TheBull PREMIUM’s Bull of the Week last week, Rio Tinto’s takeover target Coal & Allied, led the way with a 28% surge, while JB Hi-Fi (+10.8%) and…