How to insure your investment portfolio before it’s too late

There’s nothing like a 23 per cent fall in the sharemarket to focus investors’ minds on protecting their portfolio. Arguably, it’s a bit late to think about this now but for those who have used the slump to establish new shareholdings, the summer’s experience should have portfolio insurance high on the agenda. You can get…

Use these 5 ratios to unearth superior stocks

We all want to find the next Rio Tinto, but long before it’s trading at $100 a share, or Google when it was a tiny IT company with only a vision. But how do we know that a company will be a superior player over the long haul? What key ratios unlock the secret to…

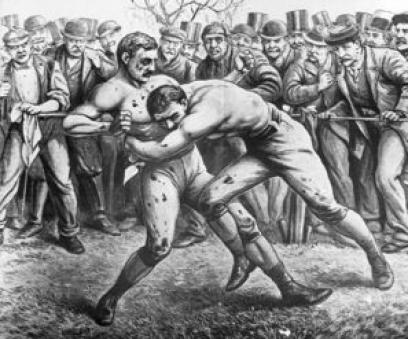

Battle of the CFD providers

The Australian contracts for difference (CFD) market is estimated to be worth up to $400 billion – not bad for a market that did not exist six years ago. But this very lucrative market is being competed for by providers of two different CFD trading models – the market-maker model, and the direct market access…

How to trade CFDs without losing your shirt

Trading is a great occupation if you don’t lose money doing it. Once losses are made – and start to pile up – trading can begin to lose its appeal very quickly. Amateur traders who try their hand on Contracts for Difference (CFDs) can find that a small loss can escalate into a more serious…

How to trade CFDs without losing your shirt

Trading is a great occupation if you don’t lose money doing it. Once losses are made – and start to pile up – trading can begin to lose its appeal very quickly. Amateur traders who try their hand on Contracts for Difference (CFDs) can find that a small loss can escalate into a more serious…

$65,000 in a week trading CFDs

Will Kraa recently enjoyed a stellar run trading CFDs – pulling in $65,000 in just one week. Kraa, a former teacher and avid trader for the past six years, isn’t new to the sensation of multiplying his money trading CFDs. Back in 2003 when Kraa first tried his hand at the highly leveraged derivative, he…

Guide to analysing stocks – part 1

Academics and researchers have spent considerable time searching for the secret to making it rich on the sharemarket. The trouble for investors is that – when every supposed ‘expert’ yells from the rooftops proclaiming the secret to successful stock investing – it’s almost impossible to separate the researched theory from the pure sales pitch. For…

Measuring the strength of the Australian sharemarket

Most agree that the major ingredients required to herald a sharemarket crash are investor euphoria combined with an overvalued sharemarket; like a pressure cooker, as prices for stocks soar upwards, a market becomes overheated and the likelihood of a market crash is ever more present. Last week we looked at the fundamental reasons for why…

Why do commodities traders always check the LME website?

Why do traders regularly check the London Metal Exchange (www.lme.co.uk)? Response: The London Metals Exchange (LME) has been established for over 130 years and is the world’s foremost non-ferrous metals and plastics market. Traders can obtain accurate price data, forecasts, and analysis about the futures contracts that are offered by the exchange. The LME offers…

Do you pay tax when rolling shares into a self managed super fund?

I have $100,000 worth of shares in my portfolio and I would like to roll it over into my self managed super fund. Will I pay tax on the rollover, and if so how much? When I have it in my self managed fund and I want to trade on any of these stocks, will…