Foreign exchange trading, also known as forex trading, refers to buying and selling currencies to profit from differences in exchange rates. There is no centralised marketplace for swapping currencies – forex trading simply occurs over the counter (OTC) via computer networks. In this article, we’ll discuss several key aspects to help novices start trading forex in Australia.

What is Forex Trading in Australia?

Forex trading means buying and selling currencies to make a profit. Anyone who has travelled abroad will have traded forex. For example, if an individual travels to the US, they need to buy US dollars using AUD dollars, swapping one currency for another.

Traders conduct the same transaction but follow a predetermined strategy to generate returns. However, forex traders do not deal with physical currencies. Most forex traders use CFD trading platforms (contracts-for-difference), a derivative that allows any trader to open and close positions without owning the assets.

The forex market is the largest in the world and used to be dominated by institutional traders (firms) and financial institutions (such as banks). However, thanks to the internet and technological advancements, anyone can now trade forex via an internet connection from the comfort of their home.

The forex market is affected by geopolitical events, i.e., wars, natural events, or disasters, such as earthquakes and events that impact the strength of a country’s currency. Traders attempt to profit from these events, especially since the forex market is open 24 hours a day across different time zones – which means they can react to the news before the country’s stock exchange opens.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

A forex trader needs to analyse currency pairs and determine if the value of a currency will strengthen or weaken relative to the other one. Then, the trader can either:

- Open a long position – which means buying the currency they expect will increase in value sometime in the future. When the value rises, the trader sells the currency, and the difference represents their profit.

- Open a short position – which means short-selling the currency, which it is believed will weaken and repurchasing it at a cheaper rate; the price difference represents the trader’s profit.

Types of Currency Pairs

Currencies are represented by a code of three letters, such as AUD for Australian dollars or USD for US dollars. There are about 180 different currencies to choose from, but a large portion of trading activity is focused a few key currencies.

The US Dollar (USD) is the most widely traded currency, followed by the British Pound (GBP) the Euro (EUR), the Japanese Yen (JPY), the Australian Dollar (AUD), the New Zealand Dollar (NZD), the Canadian Dollar (CAD) and the Swiss Franc (CHF).

When traded against the US Dollar this group of currencies make up the seven major currency pairs – USD/GBP, USD/EUR, USD/JPY, USD/CHF, USD/CAD, AUD/USD and NZD/USD.

When this group of currencies are traded against each other, not the US Dollar, they make up the forty two minor pairs. This group includes any combination of the seven most widely trade currencies paired with one another, excluding the US Dollar. Some of the most popular minor pairs include EUR/GBP, EUR/JPY and AUD/JPY.

Any combination of currencies where one, or both, are not included in the above list of major currencies are known as exotic pairs. Some of the more popular exotic pairs combine the US Dollar with a less popular currency, for example the Mexican Peso (USD/MXN), the Swedish Krona (USD/SEK) and the South African Rand (USD/ZAR).

Any currency pair that does not include the USD Dollar is known as a cross-pair. This group includes the forty two minor pairs but also exotic pairs such as EUR/SEK, GBP/MXN and AUD/ZAR.

Finally, any currency that is closely related to a particular commodity is known as a commodity currency. When paired with each other, or another major currency, they make up the commodity pairs. Some of the most popular commodity currencies include the Canadian Dollar (CAD), the Mexican Peso (MXN) and the Australian Dollar (AUD).

Forex Trades Explained

In forex, each transaction is double-sided. For example, to buy USD, you need to sell AUD – which is why ‘currency pairs’ is a common term allowing one currency to be sold for another.

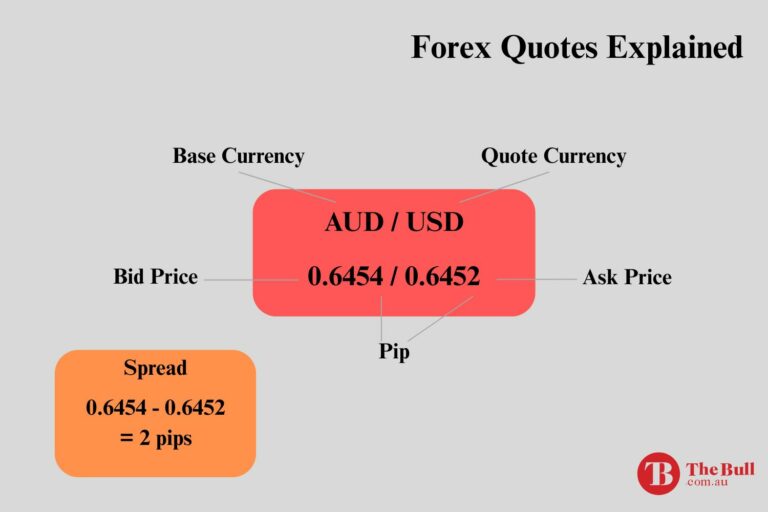

Each currency pair is formed of a base currency and a quoted currency. For example, AUD/USD is 0.67847. The base currency is AUD, and the quoted currency is USD. That means you can buy $0.67847 USD with $1 AUD.

Some other key terms involved in forex trading are:

- Bid-ask spread is the difference between a currency pair’s buying and selling price. This is a way for the broker to generate profit, so traders often look for forex brokers with the lowest bid-ask spreads. However, the spread is also influenced by market conditions – for example, in the case of an exotic (less popular) currency pair, the bid-ask spread is high because of low volume. The spread is usually lower for major pairs, such as AUD/USD or EUR/USD.

- Pips: currency pairs are often quoted with multiple decimals, as shown above. If the AUD/USD pair changes from 0.6784 to 0.6785 (fourth decimal), it increases by one pip.

- Currency lots: when you place an order, the lot size is the unit of measurement. It determines how many currency units were sold or bought in one transaction. A standard lot is about 100,000 units of currency.

Is Forex Trading Legal in Australia?

Forex trading is legal in Australia and is regulated by the Australian Securities and Investments Commission (ASIC). This institution licenses brokers and other firms and ensures they follow the regulations which are in place to protect traders and investors.

For example, ASIC sets a limit on leverage. Leverage means using borrowed money to invest, so if the trader only has $500, a leverage of 2:1 means they can borrow another $500 to open a trade worth $1,000.

This could result in doubling their profit or loss depending on the trade’s performance. That is why using leverage is considered risky, and the ASIC implemented limits on the leverage that can be used. It ranges from 30:1 to 2:1, depending on the asset involved.

When trading forex in Australia, it is vital that a broker is chosen that is regulated by the ASIC to provide added protection.

How is Forex Trading Taxed in Australia?

Technically, many forex traders do not trade physical currencies but trade contracts-for-difference (CFDs). A CFD is a type of derivative or a contract, the value of which is based on the difference between entry and exit prices. For example, a stock CFD allows the trader to buy and sell the stock without actually owning it.

In forex, the concept is similar: instead of buying and selling currencies, traders use CFDs to speculate on the prices. The profits must be included in the assessable income when the trade is closed (not when the profits are transferred from the trading account).

Similarly, the loss must be added as a deduction when the trade is closed. Then, the trader needs to pay tax on all the income at the marginal rate (depending on their income level).

Basically, there are two categories to consider for tax purposes. Are you a trader or investor? A trader holds assets for less than 12 months and makes money on short-term transactions. As a result, they pay personal tax rates. On the other hand, an investor is considered someone who trades for more than 12 months of the year and makes a profit. In this instance, they are liable for capital gains tax.

If a trader conducts many trades, they may be considered to be ‘in business’. If this happens, they can claim deductions, such as home office expenses. The ATO (Australian Taxation Office) can help determine if someone’s trading activity is considered ‘in business’ or not.

Australian Forex Market Hours

The forex market is a global marketplace, and continuous trading is possible because there is no centralised location. The market is a global network of brokers, banks, institutional firms, and individual traders.

Unlike stocks or other assets listed on exchanges, the forex market hours in Australia and anywhere in the world are 24 hours per day, five and a half days per week. This is because most forex activity occurs globally, and the market remains active due to time zone differences. For example, when the US trading day ends, the forex trading activity starts in Tokyo, ensuring continuity.

The main trading sessions are Monday to Friday:

- Sydney/Oceania session – 7am to 4pm AEST

- Hong Kong/Asian session – 10am to 7pm AEST

- London/European session – 5pm to 2am AEST

- New York/American session – 10pm to 7am AEST

The Best Times to Trade Forex

Just because you can trade forex 24 hours a day from Monday to Friday, doesn’t mean that you should. There are certain periods during the day that are better for trading forex than others.

As a general rule, it is better to wait for times when more than one market is open. The trading day is divided into four sessions, when different markets around the world operate. The times when these markets overlap usually see higher trading volumes, and therefore more trading opportunities.

Here are the times when trading sessions overlap:

- The Sydney-Tokyo Overlap – 10am to 4pm AEST

- The Tokyo-London Overlap – 5pm to 7pm AEST

- The London-New York Overlap – 10pm to 2am AEST

The best time to trade forex will also depend on which currency pairs you are trading. Currency pairs will experience higher trading voume when the market sessions that correspond to those currencies overlap. For example, pairs such as AUD/JPY and NZD/JPY will experience higher volume during the Sydney-Tokyo overlap, whereas pairs like EUR/USD and GBP/USD will see higher volumes during the London-New York overlap.

How to Start Trading Forex in Australia

If you want to start trading forex in Australia, there are only a few steps to follow:

- Do your due diligence and select a licensed forex broker for your needs.

- Open a brokerage account and deposit your capital.

- Devise your trading strategy before opening your trades.

The forex market can only be accessed by individual traders via brokers or banks, which act as intermediaries. When choosing a forex broker, multiple factors should be considered. They include trading platforms, fees and commissions, execution speeds, trading tools available, customer support (ideally via phone or live chat) and educational guides that match your experience and knowledge level.

For added protection, ensure your chosen forex broker is regulated by the Australian Securities and Investments Commission (ASIC).

A good broker should offer a demo account, which allows users to trade with virtual money using actual market prices and conditions. These demo accounts are a great benefit even for experienced traders, as they can test their trading strategy before risking real money.

Finally, to be successful, a novice trader needs to develop some trading strategies. These depend on trading objectives, risk appetite, and experience. To help trade forex successfully stay up to date with market and economic developments, including interest rate changes, which will have an impact on the value of any given currency.

Summary

The forex market is the largest and most active in the world. To start trading forex in Australia, you should choose an ASIC-regulated brokerage firm and open a forex trading account. Forex trading can be lucrative, but with any trade comes with risks. However, it’s essential to be mindful of the tax implications of any profit you might earn and ensure you take qualified advice before starting on your trading journey.

Forex Trading FAQs

Is Forex Trading Legal in Australia?

Forex trading is legal in Australia and is regulated by the Australian Securities and Investments Commission (ASIC).

What is Leverage in Forex?

Leverage is a way of trading using ‘borrowed’ funds and is very common in forex trading. For example leverage of 10:1 means you can open a trade worth $500 with just $50. This means your potential profits, but also potential losses, are dramatically increased.

What is a Pip in Forex?

A pip is a standard unit that measures the change in value between two currencies. Currency pairs are quoted to multiple decimal places and a pip is in the fourth decimal. For example if AUD/USD goes from 0.6784 to 0.6785, it increased by one pip.