Another year, another burst of extreme crypto volatility. But the blockchain technology behind bitcoin, stablecoins and other digital assets continues to grow in importance.

Sometimes innovation happens overnight. The Monday after the Big Bang in 1986, when the market was deregulated and stepped into the electronic age, the noise and bustle of the trading floor of the London Stock Exchange (LSE) was suddenly gone and all was eerily quiet.

Sometimes it creeps forward unnoticed before seeming ubiquitous. Cryptocurrencies like Bitcoin have existed for over a decade, but their extreme volatility has obscured the real revolution: the blockchain technology which underpins them. If nothing else, Bitcoin has proven that blockchain works.

Distributed ledger technology (DLT), of which blockchain is a form, is now being developed for many applications around the world, most visibly in finance. Just as the switch to electronic trading fundamentally changed the financial system 35 years ago, so DLT is set to potentially revolutionise it once again, with profound implications for investors. Below we explore the options emerging for investors.

The digital revolution

Top Australian Brokers

- City Index - Aussie shares from $5 - Read our review

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

DLT provides a secure way to trade assets and record those transactions in multiple places at the same time, using a distributed ledger. This ledger is made virtually tamper-proof thanks to the cryptographic “fingerprint” that users leave, as well “consensus protocols” which decide on the legitimacy of the transaction, while smart contracts – machine-executable codes – are automatically triggered to execute pre-agreed contractual obligations. These factors may eliminate the need for intermediaries, can reduce counterparty risk and ultimately could reduce transaction fees and operating costs.

We therefore expect DLT to disrupt many parts of the financial world. Banks are already altering their trading infrastructure and the type of assets they trade. Custody providers and exchanges are developing new clearing and settlement processes to accommodate the ‘new’ digital assets created on the DLT, and to tackle some of the potential risks, meaning investors can gain easier access to a broader range of potential diversifiers and sources of return.

Many digital assets will not, in fact, be new. They will simply be alternative ways of doing what trading and investing have always done: to transfer capital to where it drives the greatest financial and non-financial returns with the least possible friction.

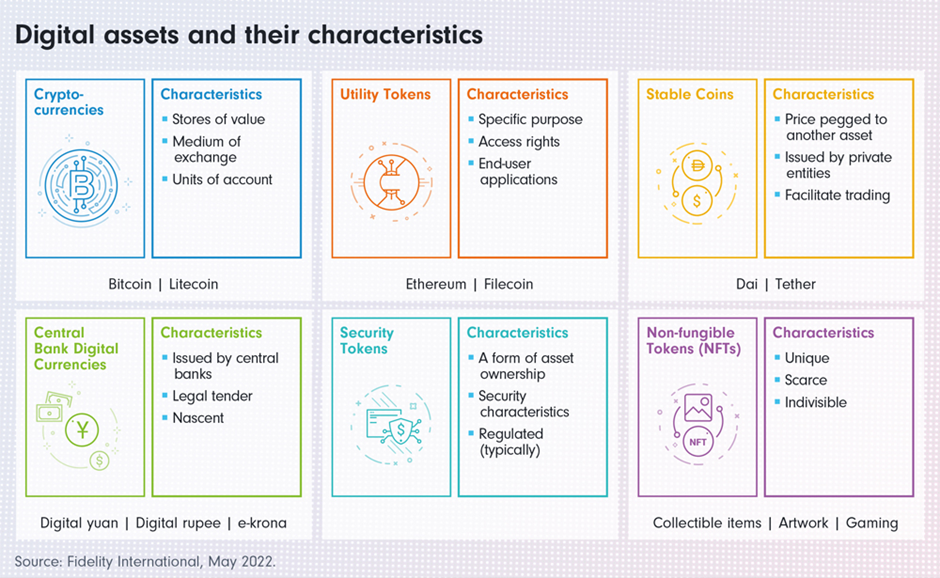

Digital assets take several forms. While a universal taxonomy is yet to be agreed upon, these include medium of exchange tokens (e.g., cryptocurrencies), utility tokens (essentially a voucher for a future product or service) and security tokens (similar to the fractional ownership provided by stocks and bonds, and often related to them). Each asset has particular properties that offer new opportunities and, inevitably, create some risks. Below we examine some of the ways in which digital assets, and DLT, could change investing.

A common infrastructure

One of the most exciting aspects of digital assets is that they may offer investors a much greater degree of personalisation of fund type, investment size, geography, and theme, than traditional managed investment funds currently do. This is thanks to their design and the design of the infrastructure that sits underneath them, which could one day create a global investment platform. Investors may be able to pick and choose the components that suit them at a scale they can afford.

Having a mutualised infrastructure, such as a common ledger between an asset manager and a bank or between an insurer and a non-financial entity, could also remove a lot of technological and administrative friction, especially when executing cross-border trades in multiple security types. Moreover, this shared infrastructure would speed up and simplify reporting to stakeholders and provide regulators with an easily accessible audit trail.

For example, a client securely onboarded by one entity would automatically be allowed to operate with others on the ledger, no matter where they were located. Individual risk appetites could be assessed using real data, for instance by looking at the type of transactions a client performs, the complexity of their existing investments, or how they actually spend money, instead of relying on the typical questionnaires used to assess how much risk an investor is ready and willing to take. This could open up investing to new participants or offer new investment opportunities for existing participants.

Cheaper by the token

Tokenisation (the digitisation of ownership rights) and fractionalisation (the slicing of assets or securities into smaller, bite-size units) are other features enabled by DLT that could broaden access to investing for many by lowering the threshold to gain exposure to those assets. Take corporate bonds as an example. Not only are many deals still brokered over the phone between institutions, but the bonds are usually sold in tranches exceeding US$300,000. Both the size of transaction and the costs involved in brokering put them out of the reach of retail investors.

But if corporate bonds were tokenised as digital assets, the market could be opened up to more investors, and potentially deepen liquidity. Investors could maintain diversification while tailoring their return profiles more closely to their individual investment goals (e.g., investing in a bond that matures at the right time to pay for a child’s future university education).

Going private – and green

Tokenisation could also be used to increase access to private markets and other investments currently only available to institutions or high net worth individuals. These include commercial real estate, timber, or collectibles such as paintings and sculptures. Green infrastructure is another area where tokenisation could allow retail investors greater participation as the world moves towards net zero emissions, be it as a way to access infrastructure investments, typically reserved for institutional clients, or by offering investors more quantifiable information on the impact of their investments.

These assets offer a different type of risk to publicly listed securities, namely liquidity risk. While tokenisation does not create liquidity per se, it can facilitate the exchange of illiquid assets in secondary markets. Consider venture capital funds. Limited partners must typically wait many years before their investment can be liquidated. The tokenisation of limited partners’ rights could allow them to sell their position in a secondary market. While some of the illiquidity premium may be sacrificed as a result, tokenisation can nonetheless provide a new group of investors with access to young companies on faster growth trajectories than more established listed firms and help them diversify across a wider range of assets.

Less correlation offers more diversification

From cryptocurrencies to tokenised private assets, digital assets can benefit investors’ portfolios in some circumstances thanks to potentially lower correlation with publicly traded instruments. This weaker correlation may matter because, in an era where interest rates are still low, the level of diversification offered by traditionally ‘safe’ public assets such as government bonds has been reduced.

Following a historical stretch in valuations, meanwhile, many investors are now seeking to recycle profits into areas that can still perform well over the next decade or are less correlated with public markets, if not necessarily less volatile. Digital assets may be less correlated and could help in this regard, while their infrastructure can offer new sources of income to bolster lower returns from traditional investments.

New income streams

Current market infrastructure needs intermediaries to help originate, trade, and administer investors’ assets. While each intermediary adds levels of expertise and service, they also create layers of fees that ultimately eat into investors’ returns. These intermediaries are unlikely to disappear overnight, but their role may evolve in a more digitised and decentralised world.

Blockchains using the Proof-of-Stake (PoS) consensus mechanism, an alternative to the Proof-of-Work (PoW) mechanism used by the Bitcoin blockchain, provide a glimpse into this disintermediation trend, and open up new revenue streams for investors. In contrast to PoW protocols where computing powers, and hence energy, are required to earn new coins, the probability of earning a reward in the PoS protocol is driven by the amount of native token owned. Therefore, investors holding the token of such blockchains, effectively contributing to their functioning and security, can be paid for putting them at the disposal of certain users, a process called “staking”.

Because staking still leaves investors exposed to the volatility of the underlying token, the return on offer can be too volatile for certain investors. However, alternatives have emerged with the rise of lending protocols in the peer-to-peer space, also referred to as decentralised finance (DeFi), and the growing availability of hedging instruments. Investors are increasingly able to access more stable income, which at the time of writing is typically a multiple of the yield generated by traditional fixed income instruments, such as money market securities or bonds. Critically, savers could access those higher yields while potentially reducing their exposure to the volatility of cryptocurrencies.

Investors can also generate new forms of revenue by facilitating trading activity across cryptocurrencies. Matching buyers and sellers in traditional markets, in particular in fixed income, can be a difficult task, requiring experience and an established network, which in turn lowers investors’ returns. Some DeFi protocols have sought to address this challenge by establishing pools of funds, which allow trades to take place automatically. Savers can contribute to those liquidity pools by committing assets to them. For this service, they could receive a share of the trading fees, and sometimes additional incentives.

Stablecoins may one day reach where banks cannot

Further into the future, there may eventually be greater use of digital assets to increase financial inclusion. Bitcoin’s wild swings in value, whilst expected for a young asset tradeable 24/7, can make it hard for risk-averse investors to hold, even if it provides a first step into the world of crypto. But another type of cryptocurrency known as ‘stablecoins’ (digital currencies pegged to steadier assets such as the US dollar or gold) could bring widespread benefits, offering access to financial services for the billion or so people across the world unable to open a bank account, let alone put their money to work.

Stablecoins may also operate in areas not covered by traditional institutions (whether for geographical, income or credit reasons), and – with fewer intermediaries – at considerably lower cost. This could give people a chance to save money and invest their savings in productive assets that may increase their wealth over time.

Moreover, the transparency of the ledger system can create the confidence to invest in new businesses, especially in areas with limited local banking services. Open ledgers may, for instance, be used to generate credit ratings automatically: a smart contract could use a user’s transactions (visible on the ledger) to work out: a) if the business is real and b) if the risk of lending to it is acceptable. This new way of making loans could increase access to funding – think micro-loans in emerging markets for instance – and creates the ability to develop new revenue opportunities.

The growing popularity of stablecoins, as well as some of the attractive features enabled by DLT, provide valuable insights in the creation of what could emerge as the ultimate stablecoins: Central Bank Digital Currencies (CBDCs). In contrast to stablecoins, which are issued by private entities, CBDCs are legal tender and benefit from the full backing of a country’s central bank. This backing is critical as it circumvents some of the challenges raised by stablecoins, namely the way they are stabilised, through reserves (e.g., ideally a dollar-for-dollar coverage), collateral (e.g., a basket of cryptocurrencies) and in particular algorithmically stabilised coins, which could be perceived by regulators as a form of derivative.

CBDCs, which are already in operation in some countries (e.g., the Bahamas and Nigeria) and are being researched by major economies, have the potential to address practical issues such as speeding up cross-border payments and supporting financial inclusion. Because of their underlying infrastructure, such as DLT, they could also open the door to new forms of monetary policy tools or facilitate unorthodox ones, such as targeted helicopter money. However, more research is still required to assess the macroeconomic impacts of CBDCs, from monetary policy to financial stability, in particular with respect to the role of commercial banks.

Buck for your bang

DLT offers the potential for a radical overhaul of financial markets, from democratising access to financial services and private assets, to cheaper, more diversified investing through tokenisation, and the ability to earn fees from participating in the network operation. It is a fast-moving and exciting landscape. At the same time, we will only navigate it successfully by making informed decisions, through engaging, learning, and consulting experts. The overhaul of markets may not happen overnight like the Big Bang of the 1980s, but the effects of DLT may be more lasting.

Originally published by Fidelity International investment experts