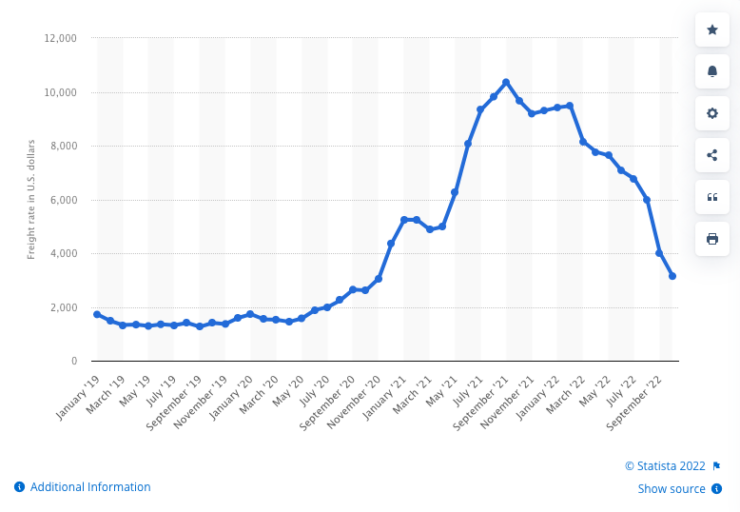

- After skyrocketing in 2021, container freight prices are retreating quickly to 2019 levels.

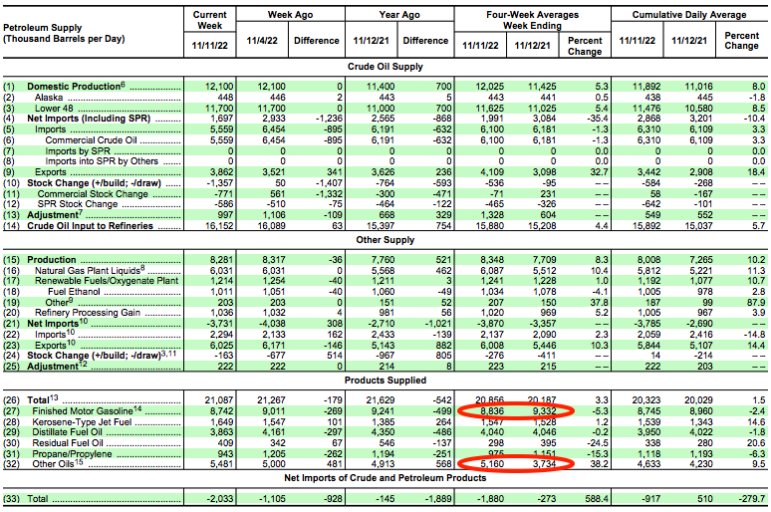

- US Gasoline prices are following a similar trajectory downward as the US remains well supplied.

- Bright spots in the supply and demand picture of the transportation fuel sector provide welcome relief to markets struggling with high heating and shelter bills.

Blink, and you’ll miss it

The global container freight prices being paid last year threatened to derail all international trade. Freight forwarders drained massive amounts of capital due to labour and capacity supply squeezes. The tightness in the market quickly shored up pandemic-depleted balance sheets at the expense of the consumer.

Fast forward to today, and the prices are returning to more sustainable 2019 levels, providing sharp relief to manufacturers, retailers, and consumers.

US Energy policy

Much was made of the US opening the spigots on strategic reserves, attempting to flood the dried-up corners previously reliant on Russian oil. There is little doubt that this strategy has been remarkably effective in keeping a lid on international oil prices.

Just as effective, if not more so, has been the loosening of regulations around gasoline blending. The US crude oil benchmark WTI is down 33% from the June highs of this year. The comparable gasoline future RBOB is down by over 40% on the same time horizon.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

President Joe Biden’s administration opened the door to a higher mix of ethanol in finished gasoline, and an E15 (15% ethanol, 85% gasoline) blend has increased the overall supply.

On initial inspection, the finished gasoline supplied to the US marketplace seems to be down slightly, suggestive of a struggling economy and reduced gasoline demand. Refiners delivered 8.8m bbls/day versus 9.3m bbls/day last year.

Yet the blending components mixed in with the other oils are up massively, from 3.7m bbls/day to 5.2m bbls/day. Unfinished gasoline from US refiners is up markedly on last year, and blenders in the US are taking advantage of this new E15 product window.

This fuel picture is one of robust demand in the US, a firing economy, and manageable prices that will sustain the hike in demand.

More positives

The travel sector suggests that many still need to get the memo on the recession. TSA figures out of the US indicate that passenger figures are narrowing in on pre-pandemic levels.

TSA checkpoint travel numbers are only a few per cent lower this year than at the comparable time in 2019.

Heating tracking lower

A moderate European winter thus far and forecasts for more of the same have kept the lid on international gas prices.

The North Asian LNG is tracking lower, following the UK and Dutch gas prices. The Dutch TTF prompt price is currently hovering around Euro 115 / MW. Still almost eight times the price at a comparable time in 2019 but going in the right direction, down by over 65% from the August highs.

Tight heating oil supply and demand dynamics in the northeast US threaten to derail the good work done in the other fuels sector. Heating oil futures are down much less than gasoline and crude, only 23% from the June highs.

Outlook

Overall, the policy enacted by the US government in response to Russian energy supply displacement has been very effective. Despite rising demand to cover European gas restocking and an increased transportation fuel demand, prices are trending southward.

Australia’s position as a net oil importer benefits significantly from the US’s ability to shore up oil markets. This should moderate Australia’s overall inflation picture and provide some wind to the economic sails.

The historically high coal and gas prices will continue to boost Australia’s balance of payments and may shield the lucky country from another recession.