- Financial and physical commodity markets are increasingly dislocated

- Dislocation points to squeezes and bottlenecks in the supply chain

- As the market adjusts to rerouting supply chains, what is the outlook for Australian stocks?

Supply squeezes

Oil and gas blockades in Libya continue to disrupt the international market with the loss of a key crude oil supplier when supplies are particularly tight.

Rival political factions are set to move closer together in the coming days as Eastern Libya’s leader Fathi Bashaga takes office in the capital, Tripoli. Signs are that mediation is closer and that progress can be made toward free elections and stability for the region. Unlocking the political impasse will return approximately 800,000 barrels of crude oil to an undersupplied international market.

With Libyan production almost closed off to European refiners, it is still an almighty scramble to secure physical cargoes. Nearby delivery of the crude grades acceptable to European refiners are remaining stubbornly high.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Gluts and bottlenecks

In a somewhat counterintuitive market response, accelerated US production, high prices, and government reserve (SPR) release is driving a swelling of the US commercial inventories and is starting to get on top of US crude prices and the futures market.

The American Petroleum Institute indicates a build in oil and oil products inventories of an aggregate of over 10m barrels, suggesting increased supply to the US markets and tempered demand.

The closely followed US Energy Information Administration (EIA ) data on oil inventories will be released late Wednesday evening, shedding light on the market response.

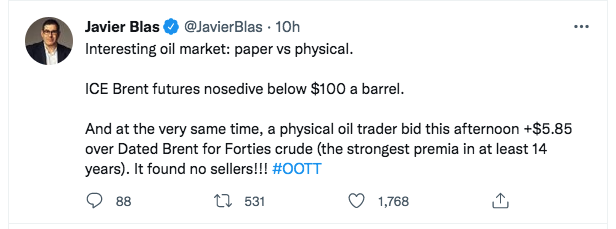

Building inventories sending the US crude oil futures for nearby delivery sharply lower by 7% before recovering slightly at the close and in today’s open. European futures are trailing the US crude market, with physical price premiums widening as a result.

The divergence in the physical and paper market is symptomatic of the have and have nots and the inflexibility of oil supply chains. With refiners unable to adapt quickly to resupply of grades their infrastructure is not calibrated for, benchmark grades like Brent and WTI are only telling part of the picture of the state of the oil trading market.

Smoothing out supply chains

Bottlenecks in supply chains will take some time to work out but are not insurmountable obstacles to overcome for an adjusting (albeit slowly) network of suppliers, traders, and procurers of commodities.

As the market adjusts to the current geopolitical climate, time will be required to settle the flow. It will happen eventually, given the additional resources that will inevitably be applied to large arbitrage opportunities.

Impact on Australian markets

The selloff in benchmark crudes gives some hope that we have turned the corner on inflation. Native coal and gas resources for power generation are inoculating Australia from the steep inflation that Europe is currently facing.

The S&P ASX 200 is flat at the open, the fall in oil overnight providing fodder to a slowing of rate hikes, positively impacting the rate-sensitive technology sector. Block, Inc ASX:SQ2 (SQ2) recovered some of yesterday’s losses and was up 3.2% by midday.

The glimmer of light in oil futures was not enough to disperse recession clouds entirely. The relative safe harbour of healthcare is the big winner today. Mayne Pharma Group Ltd ASX:MYX (MYX) is up over 6% from last night’s close, with RHYTHM Biosciences Ltd ASX:RHY (RHY) narrowing in on a 10% gain from yesterday.

Woodside Energy Group Ltd ASX:WDS (WDS) is lower by 2.5%, signalling a tempering in the outlook for energy demand.

Sectoral shifts in fund management allocation from energy to healthcare suggest that we may only be at the start of a tough time for our markets.