With interest rates likely to be lower for longer, investors are seeking yield from potentially riskier investments. We analyse alternatives and share three key factors to consider in the hunt for income.

Record-low interest rates pose a challenge for income-oriented investors. That challenge is particularly acute for those living off the income from cash investments.

While their capital may be stable, ever-lower interest rates have seen their incomes steadily falling. So it’s unsurprising that many are moving away from cash and looking further afield.

Yet shifting from cash to a different asset class involves much more than just switching to a higher-yielding investment. It’s important to take a whole-of-portfolio view as not all risk is the same.

Cash investments are highly liquid, highly secure, and can be an effective way to diversify and reduce risk. It follows that there are three key factors investors need to be aware of when considering the alternatives:

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Liquidity: Are you prepared to lock your capital up for longer time-frames?

Diversification: Are you putting all your eggs in one basket and potentially missing the opportunity to improve overall investment returns and manage risk?

Market expertise: Do you have the expertise to navigate diverse, global, fixed income markets or would you benefit from tapping into the expertise that specialises in finding income?

Alternatives to consider

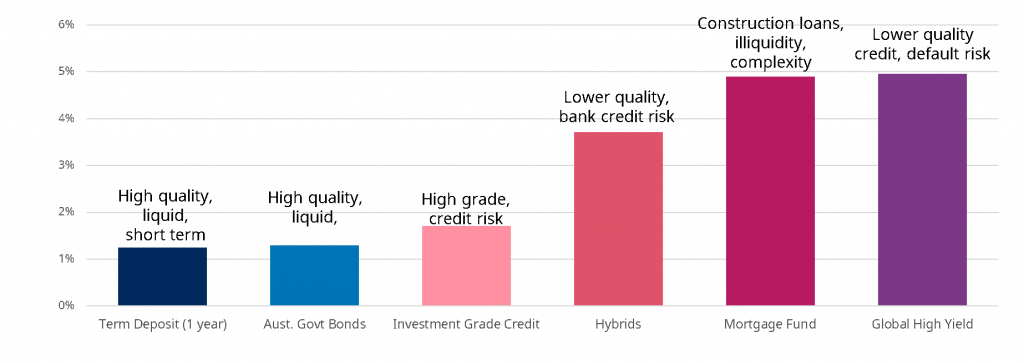

Source: Bloomberg, Schroders as at 31 December 2019. Yields on assets hedged to A$. CBA Pearls XII yield used as a proxy for Hybrid yields. Yield percentages used are for illustrative purposes only and not a guarantee of any particular return. Liquidity profile is indicative only and may vary depending on the particular product.

The graph below shows six investment options available to investors trying to boost income from their investment portfolio. As a generalisation, the further right an investor ventures, the more risk they are taking and the higher their potential to suffer a loss.

In the hunt for yield, investors are looking further to the right – higher on the risk spectrum, and potentially into areas where they may not be familiar with the characteristics of the asset. Investors must be conscious of factors such as ‘store of value’ which refers to the ability of an asset to be saved, retrieved or exchanged later.

While there are pros and cons to each option, the important thing is for investors to understand what they are holding, why they are holding it and how it will affect their portfolio performance in different market conditions. For example, Australian government bonds and investment grade credit are exposed to factors such as market-to-market risk whereas mortgage funds can be impaired by defaults, which can hamper liquidity.

So let’s return to the three asset allocation issues highlighted above, to see how the alternatives stack up.

Liquidity

There’s a saying in markets: liquidity is never a problem except when you need it most. If an investor is looking to withdraw money from an investment because they are concerned about near-term risks, it’s likely others will be too, which may mean it will cost more or take longer to exit the position.

This cost increases with the riskiness of the investment. In cases of high market volatility when it’s very costly (or even impossible) to liquidate riskier positions, sometimes redemptions from funds can be frozen.

At other times investors simply need liquidity because plans change. Having cash available provides maximum flexibility to respond at a limited cost (both transactional, and in terms of market timing).

All of these considerations suggest it’s worth keeping at least some capital in a more liquid investment option, perhaps as part of a diversified fixed interest portfolio.

Diversification

Investors have been taught that the more risk they accept, the greater the potential returns. Yet while this is generally true over the long term, there will always be periods where greater risk will detract from returns – as happens when share markets are falling. Given the unpredictability of markets, diversification across asset classes is crucial to delivering more reliable returns.

Diversification is important within asset classes too. Not all investors appreciate that there are many types of fixed income, each of which behave very differently in different market conditions. That can create attractive opportunities for investors, but it also means diversification across fixed income markets can be an essential tool for improving overall returns and managing risk.

Tapping into fixed income expertise

When moving away from the security of cash, it can make sense to choose an investment with in-built risk controls. Because fixed income markets are diverse, global, and frequently changing, that may mean tapping into the expertise of fixed income specialists – ‘active’ managers, rather than ‘passive’.

One of the peculiarities of fixed income markets is that indices are weighted towards entities with the most debt, which can leave passive investors heavily exposed to lower quality credit, carrying the highest levels of risk. In contrast, actively managed fixed income funds provide access to a team of experts who specialise in finding high quality income opportunities, with the aim of taking advantage of them at the right time in a market cycle, while also focusing on managing risks.

Active managers often focus on valuations, or the price paid for an asset, which can have a significant bearing on the investment return achieved. Put simply: they aim to help investors find ‘winners’ and avoid ‘losers’.

Choosing the right option

Finding the right option isn’t always easy, but it is important. The key is to keep your overall investment objectives in mind, then build a portfolio to match – without taking on too much risk.

Schroders has launched an active fixed income exchange traded fund (ETF): the Schroder Absolute Return Income (Managed Fund) (Chi-X code: PAYS). PAYS is designed to help investors strengthen the defensive allocation within their portfolios by boosting income while protecting capital.

PAYS gives you exposure to the Schroder Absolute Return Income Fund, which has a track record of meeting investors’ needs for reliable monthly income, delivering a total return of 6.13% over the last 12 months (post-fees) with a competitive management fee of 0.54% pa.

PAYS gives investors the flexibility to access their money if they need to, providing peace of mind that there is a strong focus on managing risk, should markets fall.

Published by Mihkel Kase, Fund Manager, Fixed Income, Schroders