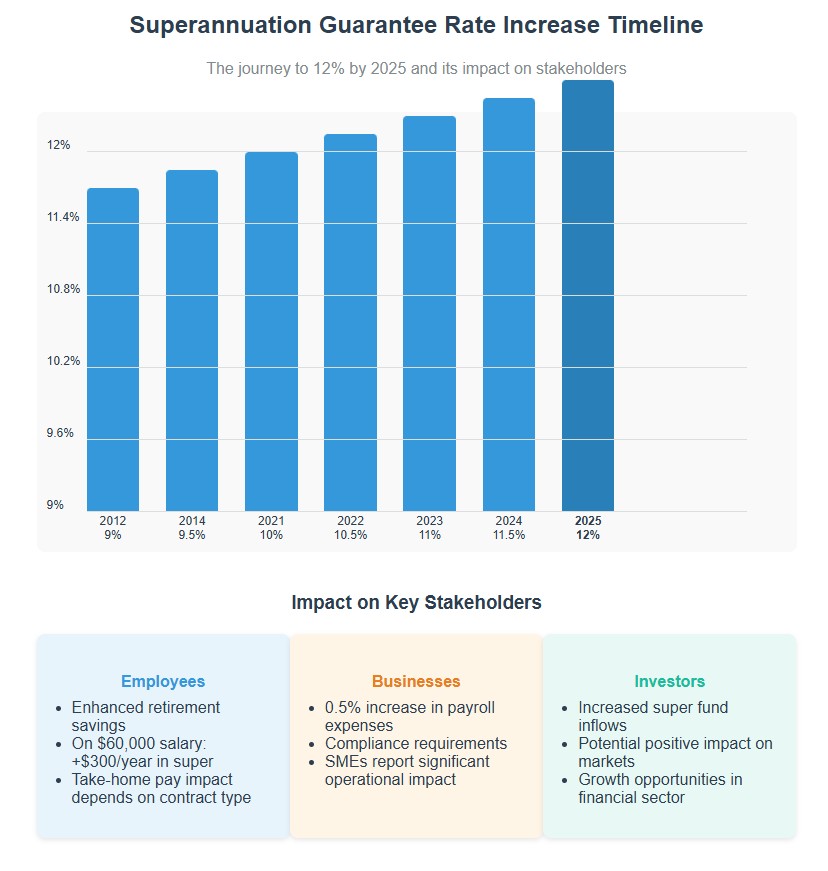

Superannuations in Australia are about to shift significantly, with the Superannuation Guarantee (SG) rate set to reach 12% on July 1, 2025. This final step in a phased increase, which began over a decade ago, promises to reshape retirement savings for Australian workers and ripple through the nation’s financial markets.

For employees, the primary benefit is a bolstering of their retirement nest egg. With a higher percentage of their ordinary time earnings (OTE) directed towards superannuation, individuals can expect to accumulate a larger sum over their working lives. For instance, a worker earning $60,000 annually will see an additional $300 contributed to their superannuation fund each year. This incremental increase, compounded over decades, can substantially improve retirement outcomes and reduce reliance on the age pension. However, the impact on take-home pay is less straightforward. In “base plus” remuneration models, employers typically absorb the additional cost. But for employees on “total package” arrangements, the SG increase may be offset by a reduction in their base salary, potentially leading to a decrease in their immediate disposable income.

Businesses, particularly small and medium-sized enterprises (SMEs), face the immediate challenge of increased payroll costs. The 0.5% rise in the superannuation guarantee, while seemingly small, can significantly impact the bottom line. A recent survey highlighted that a substantial proportion of SMEs view the increasing SG as a major operational challenge, surpassing other regulatory burdens. Employers must ensure their payroll systems are updated to reflect the new 12% SG rate for all payments made on or after July 1, 2025, to avoid potential penalties from the Australian Taxation Office (ATO). Some businesses may look into streamlining operations or adjusting pricing to mitigate costs.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The surge in superannuation contributions is expected to inject significant capital into the Australian financial markets. Superannuation funds will likely increase their investments in both domestic and international markets, potentially driving up demand for assets across various sectors. This could lead to positive performance trends for major superannuation funds, listed investment companies, and financial service businesses that benefit from increased super inflows. While there are no direct “earnings estimates” for the SG rate itself, analysts anticipate that the increased contributions will support continued growth in the superannuation sector and related investment products over the coming years.

The gradual increase from 9% in 2012 to 12% in 2025 reflects a long-term government strategy to improve retirement outcomes and reduce future reliance on the age pension. This steady rise provides a degree of predictability for businesses and individuals, but the cumulative impact of these increases over time is substantial.

The Bull Case

- Increased superannuation balances will lead to greater financial security for retirees, reducing reliance on government assistance.

- Increased inflows into superannuation funds will boost investment in Australian and international markets, potentially driving economic growth.

- Greater capital allocation to Australian equities and other assets may lead to higher returns for investors and stronger performance for fund managers.

The Bear Case

- Increased payroll costs for businesses, particularly SMEs, may lead to reduced hiring or wage growth.

- The SG increase may be offset by lower wage growth or reduced take-home pay for some employees, negating the intended benefits.

- Excessive capital inflows into superannuation funds could lead to asset bubbles or misallocation of resources, creating instability in the financial markets.

The upcoming increase in the Superannuation Guarantee rate to 12% represents a pivotal moment for Australia’s retirement system and financial markets. While it promises to improve retirement outcomes for many Australians and inject capital into the investment sector, it also presents challenges for businesses and requires careful planning and adaptation by all stakeholders. Staying informed, proactive, and engaged will be crucial to navigating these changes effectively and maximizing the potential benefits.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy