Xero’s share price (ASX:XRO) has experienced some big swings in recent months, but are back on the up leading into the next set of financials. After a 23% drop from February’s highs into early April, the price has rallied 22% in the past 5 weeks to return positive YTD (+4.11%).

Macquarie analysts recently reiterated optimism, citing potential upside from U.S. market penetration and accretive payment integrations with Stripe. They highlighted Xero’s pricing advantage over Intuit (44% cheaper base plans) and projected strong EBIT surprises in the upcoming FY25 results. While Goldman Sachs and Citi forecast 18–41% upside (price targets: $201–$214), the stock trades at 33.6x FY26 EV/EBITDA, below peers like WiseTech (63x) but above historical averages.

While Xero’s ANZ revenue grew 27% in H1 FY25, international markets, particularly the U.K, remain challenging. The U.K. contributes 26% of subscribers but faces macroeconomic stagnation, raising concerns about growth sustainability.

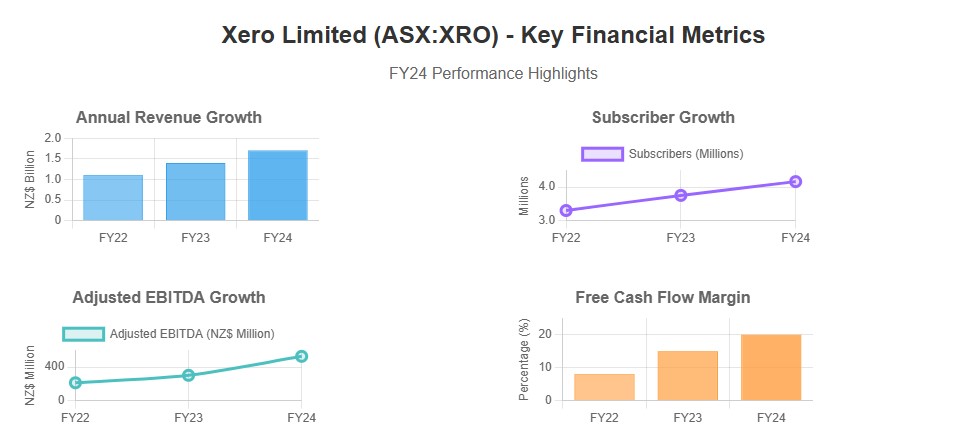

Taking a look back at Xero’s FY24 results for clues, and the report released in May 2024 marked somewhat of a turning point for the company, with adjusted EBITDA surging 75% to NZ$527 million and revenue growing 22% to NZ$1.7 billion. The return to profitability (NZ$175 million net income) reflected successful cost management under CEO Sukhinder Singh Cassidy, who prioritized operational efficiency while maintaining subscriber growth (+11% YoY to 4.16 million users). Free cash flow margins expanded to 20%, crossing the Rule of 40 threshold, a key benchmark for SaaS companies. The 41.77% in gains for Xero shares since the report helped accelerate a rebound that had been a few years in the making, with the stock taking 3 years to return to 2021 highs.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Xero’s U.S. strategy has emerged as a critical growth lever. Macquarie notes that new management, product enhancements, and regulatory tailwinds position Xero to challenge Intuit’s 70% market share among 33 million SMBs. Recent partnerships with Karbon (practice management) and BILL (online bill payments) aim to deepen functionality for accounting firms. The Stripe-powered “Tap to Pay” feature, launched in Australia and the U.K., further diversifies revenue streams.

March 2025 product updates introduced file attachments for fixed assets and streamlined partnership tax filings, addressing long-standing user requests. Citi analysts highlighted the strategic rationale behind tiered price hikes, which focus on premium plans and could boost FY26 ARPU by 5%. These increases, coupled with a stable churn rate (0.94% monthly), suggest pricing power despite economic headwinds.

Xero’s recent performance underscores its transition from a high-growth disruptor to a maturing SaaS leader. Strategic partnerships, U.S. expansion, and pricing leverage provide credible pathways to sustain 20%+ revenue growth. However, elevated valuations and macroeconomic uncertainty necessitate caution. We would be paying attention to US subscriber acceleration, margin trajectory, and any guidance revisions for FY26 as points of interest from the FY25 results.