Harrison Massey, Argonaut

BUY RECOMMENDATIONS

BUY – Whitehaven Coal (WHC)

Whitehaven recently announced it had completed the acquisition of two metallurgical coal mines from the BHP Mitsubishi Alliance. The new assets are near WHC’s existing operations and should create synergies. The acquisition will enhance the company’s sales mix, with thermal and metallurgical coal production about evenly split. In terms of size, Whitehaven has minimal competition, so the risk of any new big suppliers emerging in the short term is low.

BUY – De Grey Mining (DEG)

De Grey’s Hemi gold project is a premier undeveloped asset. The company is looking to finalise its funding package in fiscal year 2024, which should significantly de-risk the project. The company is targeting a 15-year mine life, with a definitive feasibility study highlighting a production profile of 530,000 ounces a year at a grade of 1.7 grams a tonne. The company remains an attractive target for a major producer.

HOLD RECOMMENDATIONS

HOLD – GR Engineering Services (GNG)

The company provides quality engineering design and construction services to the mining and mineral processing industries. Recent uncertainty regarding BHP’s West Musgrave nickel and copper operation may raise investor concerns, but GNG retains a strong order book for fiscal years 2024 and 2025 and a healthy cash balance.

HOLD – Mineral Resources (MIN)

MIN operates a diversified mining services business. It’s also involved in iron ore and lithium mining. We believe lithium prices have been oversold. Despite a recent uptick in the share price, we believe the company is worth holding due to MIN planning to ramp up its Onslow iron ore project in mid 2024.

SELL RECOMMENDATIONS

SELL – Wesfarmers (WES)

The industrial conglomerate’s latest half year results exceeded market expectations. However, we believe Wesfarmers may be trading above fair value. Future interest rate cuts may not be as pronounced as initially anticipated, so retailers may come under pressure if discretionary spending doesn’t rebound as strongly as expected. With the share price recently trading close to all-time highs, it may be prudent to trim exposure and pocket some gains.

SELL – National Australia Bank (NAB)

The bank has enjoyed a strong start in calendar year 2024, with the share price rising from $30.86 on January 2 to trade at $34.30 on April 11. In our view, the stock was recently trading on peak multiples. Also, in our opinion, there appears to be a lack of catalysts to move the share price higher in the short term. It may be worth considering taking some profits at these levels.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

BUY – Evolution Mining (EVN)

We expect elevated gold prices to boost underlying earnings and net mine cash flow metrics. This gold company’s balance sheet remains rock solid. There’s been a substantial boost to resources, with copper to become an important part of the mix. I anticipate upward revisions in the coming quarters.

BUY – Global X Copper Miners ETF (WIRE)

The company provides exposure to a diverse set of copper miners. We expect higher copper prices in response to ongoing supply constraints, escalating demand from infrastructure projects and the transition to green energy. The company offers positive underlying fundamentals and a bright technical outlook. We expect favourable share price momentum to continue.

HOLD RECOMMENDATIONS

HOLD – Fortescue (FMG)

The iron ore producer reported solid first half results in fiscal year 2024, with key metrics boosted by higher iron ore prices. The fully franked interim dividend of $1.08 a share was up 44 per cent on the prior corresponding period. Cash flows were strong. Achieving production targets in the second half present a challenge as iron ore prices can be volatile. Nonetheless, even around current spot prices, the valuation is reasonable.

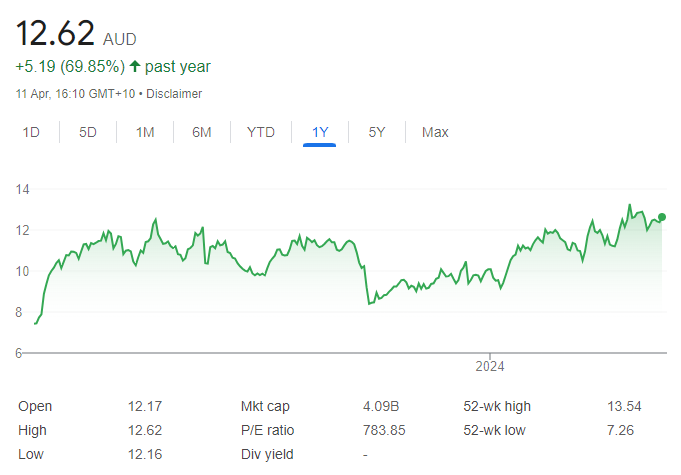

HOLD – HUB24 (HUB)

HUB24 operates an investment and superannuation platform. The company has been a solid performer year-on-year, outpacing its sector and the S&P/ASX200 index. This is mostly due to the company’s solid track record in disrupting the investment platform space. The company posted strong first half results in fiscal year 2024, with record net inflows and double-digit revenue and profit growth. However, we remain cautious given the recent increase in the share price amid uncertainty about the timing of interest rate cuts.

SELL RECOMMENDATIONS

SELL – Lendlease Group (LLC)

Investors punished the stock after this property developer and investment manager posted a statutory loss after tax of $136 million in the first half of fiscal year 2024. The group’s core operating profit after tax of $61 million was down 42 per cent on the prior corresponding period. The group lowered return on equity guidance to 7 per cent in fiscal year 2024, reflecting more uncertainty about transaction timing and higher execution risks.

SELL – Lifestyle Communities (LIC)

The company develops, owns and manages independent living residential land lease communities. Net profit after tax of $20.8 million in the first half of fiscal year 2024 was down from $25.2 million in the prior corresponding period. Profit was partially impacted by lower new home settlements. We expect more competition in this space. The shares have fallen from $18 on January 2 to trade at $14.60 on April 11. We prefer other stocks at this stage of the cycle.

Stuart Bromley, Medallion Financial Group

BUY RECOMMENDATIONS

BUY – Telix Pharmaceuticals (TLX)

Telix is a commercial stage biopharmaceutical company. Its prostate cancer imaging agent, marketed under the brand name illuccix, has been approved by the US Food and Drug Administration, the Australian Therapeutic Goods Administration and Health Canada. Total group revenue of $502.5 million in fiscal year 2023 was up 214 per cent on the prior corresponding period. It reported an inaugural full year profit after tax of $5.2 million. The company has guided fiscal year 2024 revenue to range between $675 million and $705 million at recent exchange rates. The guidance is based on global sales of illuccix and potential from other cancer imaging agents subject to product regulatory approvals.

BUY – Aeris Resources (AIS)

Revenue from ordinary activities was down 8 per cent for the half year ending December 31, 2023. The company reported a loss after tax of $18.761 million. The company placed its Jaguar zinc and copper operations into care and maintenance in September 2023. The share price has risen from 8.5 cents on February 22 to trade at 21 cents on April 11, as copper and gold prices have been recently enjoying positive momentum. We believe AIS offers upside potential. Investment house Washington H Soul Pattinson and Company owns a significant stake in AIS.

HOLD RECOMMENDATIONS

HOLD – RPMGlobal Holdings (RUL)

RUL develops and provides software and advisory services to the mining industry. The business delivered a net profit after tax of $6.8 million in the first half of fiscal year 2024, up 467 per cent on the prior corresponding period. The company recently reaffirmed previous guidance, with total revenue to range between $110 million and $115 million in fiscal year 2024 compared to $98.4 million in fiscal year 2023.

HOLD – Westgold Resources (WGX)

The share price of this gold miner has fallen from $2.77 on April 2 to trade at $2.07 on April 11. Third quarter production in fiscal year 2024 was impacted by weather issues. However, the company’s cash and bullion increased by $9 million in the third quarter, taking the group total to $247 million at the end of the quarter. Also, Westgold and Karora Resources Inc. have agreed to merge, potentially creating an Australian gold miner capable of producing 400,000 ounces a year.

SELL RECOMMENDATIONS

SELL – Platinum Asset Management (PTM)

The investment manager experienced net outflows of about $527 million in March 2024. It includes net outflows of about $467 million from the Platinum Trust Funds. Funds under management fell from $15.562 billion on February 29, 2024, to $15.457 billion on March 31, 2024. The shares have fallen from $1.305 on March 26 to trade at $1.15 on April 11. Other stocks appeal more at this stage of the cycle.

SELL – Qantas Airways (QAN)

The company delivered statutory profit after tax of $869 million in the first half of fiscal year 2024, down 13 per cent on the prior corresponding period. Statutory earnings per share of 52 cents were down 4 per cent. Net debt rose to $4 billion as new aircraft were delivered. Net debt was at the bottom of the target range. Crude oil prices can be volatile given wars in the Ukraine and the Middle East. The share price has risen from $5.01 on March 6 to trade at $5.82 on April 11. Investors may want to consider cashing in some gains.

Related Articles:

- The best automated trading platforms

- How to Trade CFDs in Australia

- A Guide to Day Trading ASX Shares

- The Best Crypto Trading Platforms in Australia

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.