Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

BUY – Triangle Energy (Global) (TEG)

The company’s Cliff Head oil field produced 53,871 barrels for the quarter ending March 31. TEG has farmed out 25 per cent of interests in exploration licences L7 and EP 437. It holds a 10.6 per cent interest in State Gas. TEG held $12.17 million in cash at the end of the quarter. While TEG is highly speculative and suits investors with a high-risk tolerance, it offers potential growth. We expect modest market capitalisation to attract buyer support. The shares finished at 1.6 cents on June 22.

BUY – Gascoyne Resources (GCY)

The emerging gold producer has been significantly re-capitalised to unlock the potential of the Never Never discovery. Gold results from the Never Never deposit have been encouraging and highlight significant potential. Never Never averaged 92 per cent overall metallurgical recovery in oxide material, with fresh material averaging above 94 per cent. The shares have risen from 11 cents on May 22 to close at 17.5 cents on June 22.

HOLD RECOMMENDATIONS

HOLD – Dimerix (DXB)

DXB is a clinical-stage biopharmaceutical company. It’s currently developing its proprietary product DMX-200 in a phase 3 clinical study targeting Focal Segmental Glomerulosclerosis (FSGS), a rare disease that can damage the kidneys. DXB has expanded the phase 3 trial to 70 sites in 11 countries. DXB is in advanced partnering negotiations. We consider DXB a high risk, high reward stock.

HOLD – Aurumin (AUN)

The Sandstone project is part of the company’s Sandstone operations, which also includes the Birrigrin and Johnson Range projects for a total resource of 946,000 ounces of gold. AUN recently announced drilling plans at Sandstone. Pre-development activity has started at the company’s Mount Dimer project, which has historically produced more than 125,000 ounces of gold. Growth potential exists, but the share price can be volatile.

SELL RECOMMENDATIONS

SELL – Commonwealth Bank of Australia (CBA)

The bank has a strong track record of performance. The stock has risen from $95.69 on June 7 to close at $100.08 on June 22. Our concern is higher interest rates and the negative impact it’s having on home loan borrowers. Another interest rate rise is possible, making it even more difficult for some borrowers to meet repayments. Investors may want to consider taking a profit.

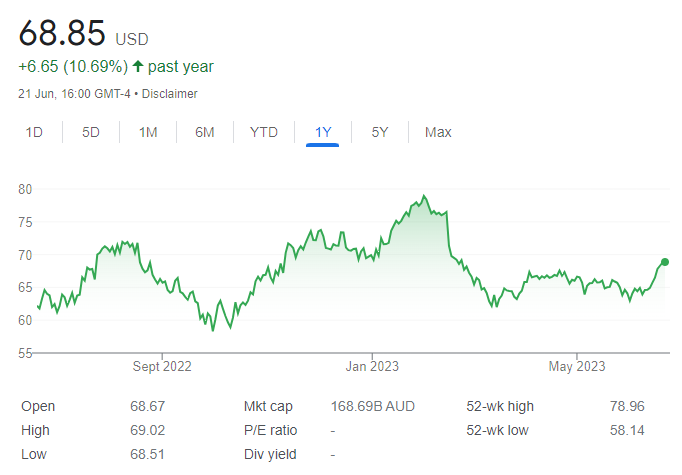

SELL – WiseTech Global (WTC)

WTC provides software solutions to the global logistics industry. Company EBITDA of $187.3 million in the first half of fiscal year 2023 was up 36 per cent on the prior corresponding period. Total revenue of $378.2 million was up 35 per cent. The share price has risen from $49.17 on January 3 to finish at $76.90 on June 22. Investors may want to consider cashing in some gains.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

BUY – Sonic Healthcare (SHL)

We have upgraded our recommendation for this healthcare provider following the acquisition of Medical Laboratories Duesseldorf in Germany. The €180 million acquisition is expected to be earnings accretive on revenues of about €50 million in fiscal year 2024. This acquisition closely follows the €190 million acquisition of Diagnosticum Laboratory Group in Germany. Demand for diagnostic services in Germany is forecast to grow in the years ahead.

BUY – SRG Global (SRG)

SRG is a diversified industrial services company. SRG upgraded EBITDA guidance by 8 per cent to between $79 million and $80 million for fiscal year 2023. The $80 million acquisition of Asset Care is tracking well and will add between $4.5 million and $5 million to EBITDA in fiscal year 2023. The company has been awarded more than $1 billion in contracts in the past 12 months, which is expected to grow EBITDA well into the future.

HOLD RECOMMENDATIONS

HOLD – Boral (BLD)

The company should benefit from improving conditions in the private and civil building sectors. Government funding is expected to flow to these sectors during the next 12 months. This building products company is successfully managing inflationary costs with cost mitigation programs. Fiscal year 2023 earnings before interest and tax may exceed forecasts. The outlook appears brighter.

HOLD – Domino’s Pizza Enterprises (DMP)

Following the recent acquisition in Cambodia and minority interests in Germany, the company has decided to optimise the corporate store network in Denmark through accelerated franchising and closing between 65 and 70 underperforming company-owned stores. Consequently, Domino’s is forecasting earnings before interest and tax to improve between $25 million and $30 million in fiscal year 2024.

SELL RECOMMENDATIONS

SELL – 29Metals (29M)

The company’s operating assets include Capricorn Copper in Queensland and Golden Grove in Western Australia. Extreme rain at Capricorn Copper in March shut operations. Executing a full recovery is a formidable task and will take time. The operational outlook for Golden Grove looks sound. However, in our view, other stocks in the gold and copper sectors appeal more at this time.

SELL – The a2 Milk Company (A2M)

In April, A2M announced it had reduced total forecast production volume needs for English label infant milk formula by 1650 metric tonnes between March and June. The company expects revenue growth to be at the lower end of previous expectations. It also expects the EBITDA margin to be similar to fiscal year 2022. The shares have fallen from $5.96 on April 19 to trade at $4.94 on June 22.

Christopher Watt, Bell Potter Securities

BUY RECOMMENDATIONS

BUY – GPT Group (GPT)

This diversified property group owns and actively manages a $27.4 billion portfolio of high quality Australian office, logistics and retail assets. The company’s businesses diversify income. The stock was recently trading at a meaningful discount to net tangible assets. It offers an attractive dividend yield, underpinned by strong occupancy rates across the portfolio.

BUY – IDP Education (IEL)

This education services provider is one of the biggest in the world. The company places international students into education institutions across six English-speaking countries. It co-owns and distributes one of the most widely accepted English language proficiency tests. We anticipate strong growth in the student placement business to be driven by structural tailwinds and product innovation.

HOLD RECOMMENDATIONS

HOLD – Technology One (TNE)

TNE is a software-as-a-service provider to customers in Australia, New Zealand, Malaysia and the UK. The company reported a strong 2023 first half result, with revenue and profit before tax ahead of our forecasts. Guidance forecasts profit before tax to grow between 10 per cent and 15 per cent for the full year, which is consistent with our expectations.

HOLD – Transurban Group (TCL)

The group builds and operates toll roads in Melbourne, Sydney and Brisbane. It also has toll roads in the US and Canada. Core Australian roads generate defensive revenue that grows with traffic volumes and toll price increases, which, at a minimum, are pegged to inflation. The stock looks fully priced at this point.

SELL RECOMMENDATIONS

SELL – Bank of Queensland (BOQ)

Cash earnings after tax of $256 million for the first half of fiscal year 2023 were down 4 per cent on the prior corresponding period. Cash earnings after tax in the retail division were down 3 per cent to $123 million, while the business division fell by 1 per cent to $136 million. Also, BOQ has entered into voluntary enforceable undertakings with the Australian Prudential Regulation Authority (APRA) and AUSTRAC to address the remediation of weaknesses and issues.

SELL – Harvey Norman Holdings (HVN)

HVN is one of Australia’s biggest consumer discretionary companies. It also operates in other countries. Excluding the effects of net property revaluation adjustments, profit after tax and non-controlling interests of $291.09 million in the first half of fiscal year 2023 was down 14.5 per cent on the prior corresponding period. Aggregated Australian franchisee sales in January 2023 were down 10.2 per cent on January 2022. The discretionary retail giant is up against higher interest rates and soaring cost of living increases.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.