- US debt ceiling negotiations are in focus as the $31.4 trillion debt ceiling is reached.

- Investors wary of prolonged negotiations to raise the ceiling must contend with the Federal Open Market Committee (FOMC) minutes on Wednesday.

- Monetary policy is front and centre to start the week and is rattling the stock market.

The Wednesday market open

Given an extra day of unpalatable news to digest before opening on Tuesday from the long weekend, the US markets sold off sharply.

It was broad-based selling, with the S&P500 down 2% and the NASDAQ down 2.5%.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The 0.5% differential between the interest rate-sensitive technology stocks suggests that economic concerns were only marginally outweighed by the valuation risk presented by a more hawkish Federal Reserve.

The S&P/ASX 200 ASX:XJO (XJO) was lower by 0.3% due to the US selling overnight.

The three main items on the market’s agenda overnight were:

- Federal Reserve (Fed) policy

- Private and government debt

- China and geopolitics

Federal Reserve Policy

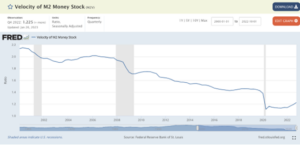

In its attempts to moderate prices to the 2% inflation target, the Fed has to contain a money supply north of $21t that is building momentum.

In the near-term, elevated credit card debt and rapid-fire purchases fuelled by low unemployment are proving near insurmountable obstacles to the Fed’s inflation target.

A helpful analogy to understand the money supply and its velocity might be a fully laden ship’s liquid cargo gathering momentum, causing considerable movement. Unstable cargo has the potential to sink a ship. The same applies to an economy if critical sector prices become too inflated.

Near record US money supply.

Source: St Louis Fed

Momentum is starting to build in the money supply.

Source: St Louis Fed

The increased frequency of goods purchased is reflected in the velocity of money and the growing credit card balances in the US.

The labour market remains extremely tight; with pay in the pocket, payment delinquencies are still at historical lows but creeping higher. It will take a rapid rise in unemployment before uncollateralised debt poses a risk to the economy.

Source: St Louis Fed

As a result of the delinquencies creeping higher, banks are starting to slow up uncollateralised credit issuance.

Source: St Louis Fed

It may be too little too late for the Fed. At least, the market thinks so, and on Tuesday, it priced in the possibility that interest rates will need to go higher to prevent overheating.

Australian comparison

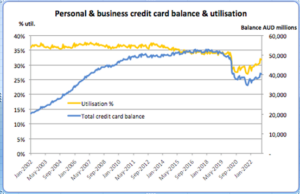

Australians spent $27.1b AUD on their credit cards in November last year, the highest monthly value of purchases on record.

Though credit card balances are rising, they are still below the highs set in 2016. Similarly, credit limit utilisations are below the average of the last 20 years.

While Australians are spending more on credit cards, the tight labour market and high employment levels mean that we’re presently spending within our means.

Source: Reserve Bank of Australia (RBA)

Like its US counterparts, the RBA is unlikely to be concerned with households overextending themselves, at least not right away, but more worried about what personal spending means for its inflation targets.

This perceived elevation in the concern of a requirement for international policymakers to provide more market intervention through raising interest rates is dragging on the stock market.

China enters the fray

US officials stated over the weekend that China is providing nonlethal assistance to the Russian military.

In what appears on the surface to be a possible return to the zeitgeist of 2016-2019, relations between China and the US provided direction on stock valuations. The market assumes trade policy will take a lead from foreign affairs and security in the coming months.

The news added impetus to the selling overnight Tuesday and is perhaps a taste of things to come.

Delicate balancing act

The Fed’s job of steering this overladen ship was already tricky, and record spending fuelled by a tight labour market has made the task that bit harder.

More aggressive interest rate policies, or indeed other possible market interventions, have the potential to derail the stock markets at home and abroad. The situation will likely become even more complicated with the foreign office taking the helm.