“Is China still investible?” is a question we’ve often heard in the market in the past two years, and indeed, rising geopolitical tensions and slowing headline growth, exacerbated by Covid, have raised doubts over the prospects for China’s markets. We are aware of these concerns and may adjust allocations accordingly across asset classes and at the level of individual securities – as we do in any market.

But when it comes to China – and especially more pessimistic investors – we think some risk missing one of the most significant evolutions taking place in the global finance industry in years: the liberalisation of China’s fast-growing investment and wealth management industry. Call it a golden age.

Consider a few datapoints. While the Covid pandemic disrupted many aspects of China’s economic life in recent years, it didn’t stop the country’s mutual fund sector from growing. Total assets invested in mutual funds have risen 71 per cent since January 2020, according to data from the Asset Management Association of China. As of the end of October, the sector’s total assets under management (AUM) stood at 26.5 trillion renminbi (US$3.8 trillion, as of Dec. 21).

The expansion is mainly driven by the rapid accumulation of household assets. China’s gross domestic product exceeded US$10,000 on a per capita basis for a third consecutive year in 2021. In his report to the Communist Party congress in October, President Xi Jinping said that per-capita GDP will take a “new, giant leap” to reach the level of a “medium-developed country” by 2035.

As a result, Chinese citizens have strong and growing demand for professional asset management services, including mutual funds.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

This demand is supported by a long-term structural shift. Demographic trends like the ageing population and shrinking labour force are adding downward pressure to China’s neutral interest rate. In response, savers are more likely to shift more of their assets from bank savings to asset management products in search of better returns.

At the same time, as awareness of the need to save for retirement grows in China, providing new investment options for pension pools is proving a growth area for mutual funds. This is likely to gain momentum as China launches individual retirement accounts: policymakers unveiled a new private pension scheme earlier this year to offer supplementary retirement funding options for the ageing population, alongside the traditional pension programs from the state or offered by companies. We believe that the new private or individual pension savings plans will prompt continuous innovation in asset management products.

Too big to ignore

From an allocation perspective, for global investors, China’s onshore markets are simply too big to ignore. The equity market and the bond market are both the second largest in the world. They are playing an increasingly important role in the global economy.

Historically, it was difficult for investors outside China to access the full range of onshore assets. But this has been changing as policymakers make market access easier for foreign investors.

With programs including Stock Connect and Bond Connect, international investors can buy and sell onshore China securities via Hong Kong. As China’s markets have matured and liberalised, global index providers have included more onshore bonds and equities into their benchmarks, which helps attract more foreign capital into the country.

The country’s domestic markets also provide attractive risk-adjusted returns. Present valuations of China equities are near historic lows. The economic slowdown and Covid-related restrictions are weighing on local companies’ financial fundamentals, but there are still opportunities for investors to seek excess returns if they dig deeper.

Diversification benefits

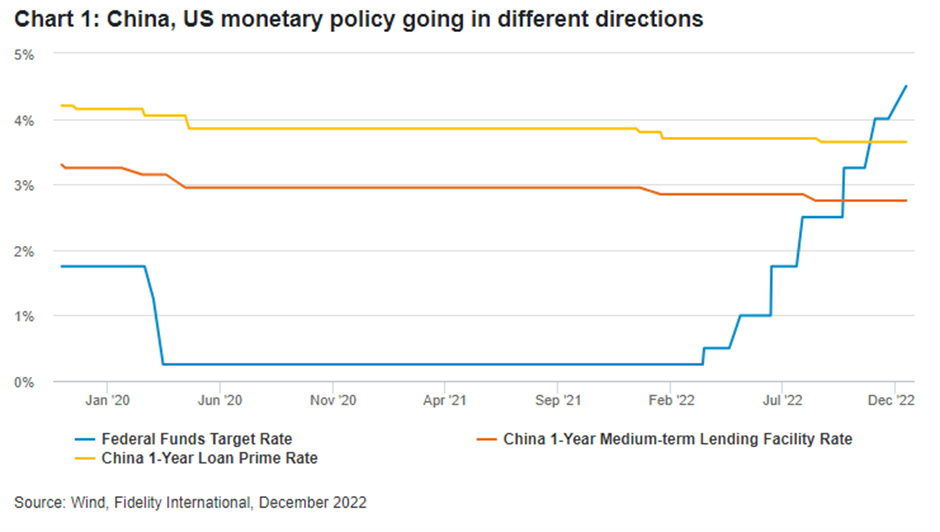

China’s bonds and equites have historically provided good diversification benefits to global portfolios because they present a low correlation with other asset classes. The difference between China’s interest rate cycle and the policy cycles of the world’s other major economies also boosts the case of Chinese assets as a diversification tool.

China continues to deepen its markets by increasing the supply of high-quality and diversified financial assets. Examples in recent years include introducing a registration-based initial public offering system and launching the Nasdaq-style Shanghai Stock Exchange STAR Market. Capital market reforms in China are likely to further improve market dynamics and transparency, bringing more high-quality investment options.

While geopolitics may dominate the headlines, we think economic growth remains a key domestic priority for the Chinese government. We expect China to continue to roll out monetary, fiscal, and regulatory stimulus to support the real economy. Foreign asset managers seeking to align with these efforts can leverage their experience and best practices from overseas, including in pension product offerings, sustainable investing practices and outbound investments strategies.

We have seen a lot of remarkable changes in the onshore capital markets since we opened our first mainland China representative office in Shanghai in 2004. Today, as the country moves toward reopening its economy, new opportunities may emerge. “Is China investible?” – we think the answer is clear.

Originally published by Fidelity International investment experts