- S&P/ASX 200 Materials ASX:^AXMJ (XMJ) is up 8.3% over the last 12 months.

- Australia’s largest gold miner, Newcrest Mining Ltd ASX:NCM (NCM), is down by 8.5% over the same period.

- Gold is often touted as a hedge against inflation; with the highest global inflation in 40 years, what has kept the lid on gold prices?

Gold, inflation, real rates

Gold prices

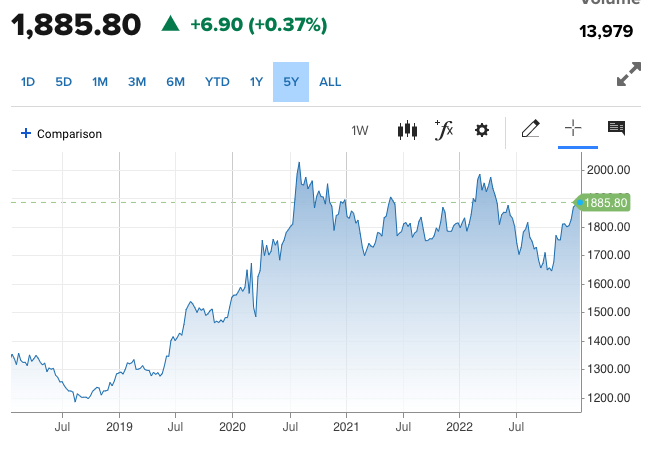

Gold has long been touted as a hedge against inflation, yet the metal has traded sideways for over two years even as the world battles its highest inflation levels in over 40 years.

Source: cnbc.com

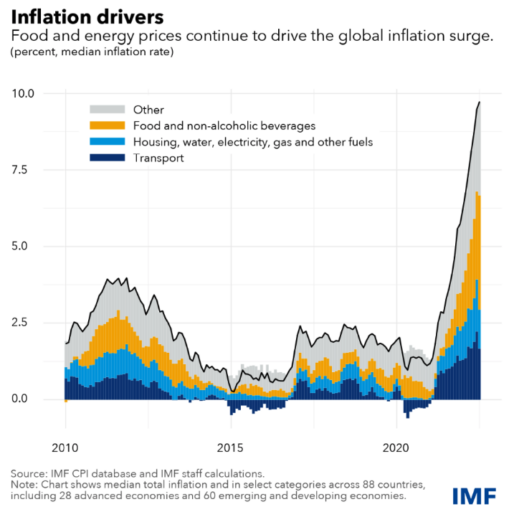

Surging inflation

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Source: imf.org

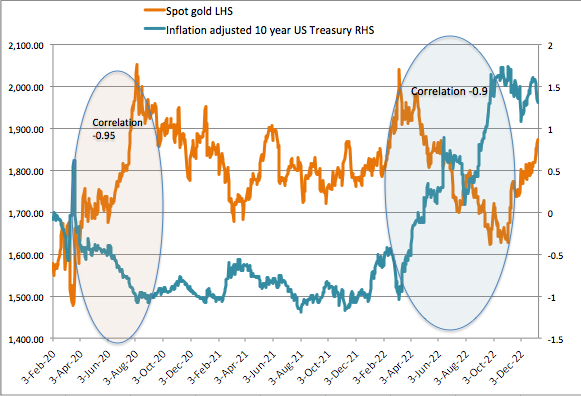

Gold and real rates

Gold doesn’t yield any income, so to attract investment dollars, other safe-yielding investments need to lose their lustre. The benchmark for a safe-yielding security is the US treasury.

The low-risk profile of the US treasury means that the US Federal Reserve need only set the payout yield marginally above the baseline inflation rate to attract investors and support the US government’s funding programme.

In this way, the investor is assured a small return for loaning money to the Fed under the rock-solid assurance the notional loan amount will be returned. As inflation eats into future cash, the Fed raises the yield slightly to cover inflation and ensure that the notional amount is repaid at future cash values.

Over the last few months, the Fed has been raising interest rates between 50bps and 75bps per month. On an annualised basis, that is between 6% and 9%. With US inflation hovering between 6% and 8%, the Fed has got ahead of inflation.

As the US Federal Reserve has been raising rates faster than inflation, it has maintained an inflation-adjusted real rate in the positive, a positive carry for those lending to the US.

The positive carry means that investors have not yet needed to look for alternatives for their super low-risk profile investment. The US treasury market has been able to ensure they get enough to cover inflation plus a little extra.

The slowdown in the rate hike cycle

Late last year, the Fed started signalling that it wishes to slow down this rate hike cycle, lest they derail many other assets in their attempts to quench the fires of inflation.

Such a turning point, while the service sector and wage inflation roar on, might just be the opportunity to enter the gold market. If inflation were to meander down only slowly from its present highs while the Fed curbs toward 25bps or lower rate hikes, gold would quickly appreciate.

The correlation with inflation-adjusted benchmark rates (real rates) over time is an inverse -0.5 or thereabouts. When there are marked shifts in direction on inflation or interest rates, the relationship is far more apparent, as demonstrated in the chart below.

At the onset of COVID, as interest rates collapsed, gold quickly shot up in value, with a correlation of -0.95. The mid-last year before the more severe rate hikes were implemented and inflation ran rampant, the correlation was -0.9.

Source: St Louis Fed

Summary

A signalled slowdown in the interest rate hike cycle, combined with persistent wage and service sector inflation as unemployment remains low, will result in the shine returning to the gold market, a welcome turn of events for NCM and other gold miners.