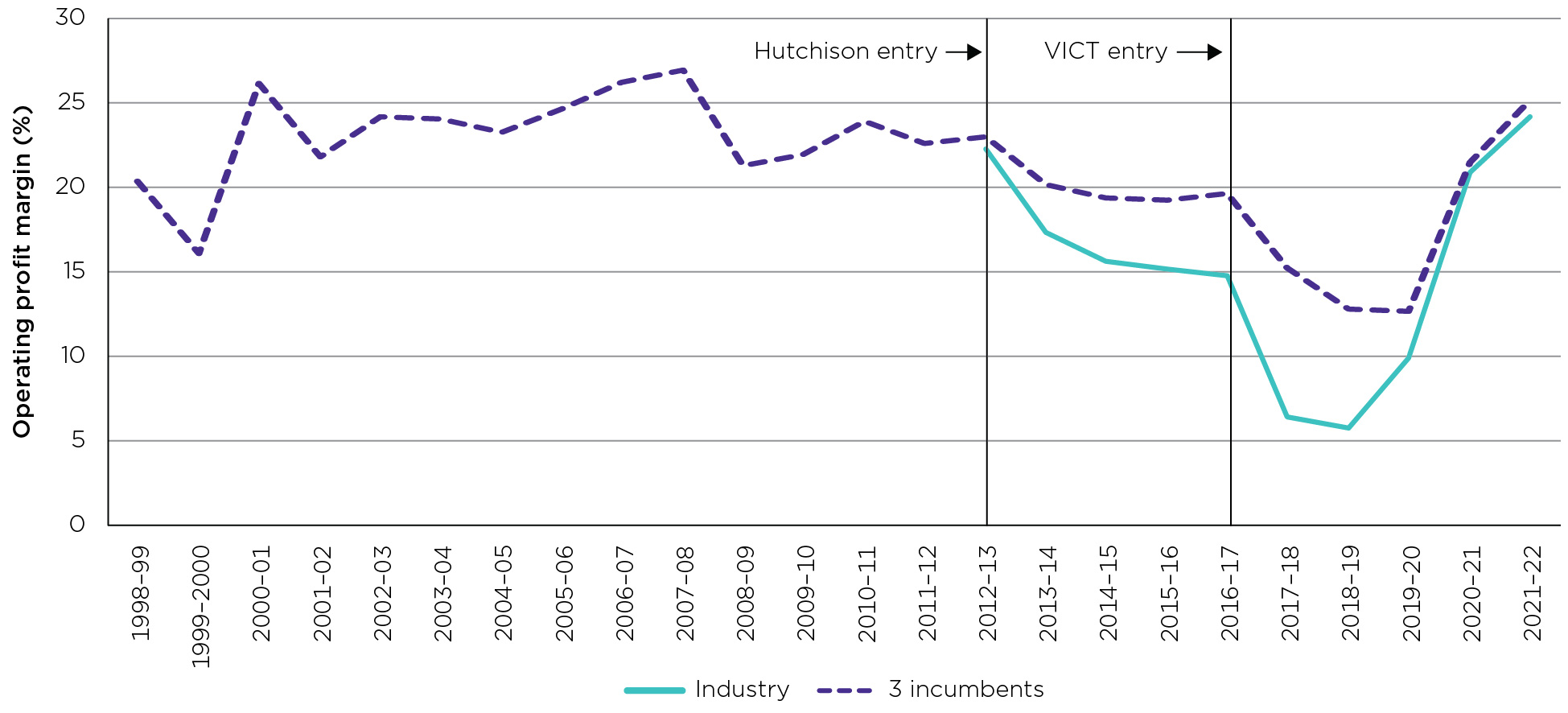

The operating profit margin of Australia’s container stevedoring industry has increased by 14 percentage points since the start of the COVID-19 pandemic to the highest level observed since the Patrick and DP World duopoly ended about a decade ago, the ACCC’s Container Stevedoring Monitoring Report 2021-22 reveals.

The report examines the prices, costs, and profits of stevedores at Australia’s international container ports, but also looks more broadly at the state of the container freight supply chain following the pandemic disruption of recent years.

It shows that the industry operating profit margin of Australia’s five stevedores was 24 per cent in 2021-22, up from 10 per cent in 2019-20.

Between 2000 and 2013, Patrick and DP World (Sydney, Melbourne, Fremantle and Brisbane), and the Adelaide container terminal collectively achieved operating profits of between 21 and 27 per cent; however, competition from Hutchison and VICT combined with large infrastructure investments and other developments led to their margins declining over the following seven years.

“Importers and exporters benefited from an injection of new competition at our largest ports several years ago, but we’re concerned that in the past few years those gains have been eroded to the detriment of importers and exporters, and, ultimately, Australian consumers,” ACCC Commissioner Anna Brakey said.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The ACCC has not yet formed a conclusive view on the drivers behind the recent increases in stevedores’ operating profits. Severely constrained global shipping capacity throughout the pandemic made it harder for importers and exporters to change to a different shipping service, and by implication a different stevedore, which may have weakened price competition between stevedores.

“If stevedores’ higher profits are due to the recent shocks to the global container freight supply chain, we’d expect their profits to decline over time as shipping and terminal congestion eases,” Ms Brakey said.

“We’ll be closely scrutinising the stevedores’ charges and financial performance in the coming years to see if there are any structural or behavioural factors sustaining higher profits, and whether any further policy or regulatory responses are warranted.”

Figure 1: Stevedores’ total operating profit margins, industry and 3 incumbents: 1998-99 to 2021–22

Source: ACCC analysis of information received from stevedores as part of the monitoring regime.

State of container freight supply chain

The report explains that COVID-19 continued to cause significant congestion and delays in the container freight supply chain in the 2021-22 financial year, although global shipping schedule reliability has improved in the second half of this year.

Schedule reliability at Australia’s container ports is influenced by the reliability of global shipping schedules as congestion and delays overseas can delay arrival at other ports along a given route.

A stevedore told the ACCC that as few as 10 per cent of ships arrived within two hours of their designated berthing window in 2021-22, but that figure had improved to between 30-40 per cent in recent months.

“Ongoing congestion in global supply chains means it’s still harder to move containers than it was pre-pandemic, but the situation has improved considerably this year,” Ms Brakey said.

The ACCC has also heard that unreliable shipping schedules have caused ‘vessel bunching’ at Australian ports, resulting in large peaks and troughs for stevedores’ container handling.

Between 2019-20 and 2021-22, the net ship rate, which is a measure of the number of containers moved on or off a ship in an hour, at Australia’s container ports fell by 18 per cent, at least partly due to vessel bunching.

“Less reliable shipping schedules, an increase in the size of ships visiting our container ports, and labour shortages across the whole supply chain have all impacted the efficiency of stevedores’ operations,” Ms Brakey said.

Figure 2: Global vessel schedule reliability: January 2018 – October 2022

Source: Sea-Intelligence Global Liner Performance Report – Issue 135

Freight rates fall

The recent slowdown in global trade has put downward pressure on global freight spot rates, which in November this year fell below US$2,000 per 40-foot container according to the Platts Container Index produced by S&P Global Commodity Insights. However, this is still roughly double the average rate in 2019.

Global freight spot rates peaked in September 2021 at nearly US$8,000 but fell to about US$5,000 by the end of June 2022.

Elevated freight rates and generally higher costs for importers to use the supply chain have contributed to higher prices for Australian consumers and have put upward pressure on inflation.

“There is currently a high degree of economic uncertainty globally, but if there’s a reduction in global trade next year as industry analysts are predicting, it should ease pressure on supply chains and freight rates even further,” Ms Brakey said.

Figure 3: S&P Global Commodity Insights Platts Container Index (US$/FEU): July 2017 to November 2022

Source: S&P Global Commodity Insights, copyright 2022 by S&P Global Inc.

Reforms are needed

The ACCC believes that the regulation of Australia’s monopoly container ports is ineffective, and the threat of further regulation in most states is not sufficiently credible. There is currently the potential for the exercise of market power to exist undetected due to the inadequate level of regulatory scrutiny.

The report says that, at a minimum, Australia’s privatised container ports (Brisbane, Sydney, Melbourne, Adelaide) should be subject to greater regulatory oversight.

The report also says that cargo owners in Australia need more protection against unreasonable detention fee practices, after the ACCC heard that some cargo owners paid significantly higher detention fees in 2021-22. Shipping lines charge detention fees to cargo owners for continuing to use containers beyond an agreed period, to incentivise their prompt return.

Cargo owners said that some shipping lines had levied detention fees on them for failing to return empty containers on time, even though the locations the shipping lines had directed the containers be returned to were full.

The ACCC supports the recommendations in the Productivity Commission’s recent draft report on Australia’s container ports to repeal Part X of the Competition and Consumer Act to encourage greater competition between shipping companies on Australian trade routes, address industrial relations issues, and develop benchmarks to measure the productivity of Australia’s container ports.

“Container shipping is critical to a trade-exposed economy like Australia. A well-functioning and more efficient supply chain would benefit all Australian businesses and consumers,” Ms Brakey said.