- The developed world ex-US NASDAQ:VXUS ETF is up 5.7% this week.

- The US S&P 500 is up 5.8% this week

- Are big international rallies reflective of an improving economic outlook or a brief respite from the pain yet to come?

Recent price action

In unison, international stock markets have rallied on very little positive news. The Australian RBA has moderated interest rate hikes but is still raising them.

OPEC is threatening cuts to production, undoing the deflationary work of the US Department of Energy (DOE).

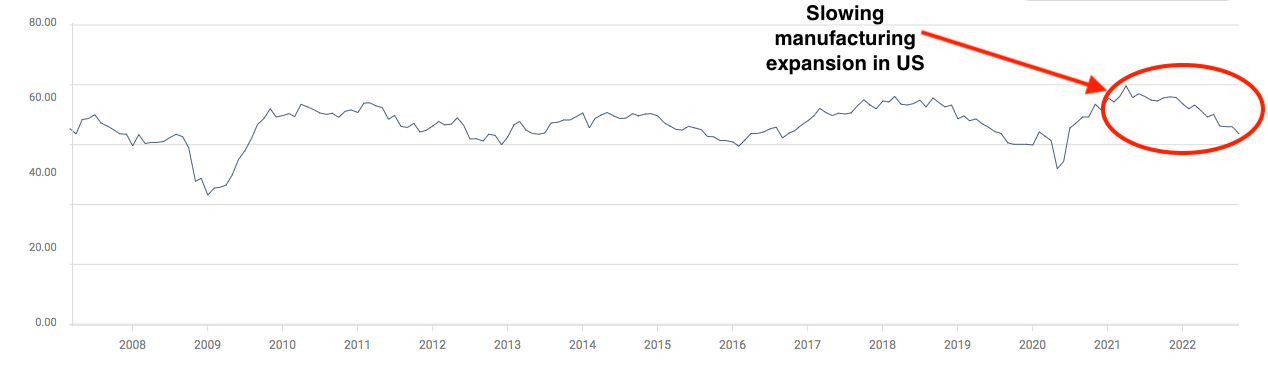

US and European manufacturing is slowing if not yet contracting. Yet international stocks are up over 5% to start the week.

Global Manufacturing

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

This week, a slew of published manufacturing data from around the world provides a window into the outlook for productivity.

The Purchasing Managers Index (PMI) is considered a leading indicator of the state of the economy. A reading above 50 implies that the economy is expanding, and below 50, it is contracting.

A broad basket of European countries, plus the US and the UK, have seen retracement in the level of expansion and, in the case of Europe, an extended period of economic contraction.

The monthly US Manufacturing Index:

In Europe, the picture is bleaker with the business conditions deteriorating. The European S&P Global Manufacturing PMI for September showed a reading of 48.4.

Herding

A commonly used statistical measure of the relationship in price action is a correlation. A positive correlation suggests that prices are moving in unison.

Portfolio managers use correlation to oversee the risk inherent in their portfolios. If the value of their portfolio holdings goes up or down together, there is a greater risk to their expected outcomes.

All over the developed world, we are concurrently seeing a raising in lending rates, a lowering in the expectations of business outcomes, souring corporate and consumer credit, and volatile currencies.

Market volatility is pulling out investments and leading to cash hoarding, mainly in US Dollars.

With pension fund, hedge and mutual fund managers all having the same thought process, we are witnessing a concerted injection and withdrawal of capital into the global stock markets. That is leading to a rise in the correlation of stock markets.

The correlated price action will provide intermittent respite but is also indicative of a general sense of market unease. Investors bundle together in a herd as cattle might rather than grazing independently. Any trigger could send the herd catapulting for the exits in a stampede.

Outlook

While the recent price action is a welcome turn of events for the international investor, one should be circumspect that this is a turning point in the markets.

With the conflation in Europe ongoing, OPEC threatening sizeable production cuts and inflation still not entirely tamed, the near-term outlook for stocks is still very much uncertain.