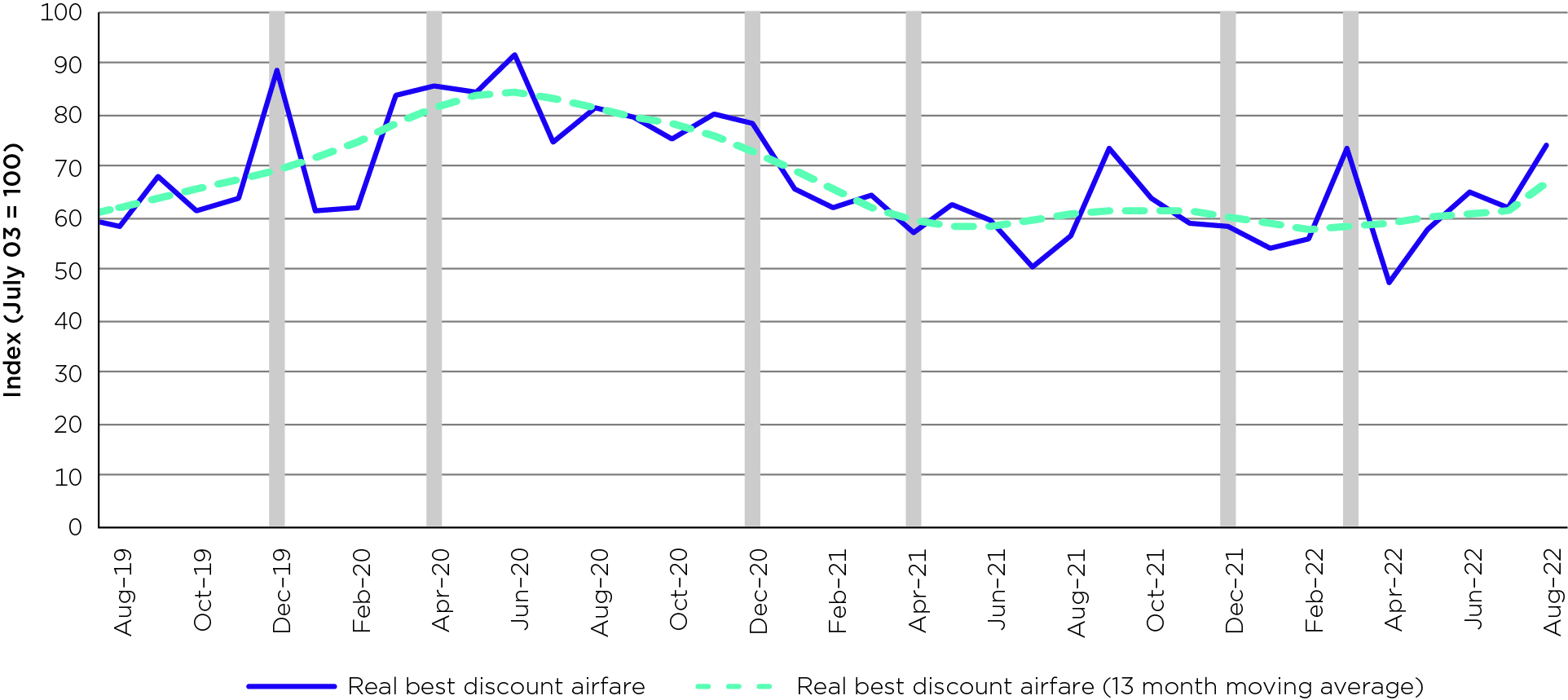

Domestic airfares increased significantly between April and August this year as airlines reduced capacity to manage staff shortages, and jet fuel costs climbed, the ACCC’s latest Airline Competition in Australia report reveals.

The quarterly report, released today, shows the cheapest economy airfares were 56 per cent higher in August 2022 than they were in April 2022 when they hit an 11-year low. Business airfares rose by 17 per cent between June and August.

“After about 18 months of historically low airfares, the cost of domestic flying has risen sharply in response to strong demand, temporary capacity reductions and very high jet fuel prices,” ACCC Chair Gina Cass-Gottlieb said.

“Discount economy airfares in August were at their highest point in almost two years.”

“In these circumstances, more than ever, the level of competition between airlines is incredibly important to maintain pressure on ticket prices and service levels across the industry,” Ms Cass Gottlieb said.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

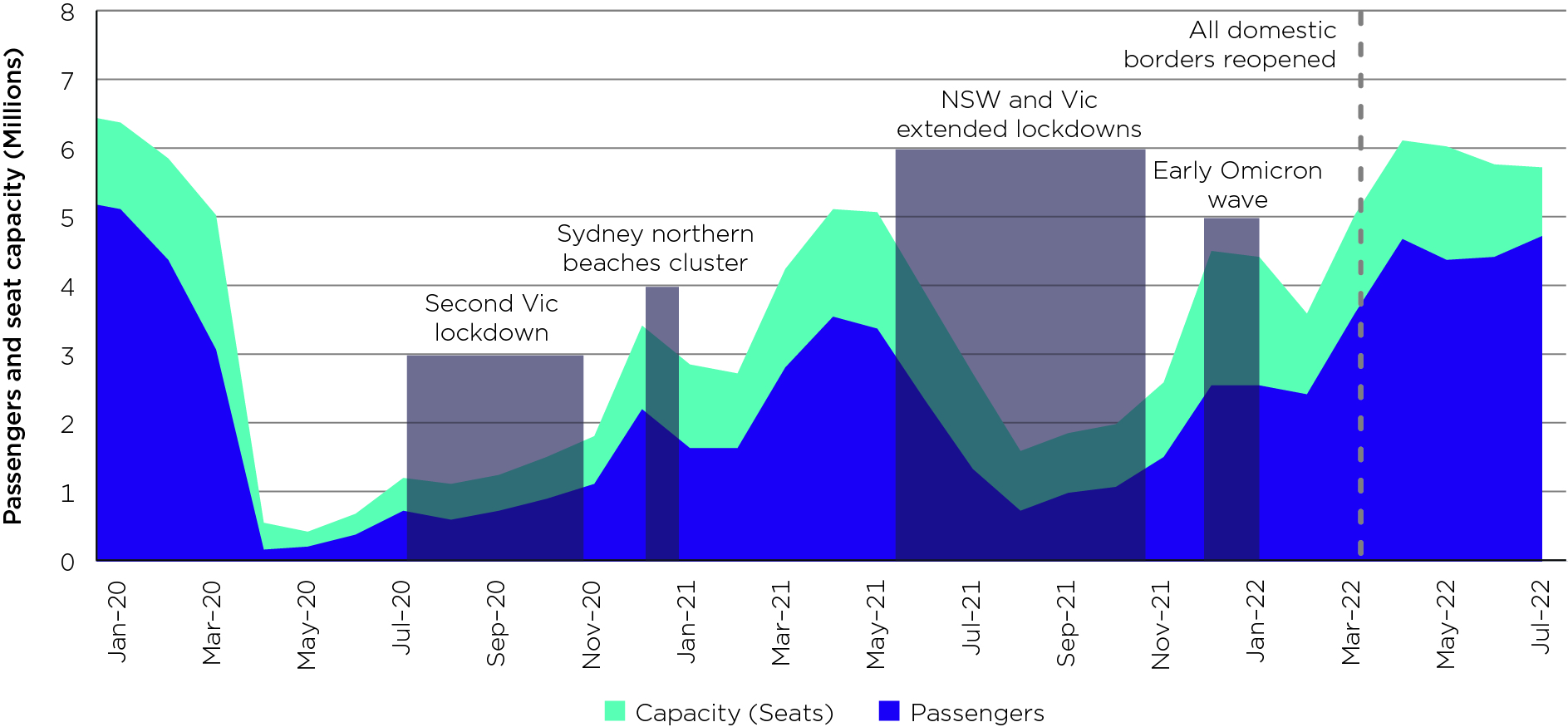

In July 2022, about 4.7 million passengers flew domestically, which was the highest number since the start of the pandemic, and 89 per cent of the passenger volume in July 2019. July is a peak time for travel due to school holidays.

In June 2022, the number of domestic airline passengers was 97 per cent of the passengers in the same month in 2019.

Travel to Queensland was particularly popular in July 2022. The number of passengers flying between Canberra and the Gold Coast almost doubled compared to July 2019. Travel between the Gold Coast and each of Melbourne and Adelaide also surpassed pre-pandemic demand.

“Pent up demand for leisure travel, particularly from people in the colder southern states, continues to drive the recovery in passenger numbers. Demand on routes between Canberra, Melbourne and Sydney has lagged behind, in part due to the slower recovery of corporate and business travel,” Ms Cass-Gottlieb said.

The strong demand for travel created challenges for an aviation industry still rebuilding its workforce and dealing with high rates of illness. In July 2022, the domestic airline industry reported the worst on-time performance on record, and airlines cancelled flights at a rate over three times the long-term average.

“We are aware that for many consumers, long awaited travel fell well short of expectations with record delays, very high rates of cancellations, lost baggage, and long wait times for call centres. We have been engaging closely with airlines to understand the source of these problems,” Ms Cass-Gottlieb said.

Rex performed significantly better than the other airlines in terms of punctuality and the rate of cancellations. It attributed this success to keeping its staff despite reduced flying over the last two years.

Airlines have advised the ACCC that on-time performance has improved more recently as rates of sickness have subsided, the aviation industry recruits more people, and the airlines reduce the number of scheduled flights.

“We expect that airlines will be honest and proactive in communicating to passengers the reasons why a flight is delayed or cancelled, how the consumer guarantees apply, and what other compensation they are entitled to,” Ms Cass-Gottlieb said.

The combination of high demand for travel and reduced capacity resulted in fuller flights. In July 2022, 82 per cent of seats were filled, while many routes to northern Australia surpassed 90 per cent. With such full planes, it has often been difficult for people to find available seats when their initial flight has been cancelled.

Qantas, Virgin and Rex all increased their market share between April and July 2022 after winning passengers from Jetstar. The Qantas Group-owned Jetstar carried 23 per cent of all domestic passengers in July, down from 28 per cent in April. Qantas carried 39 per cent of passengers in July, compared to 33 per cent for Virgin and 5 per cent for Rex.

Australian domestic air services – January 2020 to July 2022

Source: BITRE, Australian domestic airline activity; data collected by the ACCC from Qantas, Jetstar, Virgin and Rex.

Price index of cheapest discount airfares weighted across 70 busiest domestic routes – August 2019 to August 2022

Source: ACCC analysis of BITRE data on domestic discount airfares (cheapest available fare).

Note: Grey bars indicate December and Easter holiday periods.

Background

On 19 June 2020, the ACCC was directed by the former Treasurer to monitor the prices, costs and profits of Australia’s domestic airline industry and provide quarterly reports to inform Government policy. The direction is for three years. This report is the ninth under the Treasurer’s direction.

Consumers’ rights when their travel is changed or cancelled will depend on the circumstances and often the terms and conditions of the booking.

If an airline cancels a service for reasons within their control, then the normal consumer guarantee rights under the Australian Consumer Law are likely to apply, and consumers will be entitled to a replacement flight or refund. However, the consumer guarantee provisions of the Australian Consumer Law are unlikely to apply if the service is cancelled by the provider due to government restrictions. In these situations, the consumer’s entitlement to a refund or credit will generally be determined by the terms and conditions of their booking.

The Australian airlines’ websites also provide information about the assistance and any additional compensation the airlines may provide in the event of delays or cancellations.

The ACCC has confirmed it is investigating difficulties consumers are facing in using Qantas flight credits. As the investigation is ongoing the ACCC cannot comment further.