- Rising global benchmark interest rates are spooking investors as they bear witness to policymakers’ attempts to deflate their holdings.

- Investors are looking to keep their investments safe this winter.

- What are some of the best investment strategies to keep your money safe during an economic downturn?

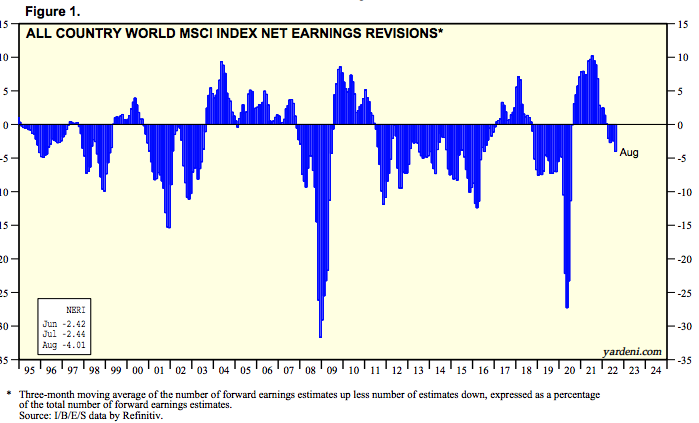

The international company earnings outlook is beginning to sour, and data gathered on projected earnings revisions are reported as negative for two or more consecutive months.

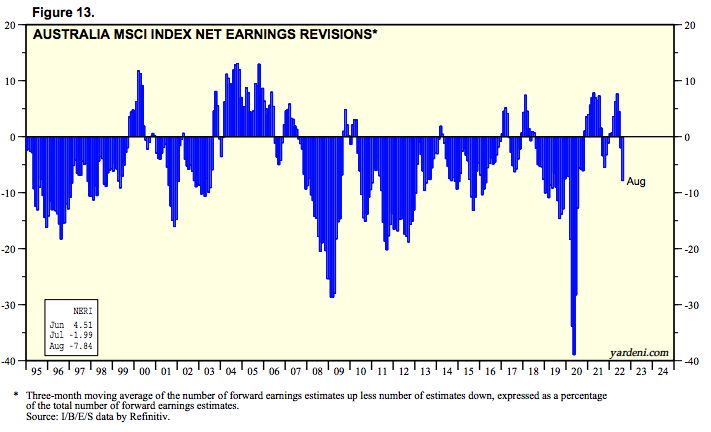

Australia followed the global trend downward in August despite recent records in raw material prices.

Raw materials

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Australia has ridden the raw material price boom following the COVID-19 lockdown; now, it seems the price tide has peaked and is starting to retreat.

Australia’s largest export in iron ore continues to take a dent from surplus raw material and the prospect of a deeper retracement in the China property sector.

The June highs in oil prices are firmly behind us as additional supply from the US, Libya and Iraq is helping European buyers find replacement barrels for displaced Russian oil imports.

A similar picture is unfolding in base metals, with copper and zinc prices softening from June highs.

With raw material prices softening and the demand outlook looking less rosy, Australia, as a country heavily reliant on the resource sector, will likely see some deterioration in its economic prospects.

Investing in a downturn

There are no home run investments during a downturn. An economic retraction impacts spending across the board, as belts and purse strings are tightened.

The companies that tend to perform better than others are those that hold the non-discretionary spending of the consumer and don’t need to adjust their business model to win over new customers.

Three of the most secure sectors to invest in during a downturn include:

- Consumer staples

- Healthcare

- Utilities

Consumer staples

This includes the companies and stores you turn to daily to feed and clothe your family on the household budget. Woolworths Group Ltd ASX:WOW (WOW) and Coles Group Ltd ASX:COL (COL) are the two largest companies in this sector. WOW and COL are down a modest 3% and 2% this year, respectively. They will find investors warming to their predictable and secure business model as promised returns on mining investments continue to be revised lower.

Healthcare

Come rain or shine, there will be a need for healthcare to grow in line with the population expansion.

For investors, healthcare is a safe place to park their money, as service providers in this sector will find a steady flow of customers.

CSL Limited ASX:CSL (CSL), Australia’s largest healthcare provider by market capitalisation, will attract the lion’s share of investments. CSL is up 2% year to date and is currently paying a dividend yield of approximately 1%.

Certainly not the exciting growth and payouts of a pure mining play, but slow and steady wins the race in difficult times.

Utilities

Irrespective of what the stock market is doing, all Australians need heat and power to keep the stoves cooking and the lights on.

Origin Energy Ltd ASX:ORG (ORG) and AGL Energy Ltd ASX:AGL (AGL) hold nearly half of Australia’s residential market share of electricity. ORG and AGL share prices are up 17% and 18% this year, respectively.

Summary

With the winds of economic winter bearing down on our shores, it might be wise to turn to the slow and steady of our trusted home and health providers when the fast and loose could be left out in the cold.