- The European trading bloc is feeling the heat of high prices

- Developed nations are rushing to respond to the crisis

- The stakes are high with the Northern Hemisphere winter on the horizon

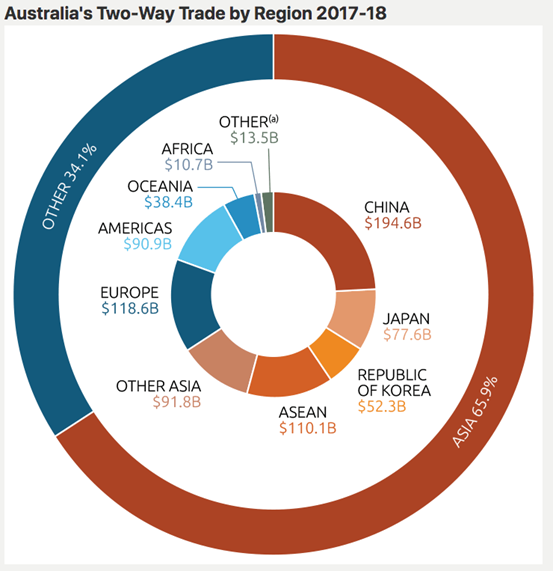

International trade

Just as Australia’s largest trading partner China is grappling with COVID-19 and a full reopening primed to supercharge the energy price landscape, Australia’s next largest trading bloc partner in Europe and the UK is currently being mauled by higher prices, with supplier Russia being incrementally shut out of its energy markets.

A worsening of economic conditions across Europe and the UK will have a direct material impact on the Australian economy.

The resulting demand fallout would spill over into other trading relationships given the close ties that Europe has with China and the Americas, rapidly deflating global asset valuations and key Australian commodity prices.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

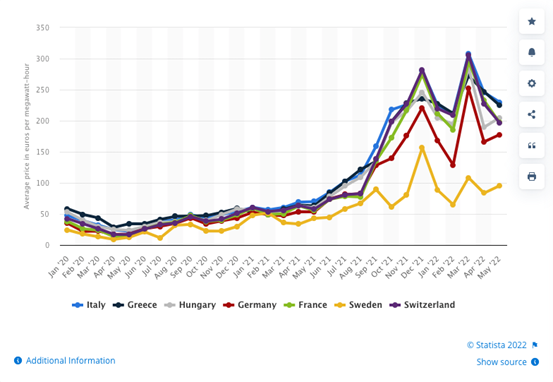

European economic winter

With the race on in Europe to restock gas for the winter, demand for coal is surging as utilities switch to coal power generation to make up for lost Russian gas and restricted US LNG imports following the Freeport terminal fire in June.

European air quality mandates and Australia’s high-quality, high-energy coal resource are serving to elevate Newcastle coal prices to records.

As waterborne trade explodes with pipes from Russia to Europe throttled, all manner of heavy shipping is experiencing generational profits and pouring more pain on the European importers.

On top of dealing with record coal and gas prices, carbon allowances are trading at all-time highs as the forced switching from gas to coal sends emission reduction credits to a premium.

We have not come round to the peak natural gas heating draws of winter that will compete with the power generators, and already the summer power prices have a foothold in 6-10-fold territory of what the average consumer would pay at this time of year.

One would imagine that these prices are unsustainable for the European consumer as feedstocks and shipping drive the energy bills in Europe to eye-watering levels.

As the impact of these price rises is drawn out, consumer credit quality in Europe will start to suffer.

The energy price crisis is yet to turn into a credit and liquidity crisis for the euro-banking sector, but it seems that this is more and more likely with each passing day.

When it rains, it pours

An extended La Niña is causing more heartache for families up and down Eastern Australia while doing little to take the heat out of Australian coal prices for the global market as the East Australian coal production and supply chain are threatened.

Thermal coal producer Whitehaven Coal Ltd ASX:WHC (WHC) is trading higher this morning, up 2.3% at AUD$4.91 per share – up over 400% from the lows of mid-2020 following the initial COVID-19 lockdowns.

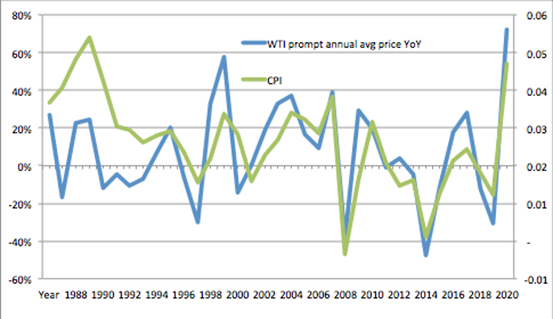

Price battlefront

In our fast-paced world, a great deal of our productivity and resulting wealth is built upon the pedestal of ready access to cheap energy.

Energy prices and all manner of consumables are intertwined.

The statistical relationship between oil price changes and the Consumer Price Index (CPI) is close and over the last 15 years even tighter.

Charted US crude against US CPI

We are running out of time for Europe and the rest of the world to avoid massive demand destruction through the extension of consumer credit due to high prices.

The resulting demand death spiral would come at the expense of businesses and jobs.

In order to avoid or at least moderate such an outcome, outgoings for consumers need to come down and that can start with the prices at the pump.

The US is throwing in the kitchen sink

Presently, no one nation is doing more to get on top of energy prices than the US.

The nation has upped production of crude and condensates by 10% from last year and plans to raise it another 10% in the year ahead.

Never-before-seen sales from its strategic reserve (SPR) are being conducted at almost 1 million barrels of oil per day, roughly the entire production of Libya.

Commercial inventories in the US have levelled out and there are signs that onshore US demand is moderating under higher prices and energy efficiencies.

European demand for US oil products continues to stretch the reserves as the Libya port blockades stem the flow of a key European refiner feedstock.

Outlook

Europe has spent a lot of its reserves, and this winter will be more prone to the elements than at any time in recent history, post-WW2.

A warm and windy winter will take the heat out of energy prices through renewable power generation.

A cold, still and cloudy winter will be an economic disaster with industry forced to close for months on end.

Most of the preparations that can be made are underway – it’s up to the heavens now.