- The ASX All Ords is down 12% year-to-date (YTD)

- Inflation is rocking international markets

- What is the outlook for the Australian economy?

As we round out the end of the Australian financial year (FY) 2022, let’s take stock of FY 2022.

Governments, government policy and market intervention have been the main drivers of market volatility in recent months. Lockdowns, military action, embargos and embargo retaliations have propelled commodities into rarefied air.

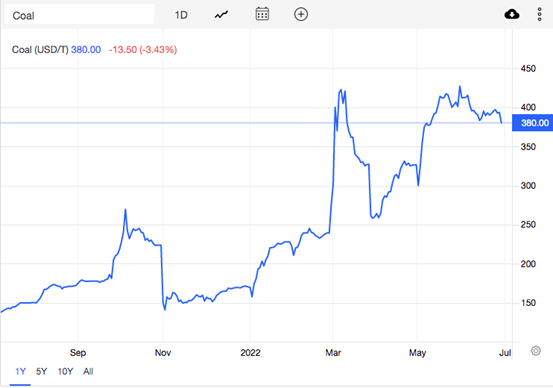

European geopolitics and the resulting energy embargos pushed coal and gas to all-time highs this year, with oil hovering around 110-120 USD/BBL.

Iron ore has dropped back from September 2021 record highs, though it is still attracting a robust 125 USD/MT.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

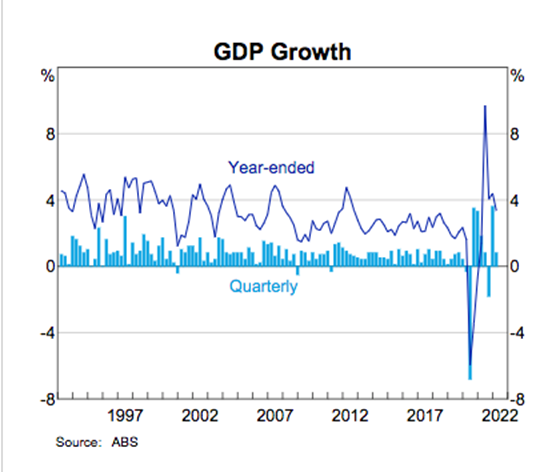

After the fallback in Australian GDP in 2020 following the shock of lockdowns, the economy has rebounded for two consecutive years and the resource sector continues to drive employment and the downstream services.

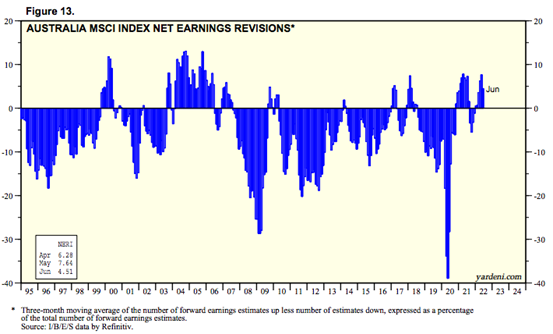

The 2022 net earnings revisions have been positive thus far and the near-term outlook for Australian companies is holding up in the face of higher prices.

High prices for consumers are dampening the growth rate, but Australia is still heading forward, and companies are hiring, expanding and addressing the robust international demand for reliably supplied raw materials.

Near-term outlook

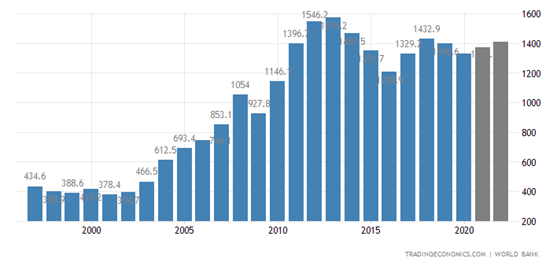

In 2015, the US Federal Reserve started tapering the size of its balance sheet and the US dollar appreciated.

Australian output equivalency in US dollars fell back through 2016, but continues to rally again on resource demand and expansive US Federal quantitative programmes.

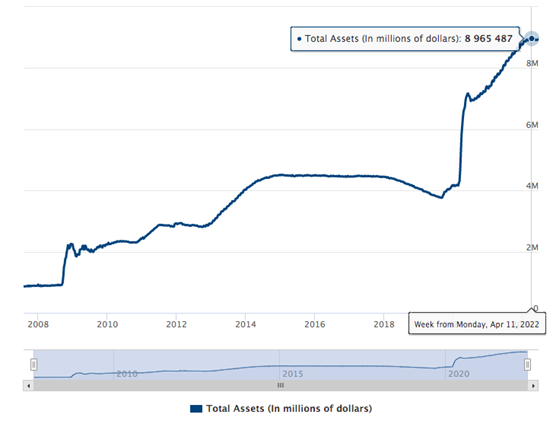

The US dollar continues its appreciation against a basket of international currencies as a safe haven and the Fed is left with few options but to stem the supply of new dollars as the balance sheet grows to dizzying heights.

Further tightening from the Fed in 2022 and 2023 and we should expect to see some downward pressure being applied to commodity prices and a softening of the Australian economic outlook.

Federal Reserve Board balance sheet growth

European struggles

With peak winter demand around the corner, European markets are stocking coal and gas, pre-empting upcoming declines in Russian supply.

Australia is addressing European requirements as best it can, the demand sending Newcastle coal into uncharted territory.

LNG headed higher

After forgoing some Gulf of Mexico cargoes for European emergency supply,

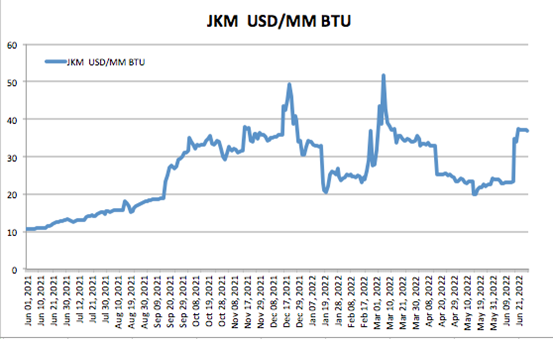

Asian buyers are currently in the market for winter restocking, and labour action in the North West is squeezing the Japanese landed LNG price toward 40 USD/MMBTU.

Staples in focus

A key priority for developing nations is the staple crop prices.

Indonesian President Joko Widodo was recently in Ukraine in order to get a lay of the land and press their concerns to President Volodymyr Zelensky.

The large wheat exporter Ukraine has planted a decent crop – over 65% of growing land is sown – and it remains to be seen if it’s able to get its cargoes away through the Black Sea.

It is in Russian interests to maintain cordial relations with developing nations, so the probability is weighted to Ukraine being able to ship its harvested wheat later in the year.

US wheat futures have come off from highs as a result of the Ukraine planting, but there are still large unknowns with this crop post-harvest.

The Australian economy as an international exporter of a broad basket of commodities continues to grow in the face of stifling consumer inflation.

Australian companies on average have been able to get through this challenging time.

Looking ahead

As Europe starts to slide into a technical recession in the face of withering price rises, the contagion to other markets may start to weigh on our companies at home.

A rising US dollar against a backdrop of consumers running dry from months of record raw materials prices may potentially spill into Australian asset devaluation.

The juggernaut US Federal Reserve balance sheet on swift international trade is running full steam toward impenetrably high prices.

It is certainly very difficult for commodities to maintain these levels before the world economy runs headlong into a retail credit cliff – something has to give, and soon.