Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

QBE Insurance Group (QBE)

QBE underwrites and provides insurance products to customers across the globe. QBE has increased insurance rates over the past year, which is likely to increase margins and underlying profit into 2022. Pricing tailwinds are evident, and the stock is relatively inexpensive as it was recently trading on a forecast price/earnings multiple of 12.8 times for fiscal year 2022. Our forecast price target is $13.70 amid a dividend yield of 4.2 per cent.

Westpac Bank (WBC)

We prefer WBC to the other major banks because it’s positioned relatively defensively due to its loan book skewed more towards Australian home lending. The recently announced off market buyback is positive for shareholders, and is earnings accretive. We believe WBC offers the most compelling valuation of the major banks. Our 12-month price target is $29.50 and we’re forecasting a dividend yield of 6.3 per cent.

HOLD RECOMMENDATIONS

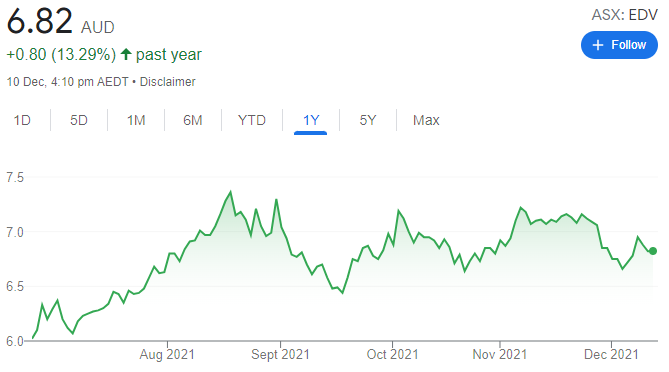

Endeavour Group (EDV)

EDV operates liquor outlets, such as Dan Murphy’s and BWS, which have benefited from lockdowns. Its portfolio of hotels should benefit from COVID-19 lockdowns being lifted in New South Wales and Victoria. The hotel portfolio is a higher margin business than the retail arm. Our 12-month price target is $6.95 and we’re forecasting a dividend yield of 3 per cent.

Macquarie Group (MQG)

MQG is a global provider of banking, financial, advisory, investment and funds management services. Near term, we believe MQG is likely to face earnings pressure from the impact of softer economic conditions, but it remains well positioned to ride out the pandemic and seize opportunities on the other side. We continue to hold MQG, as we like its exposure to long term structural growth involving infrastructure and renewables.

SELL RECOMMENDATIONS

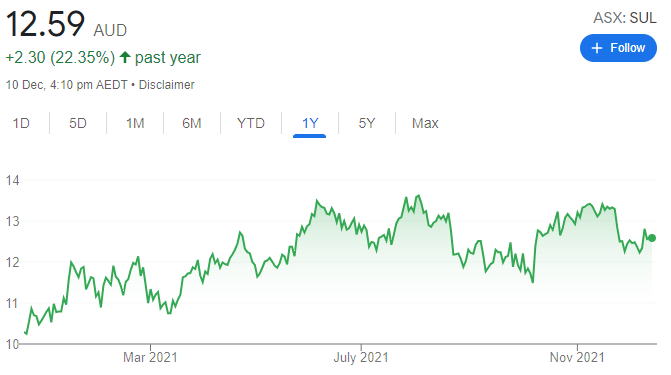

Super Retail Group (SUL)

The businesses have performed well from increasing domestic tourism, leisure activities, home-based fitness and a general acceleration in online consumption. But, in our view, earnings will moderate from currently elevated levels. We remain cautious about traditional retailers due to uncertainty flowing from the Omicron variant. It may be prudent to consider trimming holdings and taking some profits.

ASX Limited (ASX)

The shares have risen from $79.54 on October 15 to close at $89.58 on December 9. The ASX is trading well above our valuation of $67.30 and we expect relatively flat earnings growth moving forward. Investors may want to consider taking some money off the table. We believe other companies offer stronger growth prospects at this point in the cycle.

Julia Lee, Burman Invest

BUY RECOMMENDATIONS

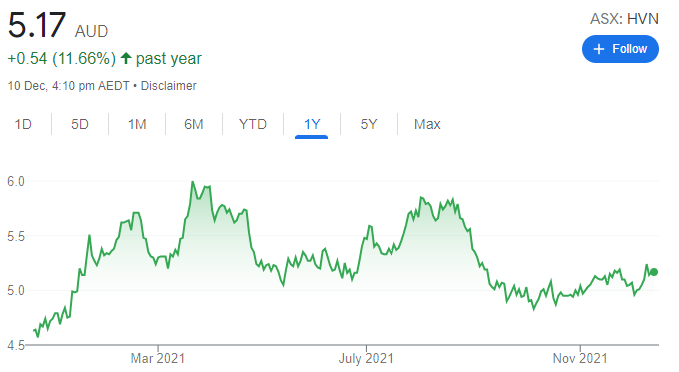

Harvey Norman Holdings (HVN)

Sales have been under pressure due to the impact of COVID-19 lockdowns. The retail giant sells big ticket items that shoppers want to see before buying. The outlook is brighter now that News South Wales and Victoria have emerged from lockdowns. Increased household savings is positive for HVN during the crucial Christmas shopping period. Internationally, all regions except Malaysia are generating growth.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Allkem (AKE)

Lithium producer Orocobre has changed its name to Allkem. The company recently upgraded production forecasts given strong production of spodumene concentrate at Mt Cattlin in the September quarter. Demand for battery grade lithium is exceeding supply, so strong prices are expected into 2022. Most sales are under term contracts, with little exposure to spot prices. But strong spot prices are positive for quarterly and annual contract negotiations. A key risk is that supply comes online faster than demand, which can drive down lithium prices.

HOLD RECOMMENDATIONS

Sydney Airport (SYD)

Sydney Airport was recently trading at a discount to the takeover offer of $8.75 from the Sydney Aviation Alliance. The Australian Competition and Consumer Commission will not oppose the proposed acquisition. In the meantime, any price below $8.35 may be seen as an opportunity to accumulate. I expect the takeover offer to proceed after satisfying further regulations, which should result in the share price trading closer to $8.75. The shares closed at $8.59 on December 9.

Westpac Bank (WBC)

The shares have been sold down heavily after its half year results. Investors were concerned about margin pressure and expenses potentially rising more than expected. However, the stock appears to have bottomed in the short term. Interest rates are expected to rise over the next few years, which should lead to better margins for the banks as they lift rates on their mortgage books.

SELL RECOMMENDATIONS

Redbubble (RBL)

RBL operates a global online market for prints, enabling artists to sell their work. People had more time for additional activities during lockdowns, driving supply to Redbubble. RBL also benefited from increasing online shopping. People now returning to schools and offices generally have less time for other activities. Online platforms face increasing competition from bricks and mortar stores now that lockdowns have been lifted.

Nearmap (NEA)

This high definition aerial imaging services provider has been under pressure due to expectations around rising interest rates. The share prices of companies, where most of the value relies on future growth, have been under pressure. We expect more selling and share price pressure when Nearmap is removed the benchmark S&P/ASX 200 in December’s re-balancing of the index.

Harrison Massey, Argonaut

BUY RECOMMENDATIONS

Medallion Metals (MM8)

The flagship project of this copper and gold explorer is located at Ravensthorpe in Western Australia. The company has an existing gold JORC resource of 674,000 ounces, of which 80 per cent is indicated and 92 per cent is within 200 metres of the surface. Following an aggressive drilling program, we believe the company will be able to expand this resource above 1 million ounces by early 2022.

Wia Gold (WIA)

Formerly Tanga Resources, WIA is a gold explorer with assets in Cote d’Ivoire. Recent infill sampling at the Mankono permit revealed promising potential of southern gold anomalies, with auger and RC drilling to start in the first quarter of calendar year 2022. The company has submitted applications for five new exploration permits near these tenements, as it aims to increase the company’s foothold in the area.

HOLD RECOMMENDATIONS

St Barbara (SBM)

First quarter gold production in fiscal year 2022 disappointed the market, in our view. Permit issues suspended operations at the Simberi gold mine in Papua New Guinea. Production at Gwalia was in line with market expectations and costs were lower for the quarter. We expect a relatively flat production profile at all operations in the short-to-medium term.

AMP (AMP)

Following its exit from the life insurance sector, AMP is aiming to recalibrate its strategy via a planned demerger of its private markets business, PrivateMarketsCo. Simplifying the company’s strategy has benefits, but we believe AMP may need to raise capital to fund the separation. Recent impairment charges of $325 million are another risk to consider in this investment.

SELL RECOMMENDATIONS

Chalice Mining (CHN)

Chalice is developing a tier 1 platinum group elements project in the Toodyay region of Western Australia. The shares soared on a big discovery at the Gonneville deposit. Despite the size and grade of the deposit, funding questions remain, in our view. We believe more metallurgical test work is needed to determine if project forecasts can be met, or are possibly too optimistic. It may be prudent to lock in some profits at these levels.

Technology One (TNE)

TNE provides software solutions. The company posted a solid fiscal year 2021 result, mostly driven by the Australian arm of the business. The challenge is to sustain growth in the years ahead. The share price has appreciated around 30 per cent since the beginning of the financial year up to December 9. The company’s overseas operations need to improve to enhance shareholder value, in our opinion. Investors may want to consider taking some profits.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.