John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

Endeavour Group (EDV)

EDV recently listed after demerging from supermarket giant Woolworths. EDV owns retail liquor chains Dan Murphy’s and BWS. It also owns 293 hotels operating 12,364 poker machines. Our buy rating reflects EDV’s defensive earnings profile. It holds a niche position, as there is no clear listed competitor on the ASX.

Sydney Airport (SYD)

The uncertainty caused by the latest lockdown in Sydney has created an attractive entry point for investors wishing to gain exposure to the travel industry. We believe the travel industry will recover strongly in response to an increasing number of COVID-19 vaccinations and governments moving on from their elimination policies. Consequently, we expect Sydney Airport to be one of the biggest beneficiaries of the recovery.

HOLD RECOMMENDATIONS

Inghams Group (ING)

This poultry company has been subjected to short selling despite consistently beating analyst forecasts. We believe the short sellers might be concerned about impending contract negotiations with supermarket giant Woolworths. We expect a deal will be done. In our view, investors should consider holding until an outcome is confirmed.

Nine Entertainment Co. Holdings (NEC)

The share price has performed strongly as investors rewarded the media company for signing content agreements with Google and Facebook. Also, its streaming business Stan continues to gain new subscribers. Despite these positives, we feel much of the good news has been priced in.

SELL RECOMMENDATIONS

AGL Energy (AGL)

We expect more disruption in the energy market. The share price may seem attractive as AGL is trading on relatively undemanding multiples. But, moving forward, we expect the share price to remain under pressure in response to cheaper power flowing from an increasing number of competitive renewable energy projects.

Electro Optic Systems Holdings (EOS)

EOS is a technology company operating in the space and defence markets. COVID-19 impacted the company’s performance in fiscal year 2020. EOS reported an operating loss after tax of more than $25 million for the year to December 31, 2020. The shares have fallen from $5.90 on January 4 to close at $4.44 on July 1. In our view, better opportunities exist elsewhere.

Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

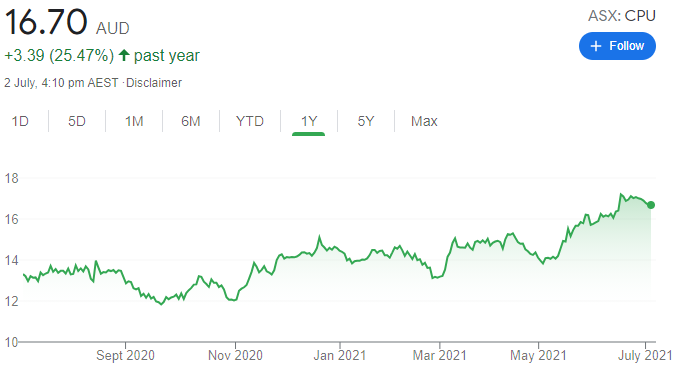

Computershare (CPU)

We see this share registry business as a core portfolio holding as it should benefit from any rise in US interest rates. The company recently acquired Wells Fargo’s registry business in the US. Post synergies, the deal is about 15 per cent accretive to value and earnings, according to our analysis. Also, it increases CPU’s cash balance to about $80 billion. We believe the stock offers a bright outlook.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

TPG Telecom (TPG)

TPG and Vodafone Hutchison Australia merged last year. The shares are trading well below our valuation of $7.17. The combined TPG group is much stronger, enabling it to compete effectively for more market share. Management guided to about $150 million in cost savings during the next three years. The shares were trading at $6.35 on July 1.

HOLD RECOMMENDATIONS

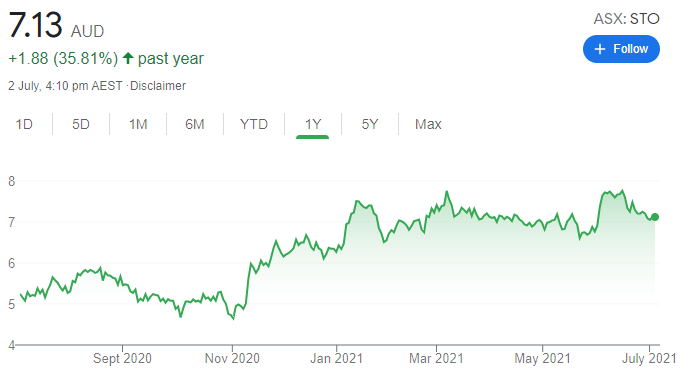

Santos (STO)

This oil and gas producer is our preferred energy company. Re-opening of key overseas economies is a tailwind for energy prices, particularly crude oil, in response to increasing demand. We expect STO to outperform given its resilient growth profile and diversified earnings base. Our valuation is $8.50 a share. The shares were trading at $7.09 on July 1.

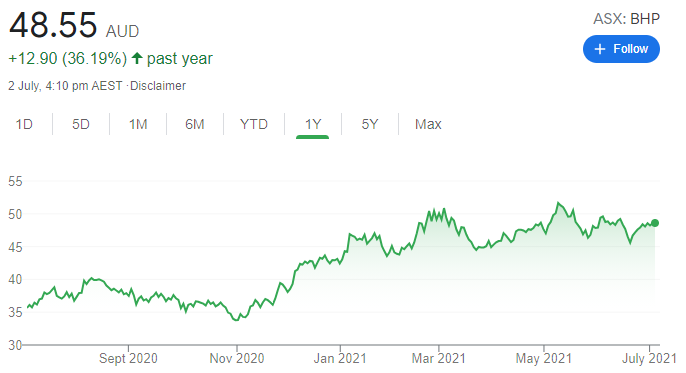

BHP Group (BHP)

This global miner is relatively low risk given its superior diversification compared to other major mining peers. Diversification helps to reduce any impact on earnings from a potential outbreak of COVID-19. We hold BHP as it has an attractive combination of balance sheet strength and a resilient dividend profile.

SELL RECOMMENDATIONS

Qube Holdings (QUB)

Qube provides integrated import and export logistics services in Australia, New Zealand and South East Asia. We’re forecasting earnings growth, but, in our view, much of the growth is priced in. The shares appear expensive as they were recently trading on a lofty price/earnings multiple. We retain a sell rating, as the stock is trading at a premium to our $2.48 valuation. The shares were trading at $3.15 on July 1.

Aurizon Holdings (AZJ)

AZJ is Australia’s largest rail freight operator. Higher coal prices recently are positive for short term sentiment. We rate AZJ highly, but fear the environmental, social and corporate governance discount will persist. AZJ isn’t one of our core portfolio stocks.

Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

Collins Foods (CKF)

The market reacted harshly to what we consider was a good full year result. Record same store sales growth at KFC Australia was backed by a solid performance from Taco Bell. The company’s performance in Germany and the Netherlands continues to improve as COVID-19 restrictions are relaxed in Europe. Astute acquisitions amid store roll-out plans are likely to drive earnings growth in the years ahead.

Gold Road Resources (GOR)

The company’s Gruyere mine is expected to deliver gold production of between 52,000 ounces and 55,000 ounces for the June quarter. All-in sustaining costs are now expected to rise to between $A1675 and $A1800 an ounce because of operational issues. The disruption hasn’t required GOR to downgrade 2021 calendar year gold production guidance of between 260,000 ounces and 300,000 ounces. We remain positive about GOR given our bullish view on the precious metal.

HOLD RECOMMENDATIONS

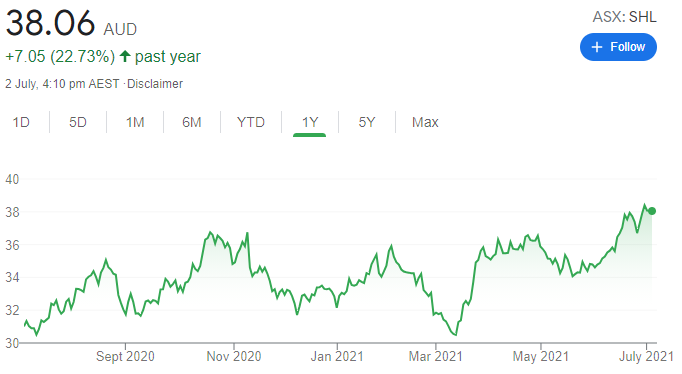

Sonic Healthcare (SHL)

Shares in this pathology provider recently rose to record highs. The company has a good track record of value building acquisitions, and appears to have made another fine choice with Canberra Medical Imaging. The shares have risen around $8 since early March to trade at $38.28 on July 1.

ARB Corporation (ARB)

The share price of this 4-wheel drive accessories supplier recently made record highs. Sales of sports utility vehicles are the fastest growing segment, so ARB is poised to benefit. ARB recently announced a collaboration with Ford. However, in our view, the shares are difficult to buy as they were recently trading on a price/earnings multiple of around 40 times.

SELL RECOMMENDATIONS

Mainstream Group Holdings (MAI)

Apex Group has offered $2.80 a share to acquire this fund administrator services provider. Mainstream directors have recommended shareholders vote in favour of the Apex scheme of arrangement later this year. The bid represents a premium of 133.3 per cent to Vistra’s offer of $1.20 a share on March 9. The shares were trading at $2.73 on July 1.

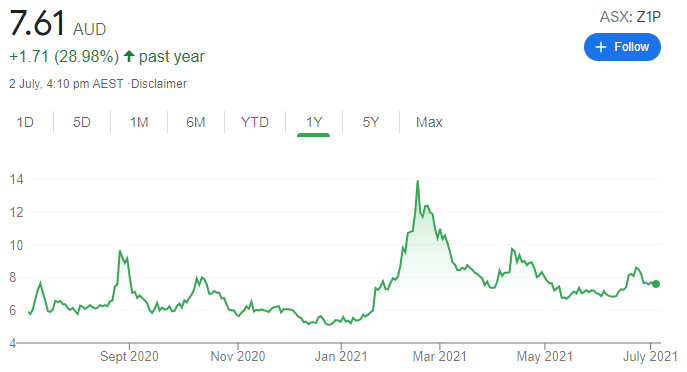

Zip Co (Z1P)

This buy now, pay later company has announced plans to expand into Europe and the Middle East. While industry competition is fierce, it’s still attracting big companies, such as PayPal. The $6.50 level is important support, marking the breakout level that saw the stock run to $14. A downside break would be a bearish signal and could be followed by a significant fall in the share price. The shares were trading at $7.71 on July 1.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.