Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

BUY – Generation Development Group (GDG)

We retain a bright outlook given GDG is a market leader in Australia for gross inflows into investment bonds. We view the flow outlook positively, with superannuation reform and an ageing population providing a significant tailwind for investment bond demand in Australia. We see scope for significant operating leverage as scale increases, which we expect will deliver strong earnings per share growth over the forecast period. Given the growth outlook, GDG’s valuation is undemanding, in our view.

BUY – Tabcorp Holdings (TAH)

The recent resignation of Tabcorp chief executive Adam Rytenskild has no impact on our positive outlook for this wagering company. We believe the market is overly concerned about Rytenskild’s abrupt departure, and the near-term cyclical weakness facing the wagering industry. Tabcorp’s total revenue market share of 33.7 per cent in the first half of fiscal year 2024 was up from 32.9 per cent in the second half of fiscal year 2023.

HOLD RECOMMENDATIONS

HOLD – Brickworks (BKW)

Following significant property revaluations undertaken in the first half of fiscal year 2024, BKW reported an underlying earnings before interest and tax loss of $84 million. Fiscal year 2024 is likely to be challenging in response to a difficult construction outlook, particularly in Australia. However, upside remains in the longer term given demand for high quality industrial property.

HOLD – New Hope Corporation (NHC)

The coal producer’s half year result ending January 31, 2024, was materially down on last year’s corresponding period, but was broadly in line with our expectations. According to our analysis, the company was recently trading at a 19 per cent discount to fair value. Saleable coal production of 4.1 million tonnes represented a 28 per cent increase on the prior corresponding period.

SELL RECOMMENDATIONS

SELL – Credit Corp Group (CCP)

CCP purchases debt ledgers in Australia, New Zealand and the US. The company reported a statutory loss of $12.1 million in the first half of fiscal year 2024. We expect stiffer competition in the purchased debt ledger space as pandemic stimulus wanes. A combination of low barriers to entry and improving operational efficiency among peers are likely to encourage more aggressive price bidding for purchased debt ledgers.

SELL – Cochlear (COH)

Cochlear makes hearing implants. The Australian Competition and Consumer Commission recently announced it would not oppose Cochlear’s proposed acquisition of the Oticon Medical implants business from parent company Demant A/S. COH shares have risen from $242.04 on October 30, 2023, to trade at $317.69 on April 18, 2024. The shares are trading at a premium to our valuation. Investors may want to consider cashing in some gains.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tony Langford, Seneca Financial Solutions

BUY RECOMMENDATIONS

BUY – Webjet (WEB)

Webjet provides online travel booking services. The company’s WebBeds business is a primary source of growth, generating EBITDA of $89.9 million in the first half of fiscal year 2024, an increase of 41 per cent on the prior corresponding period. WEB expects underlying EBITDA in fiscal year 2024 to be above the midpoint in a range of between $180 million and $190 million. We believe shares in this quality business are undervalued.

BUY – RPMGlobal Holdings (RUL)

The company develops and provides mining software solutions to Australian and international markets. At its half year result, RUL projected fiscal year 2024 EBITDA to range between $21.5 million and $23.5 million compared to $12 million in fiscal year 2023. Full year profit before tax is expected to be significantly up on last year. Investors can consider buying on earnings momentum.

HOLD RECOMMENDATIONS

HOLD – Woolworths Group (WOW)

Group sales before significant items of $34.635 billion in the first half of fiscal year 2024 were up 4.4 per cent on the prior corresponding period. Group net profit after tax of $929 million, before significant items, was up 2.5 per cent. However, the share price has fallen following the result amid several inquiries into supermarket prices. In our view, the company provides quality earnings and was recently trading on a dividend yield of about 3.3 per cent. Also, WOW shares were trading at $31.90 on April 18, which we consider a sound entry level.

HOLD – New Hope Corporation (NHC)

The coal miner’s total revenue of $857 million for the half year ending January 31, 2024, was down 46 per cent on the prior corresponding period. Net profit after tax of $251.7 million was down 62 per cent. Weaker coal prices contributed to the result. According to the outlook, the company is on track to double saleable coal production within the next five years. We expect coal prices to increase during the next 12 months.

SELL RECOMMENDATIONS

SELL – Fisher & Paykel Healthcare Corporation (FPH)

FPH makes medical devices to treat obstructive sleep apnoea. On March 27, 2024, FPH initiated a voluntary limited recall of Airvo 2 and myAirvo 2 devices manufactured before August 14, 2017. The recall relates to a speaker configuration issue that the company says may result in distorted, intermittent or inaudible alarm sound levels. The devices deliver high flow therapy to patients and are not intended for life support. FPH estimated about 9000 of the affected devices remain in use. At the time, the company estimated costs associated with the limited recall would be about $NZ12 million. We prefer competitor ResMed.

SELL – Treasury Wine Estates (TWE)

The share price of this wine giant has risen from $10.07 on January 10 to trade at $11.93 on April 18. China recently scrapping hefty tariffs on imported Australian wine is a boost for sentiment in the short term. However, competition in the wine industry may intensify as Australia is experiencing a grape glut.

John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

BUY – Tuas (TUA)

The Singapore based mobile phone service provider is on target to achieve full year positive net cashflow if it can continue to grow subscriptions at its current rate. TUA executive chairman is David Teoh, who was the founder and former chief executive of TPG Australia. We’re confident that TUA can increase its market share under Teoh. First half revenue in fiscal year 2024 rose 38 per cent on the prior corresponding period.

BUY – Paladin Energy (PDN)

We expect uranium supplies to fall short of demand as more countries consider and adopt nuclear energy as part of their future mix. The company recently announced that uranium concentrate production and drumming were achieved at the Langer Heinrich mine on March 30, 2024. PDN is focusing on ramping up production. In our view, PDN is ideally positioned to benefit from a structural supply deficit.

HOLD RECOMMENDATIONS

HOLD – Arcadium Lithium PLC (LTM)

This global lithium company has operating resources in Australia and Argentina and downstream conversion assets in the US, China, Japan and the UK. Plummeting lithium prices have negatively impacted LTM’s share price. Given Arcadium’s size and scale, we expect it to be one of the first lithium stocks to recover in line with any improvement in lithium prices.

HOLD – Tyro Payments (TYR)

This technology company provides Australian businesses with payment solutions and business banking products. EBITDA of $27.3 million in the first half of fiscal year 2024 was up 40.6 per cent on the prior corresponding period. However, transaction value in the important retail division declined by 2.1 per cent. In our view, TYR is worth holding as we expect it to benefit from any improvement in consumer sentiment.

SELL RECOMMENDATIONS

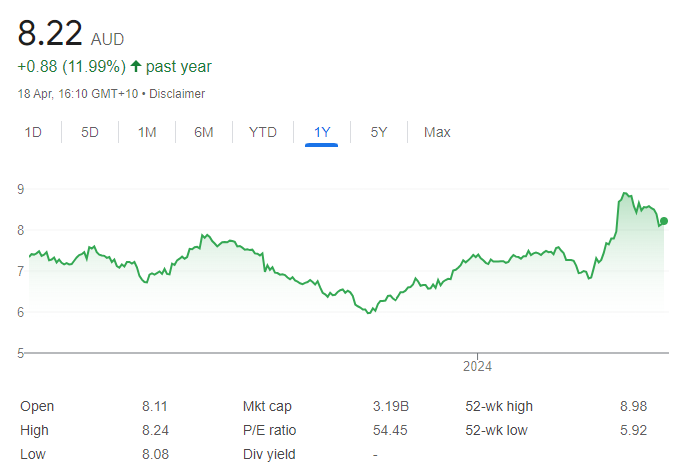

SELL – Netwealth Group (NWL)

This financial services company had funds under administration (FUA) of $84.7 billion at March 31, 2024. It increased FUA by $6.7 billion in the March quarter. The share price has risen from $12.92 on November 1, 2023, to trade at $19.82 on April 18, 2024. The company was recently trading on a lofty price/earnings ratio above 60 times, leaving little or no room for error, in our view. Investors may want to consider cashing in some gains.

SELL – SkyCity Entertainment Group (SKC)

On February 1, 2024, SKC announced it had revised its provision for a potential civil AUSTRAC penalty and associated legal costs from $A45 million on June 30, 2023, to $A73 million at December 31, 2023. The casino operator’s revised provision is an estimate of the potential exposure to penalties and legal costs. AUSTRAC filed civil penalty proceedings against SkyCity Adelaide, alleging contraventions under the Australian Anti-Money Laundering and Counter-Terrorism Financing Act. Reported revenue and profit from continuing operations fell marginally for the six months to December 31, 2023, when compared to the prior corresponding period.

Related Articles:

- The Best Australian Trading Apps

- How to Start Day Trading in Australia

- Australian Automated Trading Software

- How to Trade CFDs in Australia

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.