Chris Batchelor, Spotee.com.au

BUY RECOMMENDATIONS

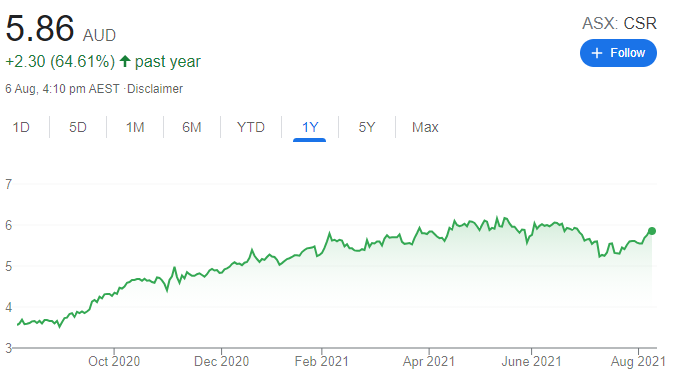

CSR (CSR)

This building products supplier should benefit from a strong housing market, driven by government incentives for construction, surging residential prices and ultra low interest rates. Working from home is contributing to an increase in renovations. CSR is also generating good revenue levels from its large land holdings, particularly in western Sydney. Given this environment, we don’t regard the company as expensive on a forward price/earnings multiple of less than 17 times.

ReadyTech Holdings (RDY)

RDY provides software-as-a-service technology to businesses and educators. In March, it was included in the S&P/ASX All Technology Index amid completing the acquisition of Open Office, a business focusing on local government and justice case management solutions. About 90 per cent of RDY revenue is recurring. Revenue has been growing strongly and we expect it to accelerate in 2022.

HOLD RECOMMENDATIONS

Collins Foods (CKF)

This KFC and Taco Bell operator generated revenue of $1.065 billion in fiscal year 2021, a 12.4 per cent increase on last year’s corresponding period. The result highlights the business model was resilient during the pandemic. Growth is expected to continue, but this is largely recognised in the valuation multiple of 24 times projected earnings.

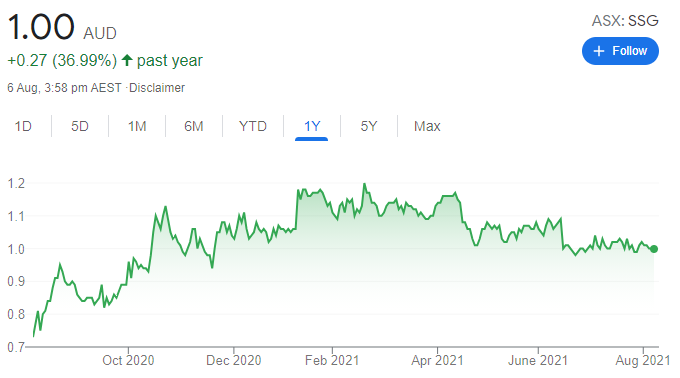

Shaver Shop Group (SSG)

Online sales have been growing strongly and now account for about 30 per cent of total sales. The prolonged lockdown in Sydney may benefit the company, as people are unable to visit hair or beauty salons. In our view, its most recent update was disappointing, with projected sales about 6 per cent below expectations. However, the forward price/earnings ratio of only 7.6 times takes this into account. My related parties have holdings in SSG.

SELL RECOMMENDATIONS

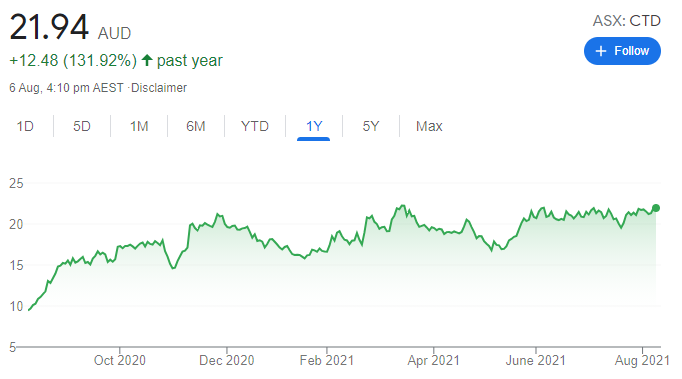

Corporate Travel Management (CTD)

This travel company has been impacted by the pandemic. However, the market is factoring in revenue to recover strongly in the 2022 financial year. However, we’re taking a more cautious stance given the challenges of the COVID-19 Delta variant. In our view, the stock is trading on a 2022 lofty price/earnings multiple to reflect bullish forecasts. We need to see a clearer outlook in relation to the pandemic.

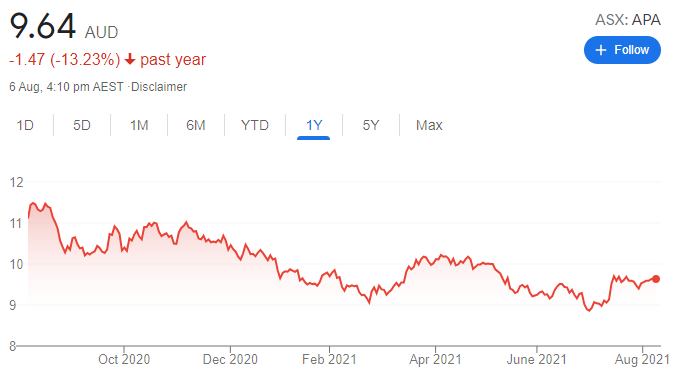

APA Group (APA)

APA Group is a gas infrastructure provider. EBITDA fell in the 2021 first half in response to lower energy consumption following COVID-19 restrictions, softer contract renewals and increasing compliance and insurance costs. We expect energy demand to be impacted by the continuing lockdown in Sydney. Other stocks appeal more at this time.

Peter Day, Sequoia Wealth Management

BUY RECOMMENDATIONS

Top Shelf International Holdings (TSI)

TSI produces and markets Australian spirits and beverage brands. The company generated strong unaudited revenue in the fourth quarter of fiscal year 2021. Cash flow was driven by increased sales and marketing expenditure. We remain attracted to significant sales momentum. A substantial asset base supports growth. The shares have risen from $1.635 on July 15 to close at $1.85 on August 5.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

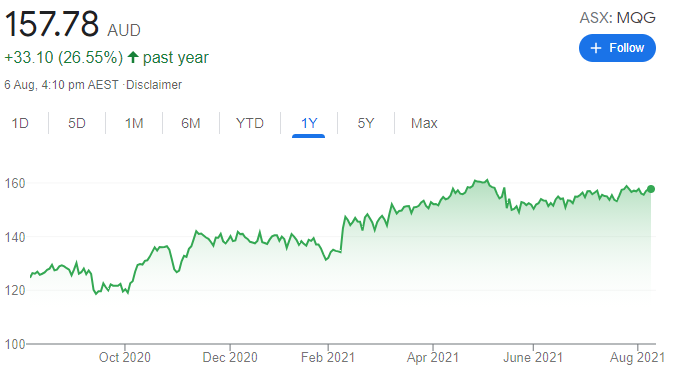

Macquarie Group (MQG)

We still view this diversified financial services group as relatively inexpensive and like its exposure to long term structural growth opportunities in infrastructure and renewables. In the short term, we believe MQG is likely to face earnings pressure from the impact of softer economic conditions, but it remains well positioned to ride out the pandemic before seizing opportunities on the other side.

HOLD RECOMMENDATIONS

CSL (CSL)

We have moved from a positive recommendation to neutral. We need to see improving plasma volumes on a sustainable basis before we turn positive again. Our valuation has been revised down by 6.5 per cent to $290 a share. Shares in this blood products group closed at $293.79 on August 5.

Mineral Resources (MIN)

Iron ore production of 5.2 million tonnes in the June quarter is up 6 per cent on the prior quarter. We’re expecting higher iron ore prices moving forward. The high growth lithium business is appealing and we expect mining services earnings to become more stable. We have increased our price target to $65 a share. The shares closed at $59.49 on August 5.

SELL RECOMMENDATIONS

Bubs Australia (BUB)

We’re forecasting this milk formula company to generate strong net sales growth in fiscal year 2022. The company’s relatively small size and strong partnerships could see it capture more market share. Our sell recommendation is largely based on valuation. Bubs may need to materially ramp up investment in new markets in 2022.

Nanosonics (NAN)

NAN specialises in preventing infection. It makes the trophon EPR ultrasound probe disinfector. It recently released the AuditPro, an automated and secure digital system. The underlying trophon business is good. But, in our view, NAN has been a disappointing performer. We had been expecting more products from its research pipeline. The shares have fallen from $8.25 on January 4 to close at $5.27 on August 5.

Thomas Wegner, Marcus Today

BUY RECOMMENDATIONS

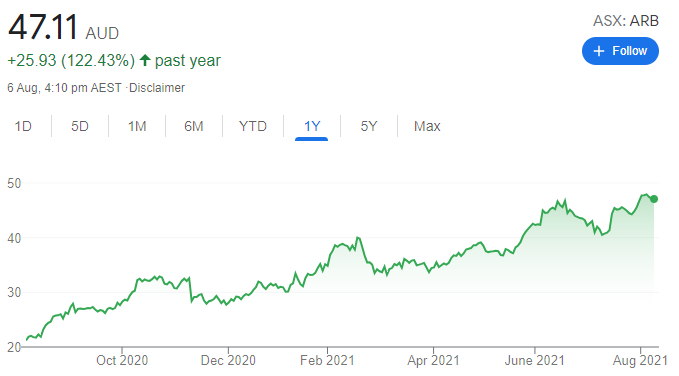

ARB Corporation (ARB)

ARB is Australia’s largest manufacturer and distributor of 4-wheel drive accessories. The share price has responded positively to the company’s strong performance. In July, ARB announced unaudited sales revenue of $623 million for the year ending June 30, 2021, a 33.9 per cent increase on the prior corresponding period. Revenue was well ahead of consensus estimates of $574.5 million. We see a compelling investment case given the strong customer order book and upbeat short term outlook.

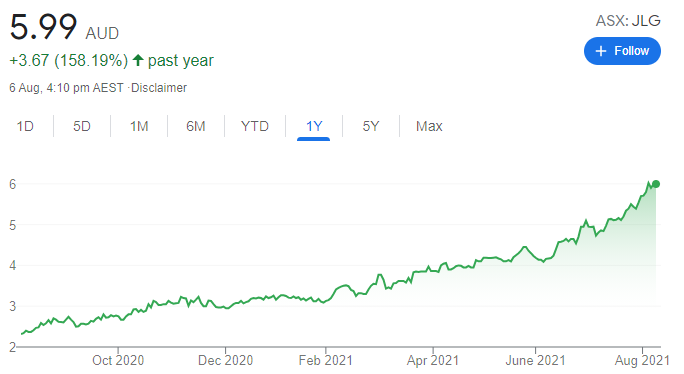

Johns Lyng Group (JLG)

This building services company specialises in emergency construction works. It upgraded guidance in June on the back of robust demand for the group’s core services. The share price has improved from $3.86 at the end of the March quarter to close at $5.90 on August 5. In our view, JLG is well positioned heading into its full year results.

HOLD RECOMMENDATIONS

Healius (HLS)

The company’s involvement in COVID-19 testing has supported the share price. The pathology unit had processed 3 million results by May. The emergence and spread of the COVID-19 Delta strain is likely to be a significant contributor to earnings in the 2022 financial year despite the roll out of vaccines.

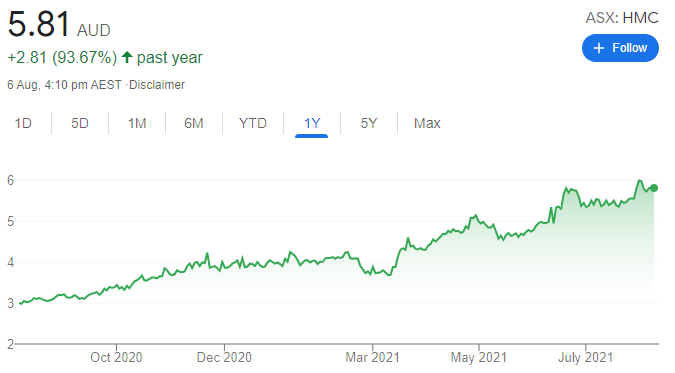

Home Consortium (HMC)

This property group reaffirmed guidance for the 2021 financial year in July. Funds from operations are expected to be no less than 12.9 cents per security. The group also forecasts a distribution of 12 cents per security. It recently upsized the initial public offering of its Healthcare and Wellness REIT to $650 million following strong investor interest.

SELL RECOMMENDATIONS

Bubs Australia (BUB)

In our view, this infant formula manufacturer is experiencing a slower than expected recovery as a result of closed international borders. Gross revenue in the 2021 financial year fell 24 per cent on the prior corresponding period to $46.8 million. This was a response to prolonged COVID-19 disruption. Managing inventory was challenging in the second half of fiscal year 2021, so product was discounted. Better growth opportunities exist elsewhere, in our view.

Helloworld Travel (HLO)

Border restrictions and lockdowns continuing to weigh on the business. The share price has fallen from $2.15 at the end of the March quarter to finish at $1.565 on August 5. In our opinion, a soft third quarter update highlighted the difficult trading conditions. In our view, a recovery will take longer than expected given the spread of the COVID-19 Delta variant.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.