Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

BUY – Fortescue (FMG)

The share price has fallen from its early February highs in response to weaker iron ore prices. But we expect iron ore prices to recover as the global growth outlook appears to be strong. The company generated increasing revenue and earnings in the first half of fiscal year 2024 when compared to the prior corresponding period. The fully franked interim dividend of $1.08 a share was also higher. We view the softer share price as a buying opportunity.

BUY – Whitehaven Coal (WHC)

The share price has fallen from $8.22 on January 10 to trade at $7.175 on April 4 as a result of softer coal prices at the end of 2023. We expect global growth to assist a recovery in coal prices. The share price looks cheap when taking into account the recently acquired metallurgical coal assets from BHP. The share price chart was recently showing impressive buying support.

HOLD RECOMMENDATIONS

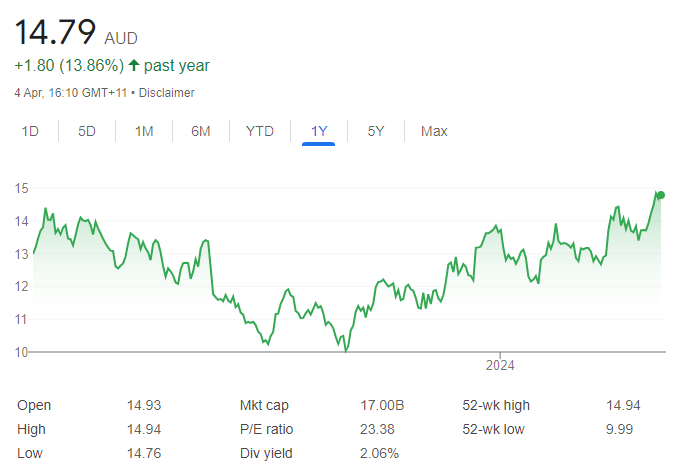

HOLD – Northern Star Resources (NST)

We remain bullish on gold, and consider NST as one of the best quality gold producers in Australia. Although costs have moved up over time, NST is still one of the lowest cost producers. A recent upside break on the share price chart shows renewed interest in the stock and we expect it to trend higher from here.

HOLD – Neuren Pharmaceuticals (NEU)

NEU develops therapies for neurological disorders and sells them via a US partner. The partner Acadia Pharmaceuticals was subjected to short selling and NEU shares also retreated. However, the stock has recovered from a recent low of $19.15 on February 28, and the overall uptrend remains in place. The shares were trading at $20.80 on April 4.

SELL RECOMMENDATIONS

SELL – Cettire (CTT)

Cettire is an online luxury goods retailer. CTT lifted revenue from ordinary activities by 89 per cent and net profit after tax by 60 per cent for the six months ending on December 31, 2023. On March 6, 2024, CTT posted an announcement, saying it believes all applicable duties and other import charges are paid to the relevant authorities at the point of customs clearance. It says goods are unable to clear customs unless the applicable duties are paid. Also, in early March, it was announced that company founder and chief executive Dean Mintz sold 27.5 million shares in CTT at $4.63 a share by way of an underwritten block trade. He retains about a 30 per cent shareholding in CTT. The shares were trading at $3.29 on April 4.

SELL – Telstra Group (TLS)

Analysts are positive about this telecommunications giant, but the share price chart tells a different story. The stock has recently struggled near a major support level at around $3.80. Investors may want to consider cashing in some gains to possibly avoid a downtrend below $3.80. The shares were trading at $3.85 on April 4.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Oliver Matthew, Marcus Today

BUY RECOMMENDATIONS

BUY – Woolworths Group (WOW)

The share price has partially bounced back after it was punished following 2024 half year results amid inquiries into supermarket prices. The shares fell from $35.87 on February 20 to trade $31.73 on March 20. Investors feared earnings had peaked as inflation moderated. The shares were trading at $32.55 on April 4 after bargain hunters bought the stock. WOW is a quality, long-term income stock. Investors may want to consider buying WOW at these prices.

BUY – Jupiter Mines (JMS)

Jupiter is a pure play manganese miner. Its flagship project is in South Africa. The JMS share price recently rose after a cyclone suspended a competitor’s manganese operations at the Groote Eylandt Mining Company (GEMCO), which is majority owned by South32 (ASX: S32). GEMCO is a big manganese supplier. JMS may benefit from GEMCO’s supply disruption, or from increasing manganese prices.

HOLD RECOMMENDATIONS

HOLD – Webjet (WEB)

The share price of this online travel agency has risen from $6.84 on March 6 to trade at $8.62 on April 4. The company recently reaffirmed earnings guidance for fiscal year 2024. The WebBeds business is on a journey to deliver $10 billion in total transaction value (TTV) in fiscal year 2030. It’s on track to deliver $5 billion in TTV in fiscal year 2025. The stock should move higher, but investors should keep a close eye on the news flow.

HOLD – Treasury Wine Estates (TWE)

The company is expected to benefit after the Chinese Ministry of Commerce recently announced it had scrapped hefty tariffs on imported Australian wine. The outlook is brighter as the company re-establishes distribution with China. The shares have risen from $10.31 on January 5 to trade at $12.94 on April 4.

SELL RECOMMENDATIONS

SELL – Washington H Soul Pattinson & Company (SOL)

SOL is a diversified investment house. The company lifted its fully franked interim dividend to 40 cents a share at its 2024 half year results. SOL has lifted its interim and final dividends for 24 consecutive years. SOL’s portfolio valuation was up 10 per cent on the prior corresponding period, but statutory net profit after tax was down 33.2 per cent. The shares have fallen from $35.74 on March 8 to trade at $34.14 on April 4. While global markets remain overbought, the risk of a correction grows.

SELL – Perpetual (PPT)

Perpetual is a global financial services firm. Net profit after tax in the first half of fiscal year 2024 was up 29 per cent on the prior corresponding period. However, asset management earnings missed analyst consensus expectations. The dividend of 65 cents a share was down 28 per cent on the prior corresponding period. While the company offers a solid yield, the share price has been trending down during the past three years. We prefer other stocks at this stage of the cycle.

John Edwards, Novus Capital

BUY RECOMMENDATIONS

BUY – APA Group (APA)

The company connects 1.4 million Australian homes and businesses to natural gas. APA owns, or has interests in gas storage facilities, gas fired powered stations and wind and solar farms. The company is pursuing electricity transmission projects to support Australia’s energy transition. The company grew earnings, distributions and free cash flow in the first half of fiscal year 2024 when compared to the prior corresponding period. Our price target is $9.80. The shares were trading at $8.45 on April 4.

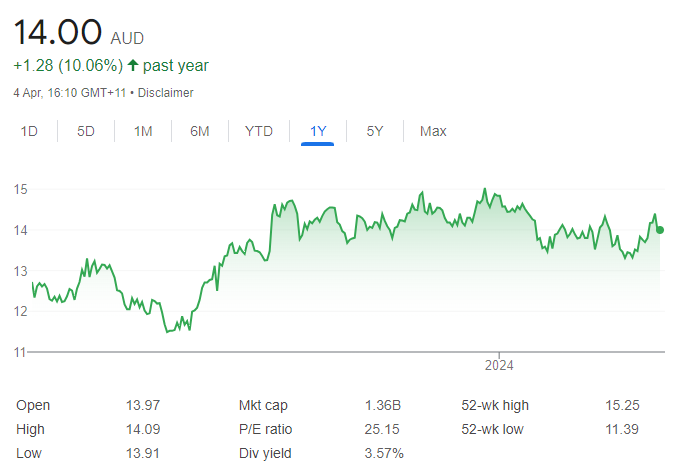

BUY – Monadelphous Group (MND)

This engineering group’s short to medium term outlooks are supported by a growing pipeline of contracted developments across the energy, lithium and rare earths sectors, which are expected to drive strong growth. MND is also expected to benefit from a growing renewable energy investment pipeline. Our price target is $15.50. The stock was trading at $14 on April 4.

HOLD RECOMMENDATIONS

HOLD – BHP Group (BHP)

Iron ore prices have fallen significantly since the start of 2024, making it one of the weaker commodities amid uncertain Chinese demand. BHP has reduced commodity diversity by selling assets. The company needs to demonstrate it can de-risk copper and potash assets, or its earnings rating may attract scrutiny. Consider holding, but keep an eye on commodity prices.

HOLD – Premier Investments (PMV)

Premier owns retail conglomerate Just Group. Brands include Smiggle, Peter Alexander and Portmans, among others. PMV reported a statutory net profit after tax of $177.2 million in the first half of fiscal year 2024, up 1.65 per cent on the prior corresponding period. The company is working towards a demerger of Smiggle by the end of January 2025 and exploring a demerger of Peter Alexander during calendar year 2025. Further detail for demerging these two growth businesses is needed as the market isn’t attributing any obvious value to the rollout potential for both brands.

SELL RECOMMENDATIONS

SELL – Platinum Asset Management (PTM)

The investment manager recently announced a turnaround program. After completing an initial review, PTM is targeting at least $25 million in annualised run rate savings. However, the savings are unlikely to generate a material impact on the company’s reported fiscal year 2024 profit. The bulk of the savings will be progressively realised during the 2025 financial year. The shares have fallen from $1.315 on March 22 to trade at $1.145 on April 4.

SELL – 29Metals (29M)

The copper and precious metals mining company has exploration and production assets in Australia and Chile. The company recently suspended operations at the Capricorn copper mine in Queensland following extended rain between late January and mid-March. We expect the share price to remain under pressure.

Related Articles:

- Commodities Trading – A Beginners Guide

- CFD Trading in Australia

- How to Start Day Trading in Australia

- The Best Australian Cryptocurrency Brokers

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.