Braden Gardiner, Tradethestructure.com

BUY RECOMMENDATIONS

Challenger Exploration (CEL)

CEL recently announced gold and copper mineralisation at its El Guayabo project in Ecuador, which comes on the back of striking gold in Argentina. I expect the news has put a floor under the price at 26 cents, and buyers will support the price in coming weeks on any pullback. I expect the price action will start building and work its way through 40 cents to new highs. The shares were trading at 34 cents on March 3.

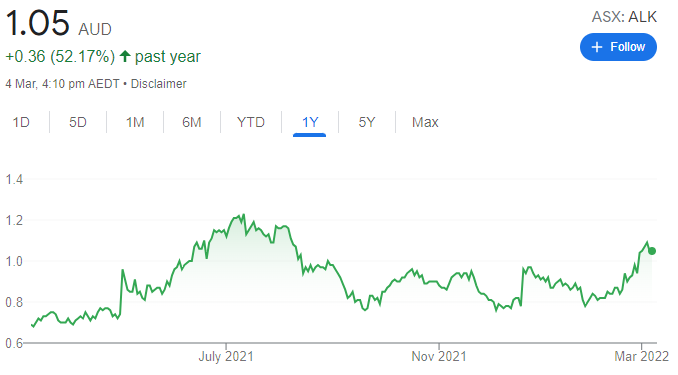

Alkane Resources (ALK)

The gold producer’s share price was oversold, in my view, which has prompted a recovery from a closing price of 78 cents on January 27. The company recently posted first half revenue of $76.91 million, an increase of 18 per cent on the prior corresponding period. The gold price has been rising, as it’s viewed as a safe haven in times of war and global tensions. We expect the price to rise from here.

HOLD RECOMMENDATIONS

Metals X (MLX)

Metals X is Australia’s largest tin producer and it also has a quality nickel-cobalt project. MLX is leveraging itself to a flourishing battery technology sector and electric vehicle market. The company’s outlook is bright, in my view. I expect the share price to continue its uptrend from here.

Prospect Resources (PSC)

This exploration company has a focus on lithium. Its flagship Acadia Lithium project is in Zimbabwe. Late last year, the board proposed selling its 87 per cent interest in the project for $US377.8 million. The deal is progressing and shareholders should keep an eye on further developments.

SELL RECOMMENDATIONS

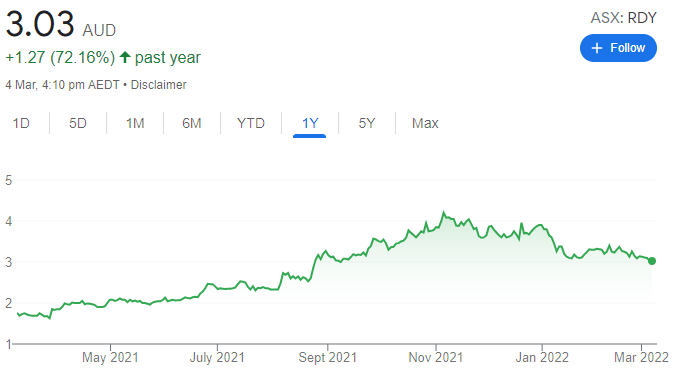

ReadyTech Holdings (RDY)

The share price of this software-as-a-service company hit an intra-day high of $4.30 on November 8, 2021. The shares were trading at $3.10 on March 3, 2022. A company update in January 2022 informed it had missed out on a government licensing project. My technical analysis suggests recent weakness is likely to continue – at least in the short term.

Imdex (IMD)

The share price of this mining technology company closed at $3.10 on January 20. It delivered a positive earnings release in early February and raised its interim dividend by 50 per cent to 1.5 cents a share. The shares were trading at $2.805 on March 3. My technical analysis suggests the price will trend lower, so investors may want to consider locking in some gains.

Harrison Massey, Argonaut

BUY RECOMMENDATIONS

AIC Mines (A1M)

This copper producer recently acquired the Eloise Copper Project in Queensland. The company upgraded its mineral resource in December to 103,500 tonnes of contained copper, a 58 per cent increase. The gold resource was upgraded to 93,300 ounces, representing a 55 per cent increase. Its latest activities report showed the company produced 8597dry metric tonnes of concentrate, which led to net revenue of $25 million. An experienced management team leads the company.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

BlackEarth Minerals NL (BEM)

BlackEarth owns and operates the Maniry graphite project in Madagascar. BEM recently announced it had increased total graphite inventory at the project by 32 per cent and uncovered several new high grade graphite zones through recent drilling programs. BlackEarth has a formal joint venture agreement with a manufacturer of expandable graphite, which will speed up its pathway to near term production.

HOLD RECOMMENDATIONS

Woolworths Group (WOW)

The supermarket giant recently faced supply chain and staffing issues in response to COVID-19 disruptions. Significant potential upside exists in the near term due to an easing of COVID-19 restrictions sweeping across Australia.

Global Lithium Resources (GL1)

GL1 owns two lithium exploration assets in Western Australia, with a mineral resource base totalling 18.4 million tonnes. The company has planned a huge drilling program of 60,000 metres in calendar year 2022 to expand the current resource and to grade profile its assets. Given a significant share price rise in a short period amid a volatile lithium market, we consider GL1 a hold for now.

SELL RECOMMENDATIONS

RED 5 (RED)

RED 5 owns and operates the King of the Hills gold project in Western Australia. The company is expecting first gold production at the King of the Hills asset by mid-2022. In our view, gold production forecasts look good, but may be optimistic for a project yet to be tested. We will examine the updates, but, in the meantime, will continue to focus on other gold production stories.

Fortescue Metals Group (FMG)

FMG is the world’s fourth largest iron ore producer. The company’s first half 2022 result was disappointing, with net profit after tax falling 32 per cent to $US2.777 billion. The fully franked interim dividend of $AUD86 cents a share was down 41 per cent on the prior corresponding period. Investors may want to consider taking a profit if a less than expected dividend reduces the short term incentive to hold the shares. Iron ore spot prices remain volatile at this point.

Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

Brambles (BXB)

This global logistics company posted sales revenue growth of 8 per cent and underlying profit growth of 4 per cent in the first half of 2022. BXB is maintaining margins and profit growth in a difficult supply chain environment. We see upside through its transformation productivity program. Also, costs should subside, as the negative effects from COVID-19 are expected to wane in the latter half of 2022.

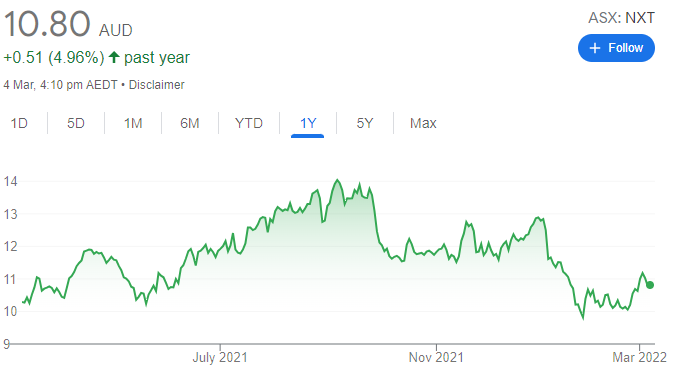

NextDC (NXT)

Strong first half 2022 results highlighted a 29 per cent jump in underlying EBITDA to $85 million. The result reveals tailwinds from Australia’s mass adoption of cloud technology, with plenty of room for expansion. NXT focuses on the premium end, where pricing is more stable with big name clients. The solid balance sheet provides confidence that we should see sustainable consistent growth. Buy on the dips.

HOLD RECOMMENDATIONS

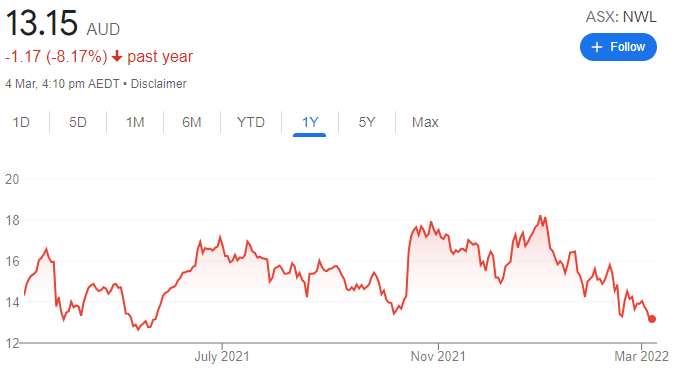

Netwealth Group (NWL)

First half 2022 statutory net profit after tax fell 1.8 per cent on the prior corresponding period to $27.1 million for this platform provider. Platform revenue rose 16.5 per cent to $82.9 million. Staffing costs rose by 32 per cent. In our view, the outlook remains fine if margins stabilise, as the company is still generating strong funds under management growth.

Charter Hall Long WALE REIT (CLW)

This trust invests in quality real estate assets that are mostly leased to corporate and government tenants. It enjoys an occupancy rate of 99 per cent. The portfolio’s weighted average lease is 12.2 years. It has acquired a 50 per cent interest in the ALE Property Group. It has good quality tenants, but, in our view, gearing is on the higher side. We consider CLW a stable income play.

SELL RECOMMENDATIONS

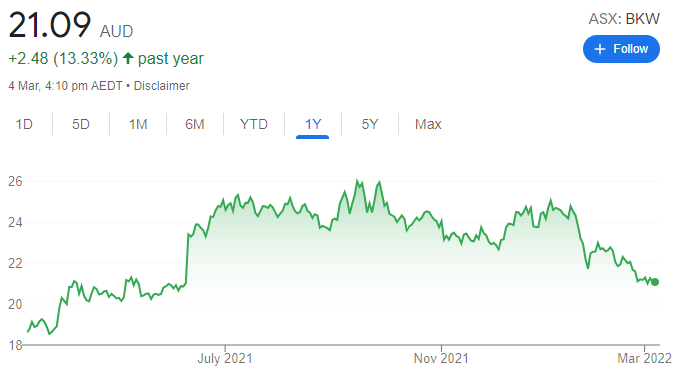

Brickworks (BKW)

We’re concerned about the company’s exposure to North America, where the household debt to disposable income ratio is peaking amid a decline in the size of housing finance. Locally, the collapse of Probuild before interest rates have even started rising is a concern for the wider industry. Investors may want to consider taking a profit.

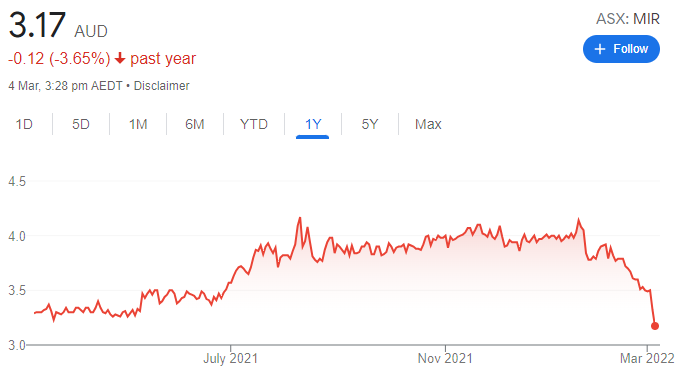

Mirrabooka Investments (MIR)

MIR invests in small and medium sized companies in Australia and New Zealand. It delivered a half year profit of $4.2 million to December 31, 2021, an increase of 23.5 per cent on the prior corresponding period. But we’re uncomfortable with a 13 per cent premium to net tangible assets in times of heightened volatility.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.