Arthur Garipoli, Seneca Financial Solutions

BUY RECOMMENDATIONS

BUY – IGO Limited (IGO)

IGO owns and operates nickel mines in Western Australia. IGO also has a stake in the Greenbushes lithium mine via a joint venture. The company recently reported underlying EBITDA of $636 million for the June quarter, an increase of 19 per cent on the previous quarter. Group nickel production was up 14 per cent. The recent price fall follows a non-cash impairment of Western Areas nickel assets. But the fall provides an attractive entry point to a company we believe offers a brighter outlook.

BUY – CSL (CSL)

Foreign currency movements will impact the company’s fiscal year 2023 forecast profit. CSL is expecting a foreign currency headwind of between $US230 million and $US250 million, up from $US175 million anticipated at its half year result. This blood products group has a solid track record of performance. Despite weaker than expected near term earnings, we like the company’s outlook. Recent share price weakness provides an attractive entry point for longer term investors

HOLD RECOMMENDATIONS

HOLD – Meteoric Resources NL (MEI)

Recent drilling results from its flagship Caldeira rare earths project in Brazil indicate a possible material resources upgrade in coming months, according to our analysis. Results indicate high-grade zones may be larger than expected. The economics of the project appear robust. The shares have risen from 6.3 cents on January 4 to trade at 23.5 cents on August 3.

HOLD – Amcor PLC (AMC)

This global packaging giant cut fiscal year 2023 guidance due to lower volumes. The short term outlook looks challenging due to lower consumer spending. However, we see this as a temporary issue and expect the company to generate meaningful growth when signs of a stronger global economy begin to emerge.

SELL RECOMMENDATIONS

SELL – Boral (BLD)

This building materials supplier recently provided a trading update. Earnings before interest and tax in the second half of fiscal year 2023 is expected to be higher than the first half due to stronger demand. The share price has risen from $2.87 on December 28, 2022 to trade at $4.25 on August 3. Given higher interest rates may possibly trigger a construction slowdown, investors may want to consider locking in some profits.

SELL – Iluka Resources (ILU)

Iluka is a mineral sands producer. Second quarter sales in fiscal year 2023 were significantly up on the first quarter. A planned major maintenance outage in the second half will impact synthetic rutile production. While the balance sheet remains strong, we see downside risk in mineral sands pricing due to a weakening macro-economic backdrop.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tom Bleakley, BW Equities

BUY RECOMMENDATIONS

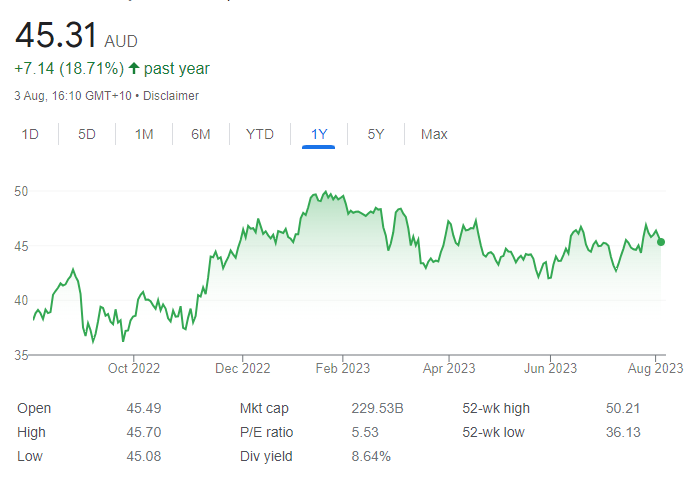

BUY – BHP Group (BHP)

Copper is the dominant mineral required in the transition to electric vehicles. So we’re bullish on copper prices moving forward. This global miner appeals given its leverage to copper and iron ore. BHP recently updated the market with its quarterly report. It revealed company performance is in line with production and cost guidance for fiscal year 2023.

BUY – CSL (CSL)

The stock has been heavily sold down since mid June after the company informed its 2023 fiscal year profit forecast would be impacted by foreign currency movements. Shares in this blood products group have fallen from $308.52 on June 13 to close at $267 on August 3. The weaker share price provides an appealing opportunity to consider buying a quality company that we expect will recover over the medium to longer term.

HOLD RECOMMENDATIONS

HOLD – Incitec Pivot (IPL)

The company recently confirmed it had received several approaches for the potential acquisition of its fertilisers business. The board is considering a potential sale. IPL is also considering separating Incitec Pivot Fertilisers and Dyno Nobel. Potentially separate businesses, as opposed to a combined group, are likely to trade at a premium, in our view. We retain a hold recommendation provided dividends are sustained.

HOLD – Goodman Group (GMG)

GMG is an integrated global property group. It’s also a specialist investment manager of industrial property. At March 31, the company had $13 billion of development works in progress. It has 99 per cent occupancy across its partnerships. Goodman is a high quality business. But we remain cautious about industrial property values in a potentially weaker economy.

SELL RECOMMENDATIONS

SELL – GrainCorp (GNC)

GNC is an agribusiness and processing company. GNC’s infrastructure assets store, process and facilitate the transport of grains and edible oils. EBITDA and net profit after tax (NPAT) fell in the first half of fiscal year 2023 when compared to the prior corresponding period. It has upgraded previous guidance for EBITDA and NPAT for fiscal year 2023. The company operates in a cyclical industry where volumes can be impacted by adverse weather. Investors may want to consider pocketing some gains.

SELL – Amcor PLC (AMC)

The global packaging giant has struggled, with net sales falling by 1 per cent for the three months to March 31, 2023 when compared to the prior corresponding period. Net income fell by 34 per cent. We prefer others until Amcor can demonstrate business conditions are returning to stronger growth. The shares have fallen from $17.50 on January 4 to finish at $15 on August 3.

Mattew Lattin, Marcus Today

BUY RECOMMENDATIONS

BUY – Santos (STO)

Sales revenue in the second quarter of fiscal year 2023 fell by 18 per cent on the prior quarter. Updated production volume guidance narrowed to between 89 million and 93 million barrels of oil equivalent from previous guidance of between 89 million to 96 million barrels of oil equivalent. Cost guidance was unchanged. STO’s Barossa project is now 66 per cent complete and is on track for first gas production in 2025. The effective delivery of Barossa is a key growth catalyst.

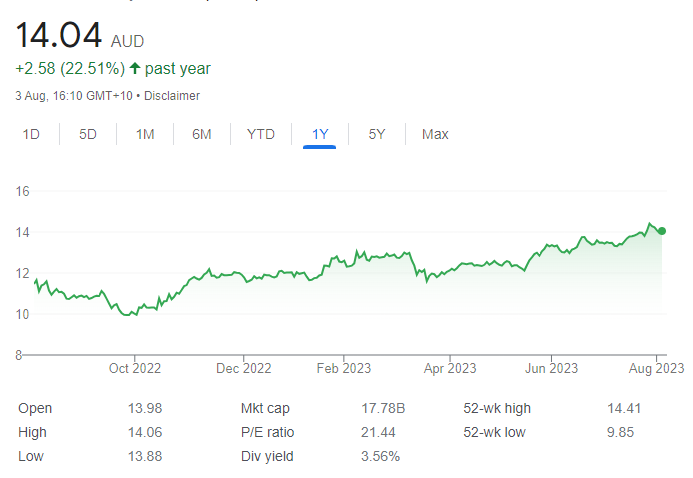

BUY – Netwealth Group (NWL)

This wealth management business ended the 2023 fourth quarter on a strong note. Funds under administration reached $70.3 billion in fiscal year 2023, an annual increase of 26.3 per cent on the previous corresponding period. The latest results may reflect improving financial markets and inflows by advisers and clients. Higher interest rates should support earnings growth.

HOLD RECOMMENDATIONS

HOLD – Suncorp Group (SUN)

First half 2023 results showed a strong performance in the insurance and banking divisions, with increasing gross written premiums and improving net interest margins. SUN’s financial health remains robust, fulfilling minimum capital requirements. Active risks, such as rising re-insurance renewal costs, should be monitored. But the outlook for SUN’s insurance division looks positive.

HOLD – Perseus Mining (PRU)

This African miner exceeded gold production expectations in the June quarter. Mines in Africa show promise, but operations in Sudan carry geo-political risk. The shares have fallen from $2.49 on April 14 to trade at $1.712 on August 3. However, PRU’s solid results and growing cash reserves offer some re-assurance.

SELL RECOMMENDATIONS

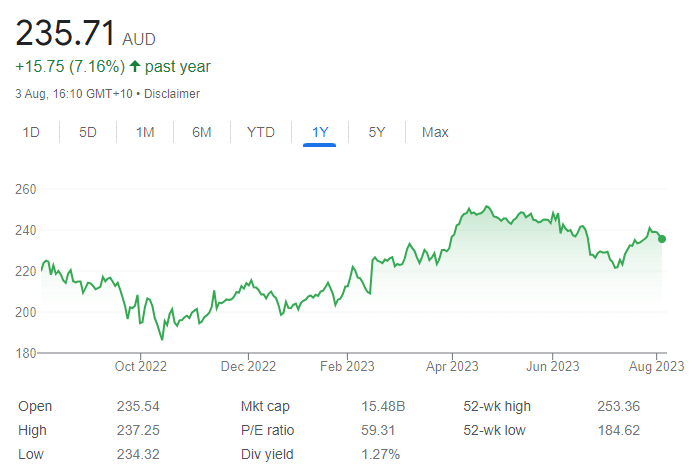

SELL – Cochlear (COH)

This hearing implants company produces high quality products. But the company is up against increasing competition. The company lifted sales revenue by 9 per cent in the first half of fiscal year 2023, but statutory net profit fell by 16 per cent. In our view, Cochlear is trading at a significant premium to industry averages, raising concerns about potential downside risk. The company is trading on an elevated price/earnings ratio, in our opinion.

SELL – Treasury Wine Estates (TWE)

The global wine company faces inflationary cost pressures. Changing consumer spending habits has impacted lower priced wines. The luxury wine segment offers potential long-term growth. But group net service revenue is expected to decline by about 2 per cent to 3 per cent in fiscal year 2023.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.