John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

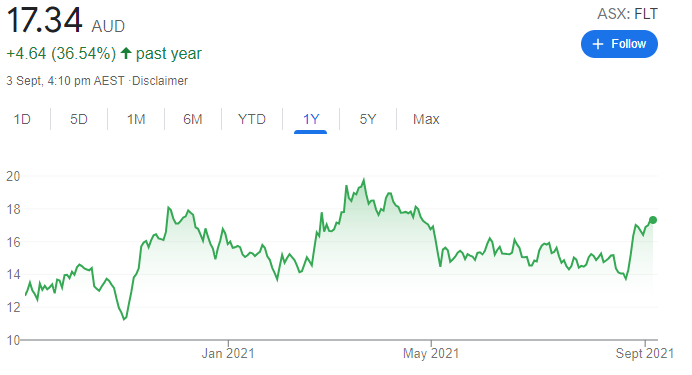

Flight Centre Travel Group (FLT)

The progress of corporate and leisure travel in the northern hemisphere has been most encouraging. Flight Centre is poised to be one of the biggest beneficiaries of this encouraging trend once Australia opens up more to increasing domestic and international travel. The share price is yet to fully reflect the upside when lockdowns are lifted.

Viva Leisure (VVA)

This health club operator recently raised $11.7 million to strengthen its balance sheet and to pursue acquisition opportunities. Since listing on the ASX in June 2019, Viva’s management team has established a strong track record in acquiring gyms in value adding locations. VVA presents investors with an upside opportunity ahead of lockdown restrictions easing on Australia’s east coast.

HOLD RECOMMENDATIONS

Jumbo Interactive (JIN)

This digital lottery company posted impressive fiscal year 2021 results. Group total transaction value was up 37 per cent to $487 million. Revenue was up 17 per cent to $83.3 million. The company has entered into an agreement to acquire Canadian lottery management provider Stride Management Inc. We suspect the share price has recently fallen in response to the agreement to acquire Stride Management rather than the results. We suggest investors monitor the progress of the acquisition before adjusting positions.

WiseTech Global (WTC)

WTC provides software solutions to the global logistics industry. Investors reacted positively to the company’s full year results, with the share price soaring in response to potential growth prospects flowing from a recovery in the global goods trade. In our view, global trade trends remain volatile. So investors should keep a close on eye on trade trends before buying or reducing their holdings in WTC.

SELL RECOMMENDATIONS

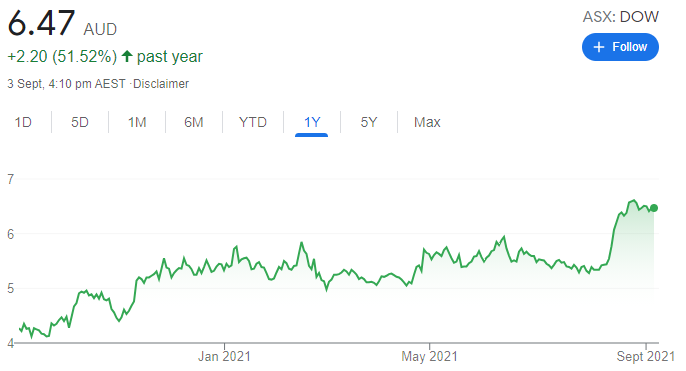

Downer EDI (DOW)

This integrated services provider suffered an 8.8 per cent fall in total revenue in fiscal year 2021. The company didn’t provide specific earnings guidance moving forward due to the changing nature of COVID-19 and ongoing restrictions. But it expects revenue and earnings to grow in its core urban services business during the next 12 months. However, we’re concerned Downer may face skill shortages and cost pressures due to the pandemic. In our view, mining services companies, such as Downer, face challenges until Western Australia softens its hard border policy.

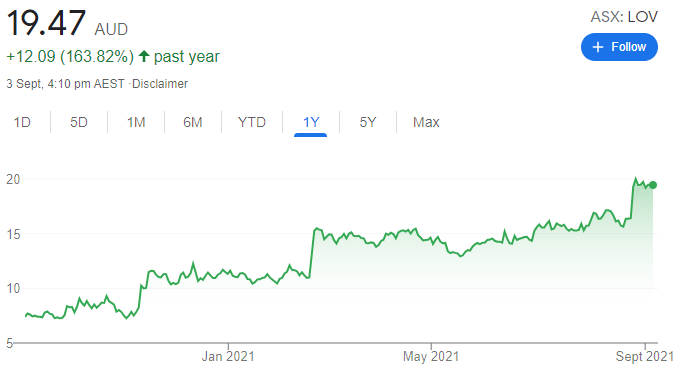

Lovisa Holdings (LOV)

This fashion jewellery and accessories retailer is well managed. Fiscal year 2021 revenue of $288 million was up 18.9 per cent on the prior corresponding period. The company’s share price has risen from $7.76 on September 3, 2020 to close at $19.48 on September 2, 2021. In our view, the shares are fully priced. We believe risk is to the downside, particularly if international expansion doesn’t go to plan. Investors may want to consider taking a profit before looking elsewhere for potentially more growth.

Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

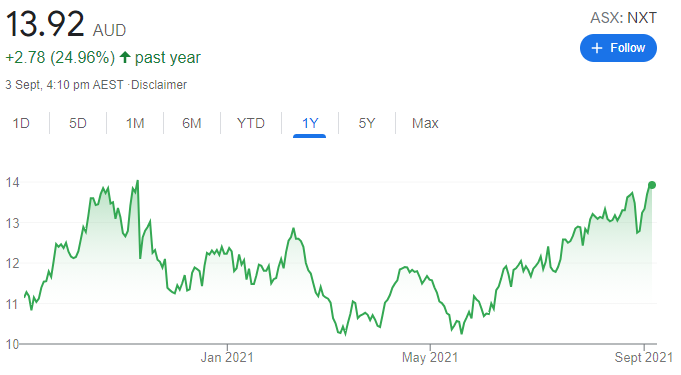

NextDC (NXT)

Australia’s biggest cloud data provider reported underlying EBITDA of $134.5 million for fiscal year 2021, an increase of 29.9 per cent on the prior corresponding period. It beat the top end of guidance. We believe the trend of growing cloud service revenue between 30 per cent and 40 per cent a year is likely to continue. This reinforces our view that demand growth justifies the company’s plan to build several more data centres. The outlook is bright.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Silk Logistics Holdings (SLH)

Silk provides port to door logistics solutions. Services include warehousing, wharf cartage and distribution. The port to door service continues to be well supported, attracting a significant number of new customers. We expect Silk to pursue acquisitions to increase operating scale amid broadening its national capabilities. Recent full year earnings beat prospectus forecasts across all metrics. We expect SLH to beat its fiscal year 2022 net profit after tax forecasts by 18 per cent.

HOLD RECOMMENDATIONS

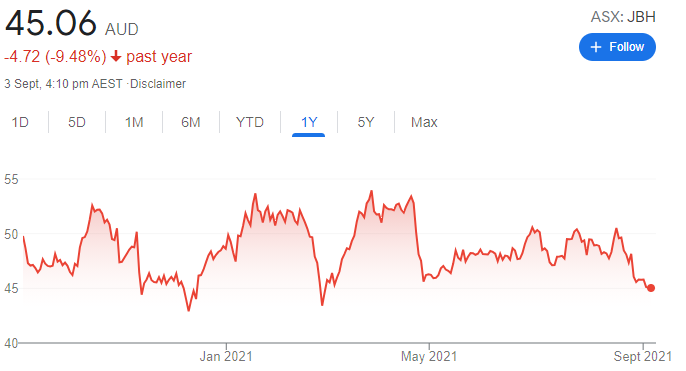

JB Hi-Fi (JBH)

We note this consumer electronics giant performs relatively well in lockdowns, but it will be hard to beat record sales achieved in fiscal year 2021. The company benefited from strong demand for consumer electronics and home appliances. Earnings before interest and tax of $743.1 million represented an increase of 53.8 per cent on the prior corresponding period. We move to a hold in the absence of a compelling catalyst to buy at this point.

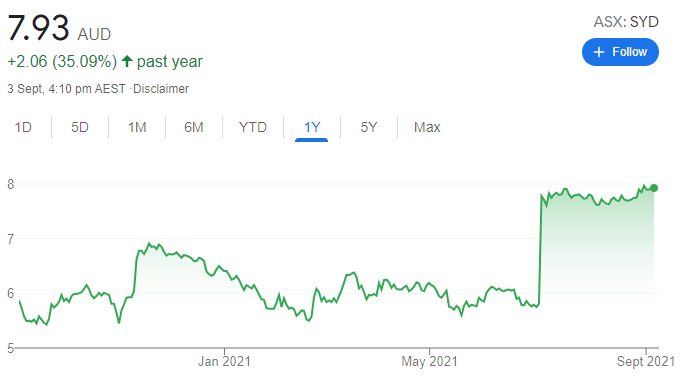

Sydney Airport (SYD)

The company’s first half results suffered in response to the pandemic. Sydney is a premier airport and we expect earnings and the share price to recover when travel levels rebound. A recent takeover bid for Sydney Airport was deemed by the SYD board to undervalue the company. We now prefer to hold for a possible revised offer, or for earnings to recover.

SELL RECOMMENDATIONS

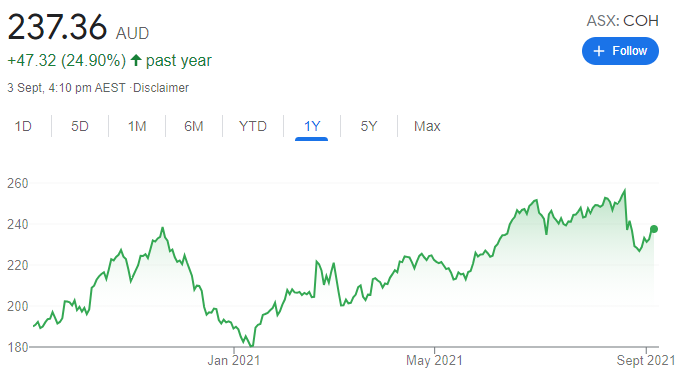

Cochlear (COH)

Fiscal year 2021 results for this hearing implants company were in line with our estimates, but below consensus. Downside risk remains due to potentially more disruptions to elective surgery. The shares finished at $232.54 on September 2. Our valuation is $214.54. Investors may want to consider trimming their portfolios and pocketing the gains.

Fortescue Metals Group (FMG)

The iron ore producer delivered a net profit after tax of $US10.3 billion in fiscal year 2021, an increase of 117 per cent on the prior corresponding period. It declared a final dividend of $A2.11 a share. Sustaining a high dividend and investing 10 per cent of net profit each year in renewable green energy may pressure the share price. The company is exposed to possible falls in iron ore prices. We retain a reduce rating, as the shares finished above our $19.20 valuation on September 2.

Niv Dagan, Peak Asset Management

BUY RECOMMENDATIONS

Volt Resources (VRC)

A share placement has successfully raised $5.75 million to fast track plans to supply battery anode material to lithium-ion battery manufacturers in Europe. In July, the company transitioned to a graphite producer after acquiring a 70 per cent controlling stake in a Ukraine graphite business. Volt has the potential to become a key market supplier of graphite and battery anode materials to growing European markets. Our company was involved in the capital raising.

Magnis Energy Technologies (MNS)

MNS aims to become a global producer of green credentialed lithium-ion battery cells. In May, it announced it had secured $US655 million in binding sales agreements. Another agreement worth $US74 million over four years was reached with a US Government supplier. About 23 per cent of project work at its New York plant is completed. MNS is also developing a graphite project in Tanzania. In our view, MNS offers growth potential within a bright outlook.

HOLD RECOMMENDATIONS

Domino’s Pizza Enterprises (DMP)

Global food sales rose 14.6 per cent in fiscal year 2021 to $3.74 billion. Underlying earnings before interest and tax were up 27.2 per cent to $293 million. The company will continue to open a significant number of new stores in the years ahead. Trading was strong in early fiscal year 2022. The revised growth outlook is positive.

Neuren Pharmaceuticals (NEU)

NEU is developing drug therapies to treat neurological disorders that emerge in early childhood. Top line results from its phase 3 trial of lead compound trofinetide – for Rett syndrome – are expected in the fourth quarter of 2021. If all goes to plan and trofinetide is approved and launched in the US, the company is forecasting potential revenue of $A111 million in the US alone, plus royalties on net sales, during 2022 and 2023. However, most pharmaceutical companies carry a degree of risk.

SELL RECOMMENDATIONS

Fortescue Metals Group (FMG)

The iron ore producer’s dividends are attractive. The final fully franked dividend of $A2.11 increased total dividends in fiscal year 2021 to $A3.58 a share. The company’s net profit after tax of $US10.3 billion was below consensus, in our view. We’re concerned that China is stockpiling iron ore, which could potentially impact momentum and margins. Increasing capital expenditure at the Iron Bridge project was announced earlier this year. We rate FMG a sell on valuation grounds. Investors may want to consider taking a profit.

Kogan.com (KGN)

The online retailer posted a 56.8 per cent increase in revenue to $780.7 million in fiscal year 2021. However, net profit after tax fell 86 per cent to $3.5 million. The company’s high inventory levels in the second half of fiscal 2021 contributed to significant increases in storage and marketing costs. The company isn’t paying a final dividend. The shares have fallen from $13.13 on August 23 to close at $10.87 on September 2. We prefer others at this point.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.