Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

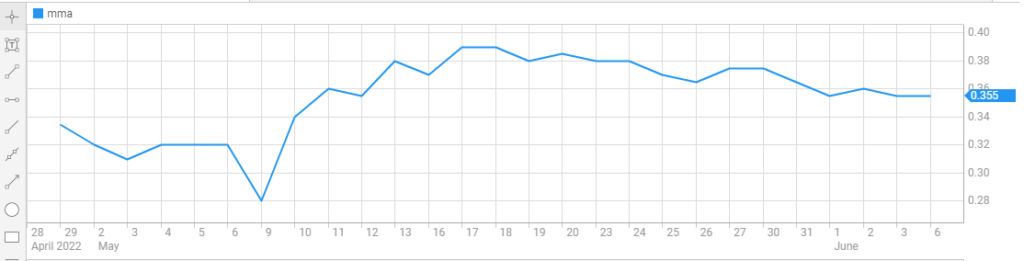

Maronan Metals (MMA)

MMA is a spin out from company Red Metal. The Maronan Project is an exploration play, targeting copper, gold, silver and lead mineralisation at Mount Isa in Queensland. Drilling will target additional shallow resources. Deeper drilling is aimed at finding a tier 1 deposit. The stock is speculative, but supported by an underlying resource and favourable 2016 mining study.

Pacgold (PGO)

The company raised $11 million in a placement and entitlement offer. Drilling has re-commenced at the Alice River Gold Project in Queensland. Initial focus will be at the F1a high grade gold zone discovered in the first phase of drilling. While the stock is highly speculative, we see the potential for resource growth.

HOLD RECOMMENDATIONS

Altamin (AZI)

Shares in this emerging zinc, cobalt, copper and lithium junior soared on a takeover offer. AZI received a cash takeover offer at 9.5 cents a share from VBS Exchange. AZI’s initial response was the offer provided an insufficient premium for control of Altamin. Investors may want to consider holding for developments.

Eagle Mountain Mining (EM2)

EM2 has reported a 17 million tonne at 1.48 per cent copper resource in Arizona. Further resource growth is likely. Part of the Oracle Ridge acquisition includes an existing underground mine, with 18 kilometres of development and extensive local infrastructure.

SELL RECOMMENDATIONS

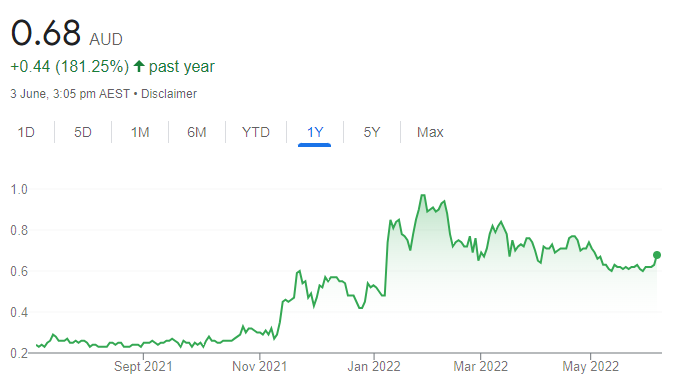

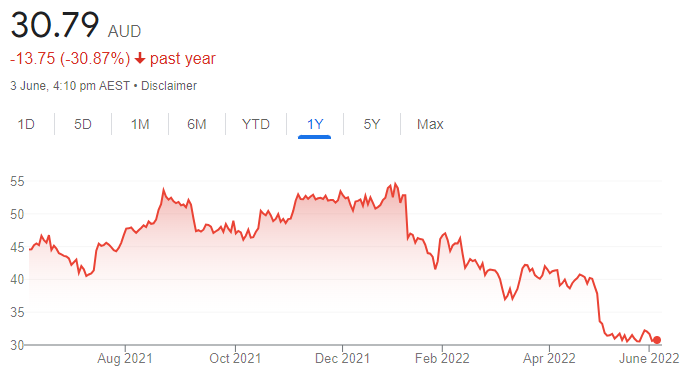

Allkem (AKE)

The share price of this lithium chemicals company has enjoyed a terrific run in the past two years. AKE has diverse lithium operations in Australia and Argentina, and is developing projects in both countries. Investors may want to consider taking profits into higher lithium prices and a strong electric vehicle theme.

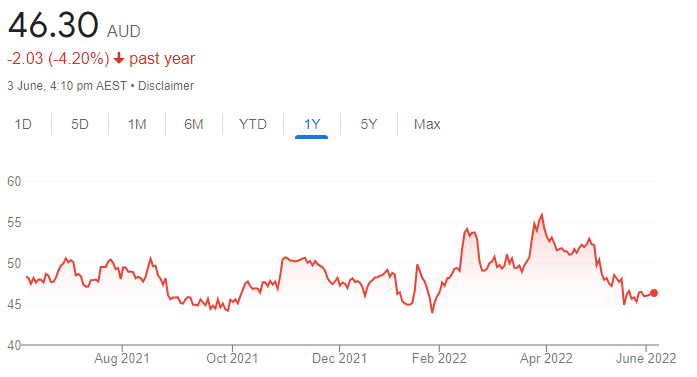

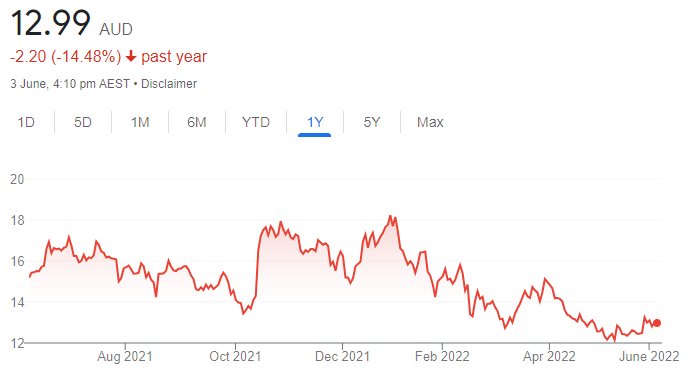

JB Hi-fi (JBH)

Higher interest rates and cost of living pressures may have an impact on discretionary spending. Australian operations at this consumer electronics giant generated solid sales growth of 11.3 per cent in the third quarter of fiscal year 2022. Investors may want consider locking in a profit.

Peter Moran, Wilsons

BUY RECOMMENDATIONS

ARB Corporation (ARB)

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

ARB is a 4-wheel drive accessories company. Underlying demand for parts remains strong, and the trend towards owning 4-wheel drive vehicles is likely to continue. We expect supply constraints to ease over time, which should generate higher levels of sales growth. We hold an overweight rating.

Collins Foods (CKF)

CKF owns more than 300 KFC outlets in Australia. CKF is well positioned for additional growth through its continuing rollout of Taco Bell outlets in Australia and via its KFC European operations. Concerns about increasing input costs have flowed to a weaker share price. Although costs will rise, investor concerns are too exaggerated, in our view. We hold an overweight rating.

HOLD RECOMMENDATIONS

ResMed (RMD)

The respiratory device maker benefited after competitor Philips announced a product recall last year. However, the gain in market share fell short of expectations due to a shortage of semiconductors needed in ResMed devices. The shares are appropriately priced. We hold a market weight rating.

TechnologyOne (TNE)

The software company recently reported a solid 2022 half year result. It posted net profit after tax of $33.2 million, up 18 per cent on the prior corresponding period. The company is attractive for generating high levels of recurring business. The company appears appropriately priced. We hold a market weight rating.

SELL RECOMMENDATIONS

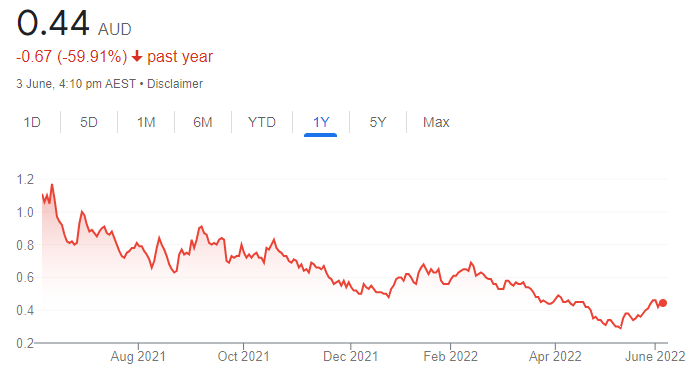

Avita Medical (AVH)

This regenerative tissue company owns RECELL, a product used to treat burns in Australian and US hospitals. The company is looking to expand RECELL applications beyond hospitals. The shares have fallen from $5.13 on November 4, 2021 to close at $1.61 on June 2, 2022. Time will tell if the company can deliver on its development pipeline. We hold an underweight rating.

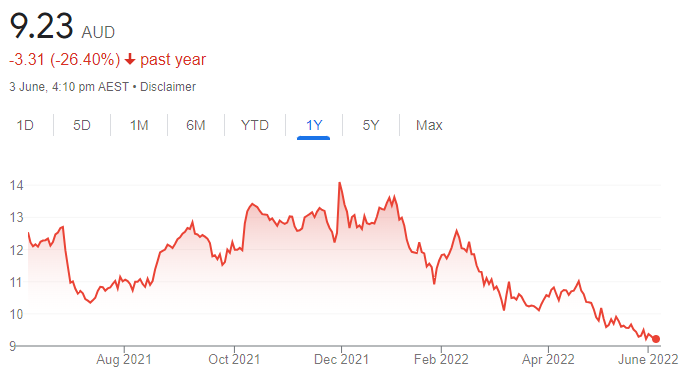

Bravura Solutions (BVS)

This provider of software services to the wealth management and funds administration industries is up against rising costs. Growing revenue is a challenge. It’s difficult for us to see cost pressures subsiding anytime soon. The shares have fallen from $2.44 on January 4 to close at $1.615 on June 2. We hold an underweight rating.

Christopher Watt, Bell Potter Securities

BUY RECOMMENDATIONS

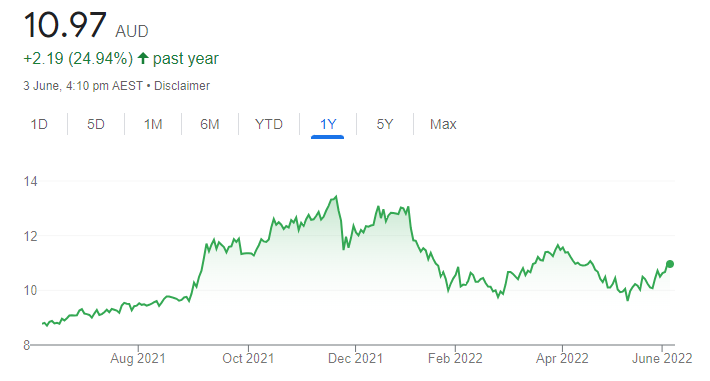

Charter Hall Long WALE REIT (CLW)

This real estate investment trust invests in quality assets that are mostly leased to government and corporate tenants. We’re attracted to CLW’s low risk income stream, secured by a sector-leading lease term of 14 years. The stock offers attractive, stable income with a recent dividend yield above 6 per cent.

Goodman Group (GMG)

GMG is a huge industrial property group. GMG offers exposure to global property development and property funds management. While investors may be concerned about rising interest rates, GMG management has flagged that quality assets are generating strong cash flow growth, which should support asset value growth.

HOLD RECOMMENDATIONS

Qube Holdings (QUB)

Qube is a vertically integrated provider of import and export logistics services. It covers port operations to long haul services. We expect strong organic growth given growing container volumes. Commodity demand driven by global growth also appeals. However, in our view, the stock looks expensive on recent price-to-earnings multiples.

Netwealth Group (NWL)

Netwealth is a leading Australian wealth management platform provider. Netwealth’s platform enables financial planners and individual investors to manage, transact and administer investments across various asset classes. NWL is an appealing long term growth story, but the stock looks expensive on recent price-to- earnings multiples, in our view.

SELL RECOMMENDATIONS

Boral (BLD)

This building materials company recently divested its non-core operations to focus on the Australian construction market. A recent trading update indicates further adverse impacts from exceptional rainfall and inflation. We expect higher interest rates to have a negative impact on construction activity.

Reliance Worldwide Corporation (RWC)

RWC designs, makes and supplies water delivery control solutions to the plumbing and heating industries. Risks remain given higher costs impacting margins. Cost recovery is a challenge. The shares have fallen from $4.30 on May 5 to close at $3.95 on June 2.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.