Philippe Bui, Medallion Financial Group

BUY RECOMMENDATIONS

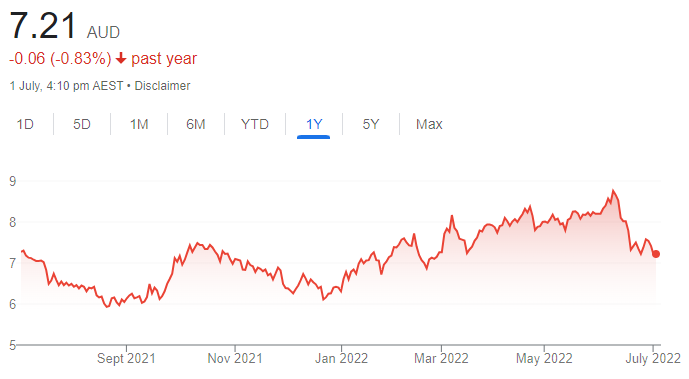

Goodman Group (GMG)

This integrated commercial and industrial property group upgraded impending fiscal year 2022 results. It lifted earnings per share guidance to 23 per cent. The share price is off its year highs in response to investor concerns regarding rising interest rates possibly impacting margins. The company still has a substantial development pipeline and a track record of increasing rent per square metre by 10 per cent a year in the past six-to-seven years.

Santos (STO)

The war in Ukraine continues to disrupt oil and gas supplies. We expect energy prices to remain above historical averages, despite the possibility they may moderate during 2022. Over the medium term, we expect LNG prices to remain resilient, given an expected reduction in coal fired energy.

HOLD RECOMMENDATIONS

DDH1 (DDH)

The company operates the biggest on-shore drill rig in Australia. The business has diversified exposure across gold, copper, iron ore and nickel. The company focuses on mine production and development, as opposed to exploration, which is more cyclical. The market sell-off leaves the company recently trading on an appealing price/earnings multiple of around 5 times.

Hearts and Minds Investments (HM1)

HM1 focuses on a global portfolio of high conviction stocks from several leading fund managers. The company donates investment fees to medical research beneficiaries. The company was recently trading at a significant discount to net tangible assets. On a longer term basis, HM1 remains attractive for investors seeking international exposure.

SELL RECOMMENDATIONS

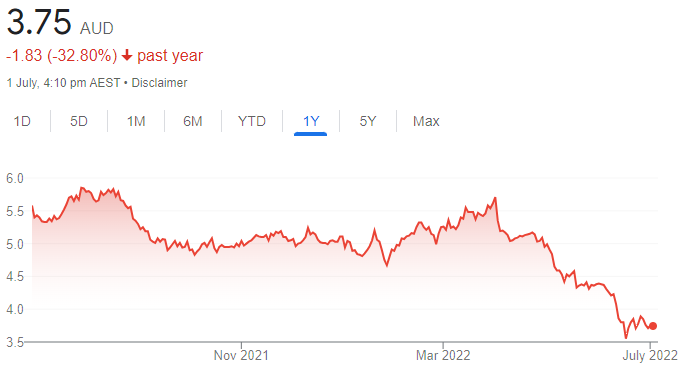

Whitehaven Coal (WHC)

Coal prices are substantially above long term levels. In our view, it’s difficult to see sustained high coal prices in coming years. WHC’s share price has risen from $2.02 on July 5, 2021 to trade at $4.835 on June 30, 2022. Investors may want to consider cashing in some gains.

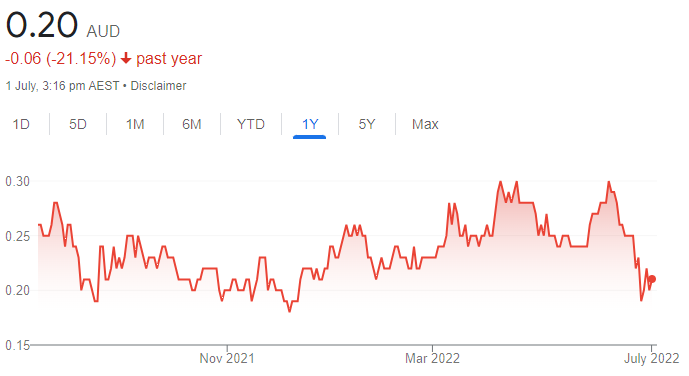

Vulcan Energy Resources (VUL)

We remain bullish about the lithium space. While lithium prices remain elevated, we prefer producers. This emerging lithium producer is aiming for net zero greenhouse gas emissions. Although the technology is exciting, the business is still some way from generating meaningful revenue.

Niv Dagan, Peak Asset Management

BUY RECOMMENDATIONS

Riversgold (RGL)

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

The explorer recently reported encouraging lithium oxide assay results from recently acquired exploration tenements. The key Tambourah project remains under explored, with only 4 per cent of the tenement package covered. The booming global market for batteries acts as a tailwind. RGL has potential to host a large lithium-caesium-tantalum system at its Tambourah project.

Besra Gold Inc. (BEZ)

Recently released encouraging drilling results at its Jugan project leaves potential for a stand-alone open pit development. In our view, impressive assay results provide confidence about the company’s prospects based on exploration and development in southern and eastern Asia. Gold can be a safe haven in uncertain and weaker economic times.

HOLD RECOMMENDATIONS

PointsBet Holdings (PBH)

The online sports wagering company secured a $94.16 million share investment from SIG Sports Investments Corp. The investment is expected to build on PBH’s operational capabilities and accelerate the company’s technology roadmap. PBH plans to grow its North American operations.

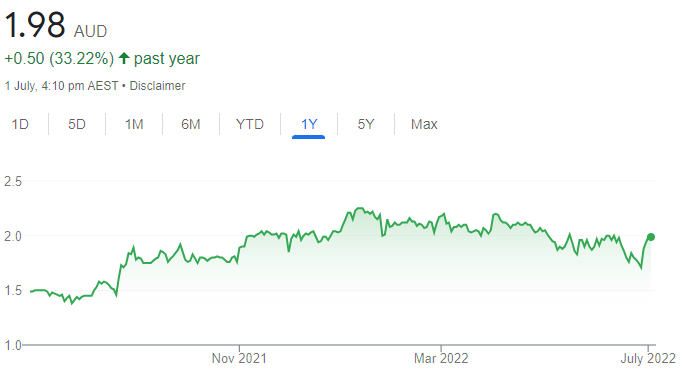

Woodside Energy Group (WDS)

The stock has been driven higher by soaring energy prices flowing from a supply crisis. The merging of BHP Group’s oil and gas portfolio with Woodside has created an energy powerhouse. We expect the merger to transition Woodside’s strategy to a low cost, lower carbon energy provider.

SELL RECOMMENDATIONS

Harvey Norman Holdings (HVN)

The retail giant reported total system sales revenue of $4.91 billion for the half year ending December 31, 2021. It represented a fall of 6.2 per cent on the prior corresponding period. According to our analysis, HVN has outperformed its peers, but we expect weaker consumer spending across the sector moving forward in response to higher cost of living expenses.

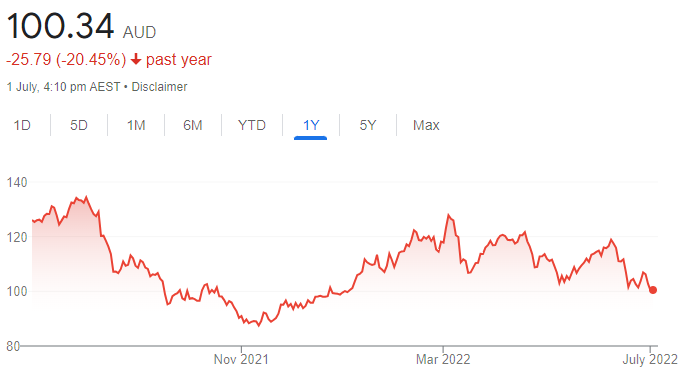

JB Hi-FI (JBH)

External pressures caused by higher interest rates and inflation have resulted in a significant share price fall for this consumer electronics giant. Spooked investors are transitioning towards safe haven assets given weakening sentiment regarding the outlook for the retail sector.

Harrison Massey, Argonaut

BUY RECOMMENDATIONS

Medallion Metals (MM8)

Medallion owns and operates the Ravensthorpe gold and copper project in Western Australia. The company recently announced a 79 per cent resource upgrade to the mineral resource estimate. The total resource has been increased to 1.37 million ounces of gold equivalent at 2.6 grams a tonne gold equivalent. The company update included a maiden copper resource at the project of 50,000 tonnes. The company is waiting for further assay results, with a resource update targeted for the end of 2022.

GR Engineering Services (GNG)

This mining services company upgraded guidance, forecasting revenue of between $620 million and $640 million for fiscal year 2022. It beat previous expectations of between $580 million and $600 million. We expect the company to be diligent in managing cost pressures. We’re forecasting the company’s dividend yield to be above 10 per cent in its next report.

HOLD RECOMMENDATIONS

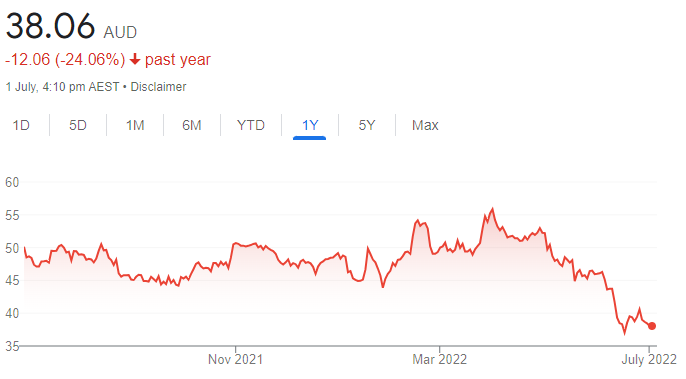

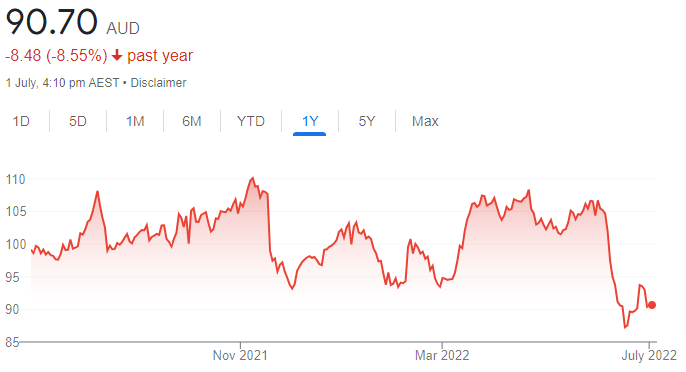

Commonwealth Bank of Australia (CBA)

Rising interest rates and cost of living increases may impact the bank’s mortgage book in the short term. Slowing economic growth and waning consumer confidence may also impact short term growth in the banking sector. The bank remains a staple of investment portfolios. The medium to long term outlook from increasing cash rates is bright.

Rio Tinto (RIO)

The global miner retains a strong cash position and we expect it to continue paying attractive dividends. Fundamentally, we believe demand for iron ore will increase before the end of 2022 in response to potentially more stimulus in China.

SELL RECOMMENDATIONS

Tabcorp Holdings (TAH)

The gambling services provider recently demerged from its lotteries business, which we believe will have an impact on the company’s long term prospects. A highly saturated betting market leaves Tabcorp exposed to fierce competition.

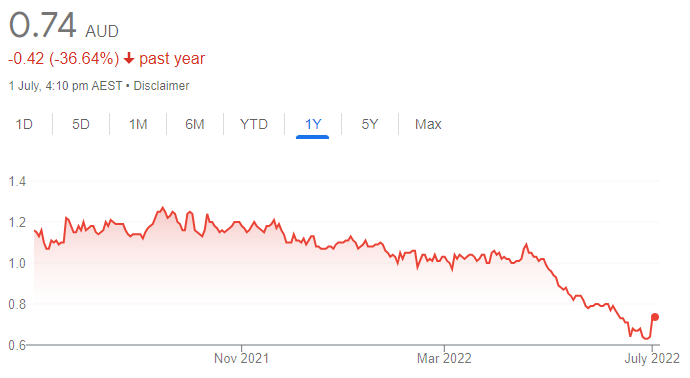

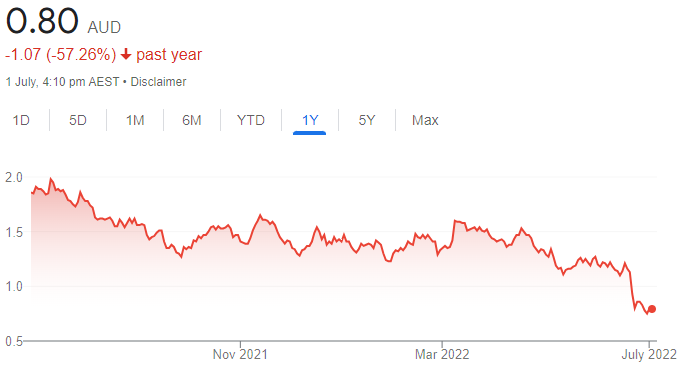

St Barbara (SBM)

This gold producer has operations in Australia and Papua New Guinea. SBM withdrew production guidance at its Simberi gold mine in February 2022. The company’s also announced it’s deferred an investment decision on sulphide expansion at the asset. Any increasing cost pressures will present challenges. The share price has fallen from $3.63 on July 6, 2020 to trade at 75.5 cents on June 30, 2022.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.