Stuart Bromley, Medallion Financial Group

BUY RECOMMENDATIONS

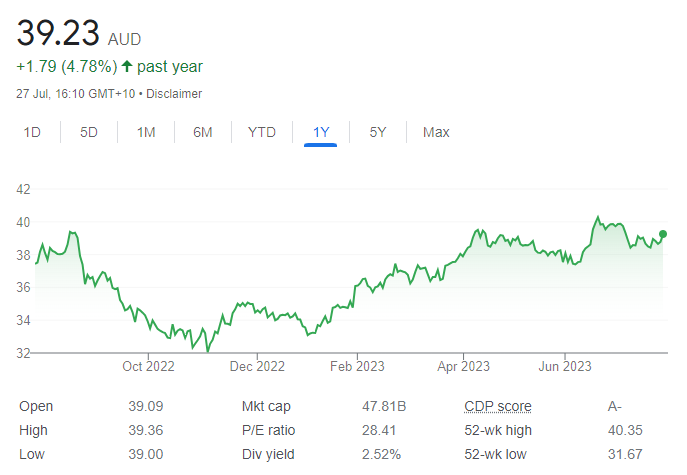

BUY – Goodman Group (GMG)

This global industrial property giant has an occupancy rate of 99 per cent, with quality long-term tenants. The company continues to build for the future, with $13.9 billion of projects in the pipeline. Particularly encouraging in the near term is the company’s low gearing levels in this high interest rate environment.

BUY – PolyNovo (PNV)

PolyNovo has continued to set month-on-month sales records with its biodegradable skin regeneration product. We’re confident strong revenue figures can be sustained into upcoming results given continuing investment in its US sales force. A capital raising late last year has left the company with a stronger balance sheet.

HOLD RECOMMENDATIONS

HOLD – Telix Pharmaceuticals (TLX)

This biopharmaceutical company delivered total revenue of $120.7 million for the quarter ending June 30, 2023. It represented a 21 per cent increase on the previous quarter. Positive operating cash flow of $10.8 million led to a closing cash balance $131.7 million. The company is preparing for future product approvals. Also, the therapeutic pipeline continues to gain momentum.

HOLD – CSL (CSL)

Management confirmed in June that foreign currency movements had negatively impacted CSL’s profit forecast for fiscal year 2023. We note constant currency profit guidance has been retained for this blood products group. While currency movements generate short-term noise, the recent share price retreat also provides an opportunity to accumulate a quality business during a period of weakness. CSL offers bright long-term prospects.

SELL RECOMMENDATIONS

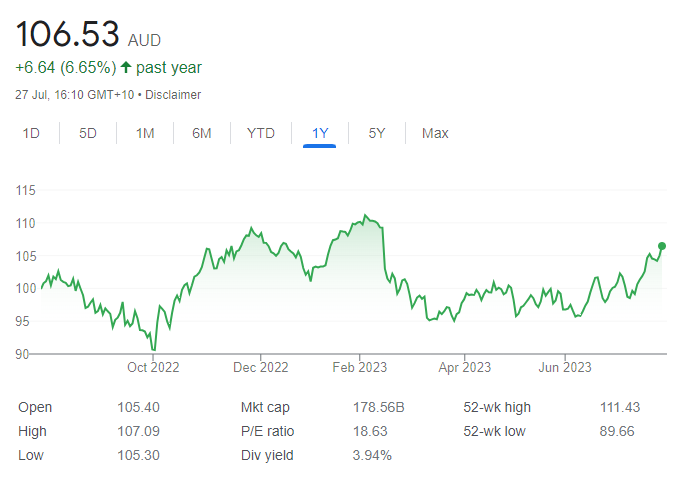

SELL – Commonwealth Bank of Australia (CBA)

CBA is a high quality business that many investors hold for the long term. The shares have risen from $95.80 on June 9 to trade at $106.43 on July 27. The price provides an opportunity to consider trimming shares based on our view of possibly lower net interest margins and slowing credit growth. In our opinion, upside is limited in the near term. We will reconsider our position on CBA should we see a price retreat.

SELL – Woolworths Group (WOW)

The supermarket giant’s own brand sales have been increasing as shoppers look to save on groceries. Group sales increased by 8 per cent in the third quarter of fiscal year 2023 when compared to the prior corresponding period. Moving forward, growing group sales and expanding margins will be a challenge in a fiercely competitive market. Also, higher interest rates and soaring cost of living expenses reduces discretionary spending. Investors may want to consider cashing in some share price gains.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

BUY – Whitehaven Coal (WHC)

A strong June quarter production report indicates that WHC remains capable of achieving high premiums in a market of tight supply. During the past four weeks, the charting pattern on WHC looks bullish. We’re confident a low is now in place and expect the stock to trend higher for the rest of 2023.

BUY – Fortescue Metals Group (FMG)

Disappointing economic growth in China has left some analysts bearish about this iron ore producer. However, we’ve seen strong buying in FMG shares this year, despite the negativity. FMG remains a contrarian trade, as the charts indicate the stock is near the start of a new uptrend. In our view, possible Chinese stimulus and bearish investors chasing the stock higher may fuel share price upside.

HOLD RECOMMENDATIONS

HOLD – BHP Group (BHP)

A solid fourth quarter result shows why BHP is the premium mining company on the ASX. This diversified miner is hitting production targets and is well placed to benefit from a recovering global economy. The share price chart was recently showing good buying support.

HOLD – Beach Energy (BPT)

Production of 5 million barrels of oil equivalent in the fourth quarter of fiscal year 2023 was up 12 per cent on the third quarter. Revenue of $450 million in the fourth quarter was up 27 per cent on the previous quarter. We believe energy prices will rise from here. The recent bullish share price pattern indicates the start of a new uptrend, in our view.

SELL RECOMMENDATIONS

SELL – ANZ Group Holdings (ANZ)

The banks continue to face headwinds due to increasing competition and potentially slower consumer lending. The ANZ share price has risen from $22.77 on June 26 to trade at $25.69 on July 27. The recent rally in ANZ’s share price provides an opportunity for investors to consider locking in some recent gains.

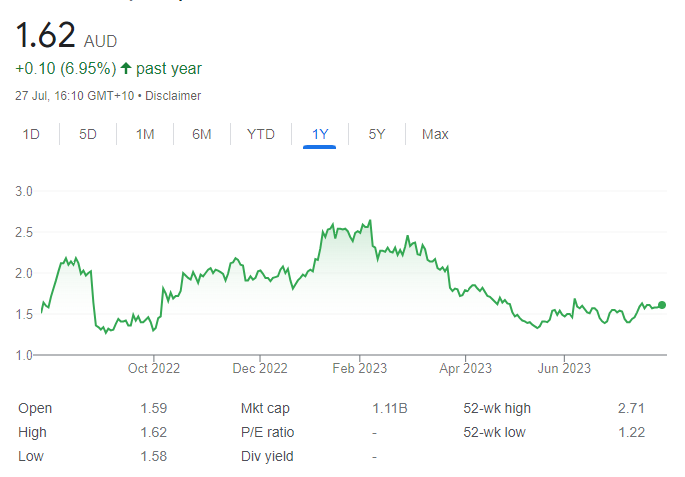

SELL – Platinum Asset Management (PTM)

The investment manager reported net outflows of about $232 million in June 2023. Funds under management post annual distribution to unit holders was $17.327 billion at June 30, 2023 compared to $17.966 billion at May 31, 2023. The shares have been trending lower for several years. This year, the price has fallen from $2.30 on February 21 to trade at $1.61 on July 27. In our view, other stocks appeal more.

Niv Dagan, Peak Asset Management

BUY RECOMMENDATIONS

BUY – Gold Mountain (GMN)

The company recently raised $2.25 million and is well funded to accelerate lithium exploration in Brazil. The company’s foothold in Brazil includes 607 square kilometres in the sought after Lithium Valley of northeast Minas Gerais state. The presence of spodumene bearing pegmatites has been identified in three project areas. Net proceeds from the placement will also enable exploration at the Wabag project in Papua New Guinea and for general working capital.

BUY – Summit Minerals (SUM)

The company recently signed a binding term sheet to acquire 80 per cent of the Castor Lithium Project with a landholding of 118 square kilometres in the prominent James Bay region of Quebec, Canada. The project covers 33 kilometres of strike length along the Yasinski Lake Greenstone Belt. The company is progressing exploration and metallurgical testing work at its high grade rare earths project in Western Australia. This stock is speculative, but offers potential. SUM was trading at 14.2 cents on July 27.

HOLD RECOMMENDATIONS

HOLD – Avenira (AEV)

AEV is a battery cathode and fertiliser focused project developer. The company plans to supply quality products to the electric vehicle, industrial chemical and agricultural markets. AEV is continuing to pursue the LFP (lithium ferro phosphate) battery manufacturing project after completing a positive scoping study. AEV is advancing discussions with stakeholders. The shares were trading at 1.6 cents on July 27.

HOLD – Castle Minerals (CDT)

The company operates the Kambale graphite project in Ghana. The company extended and completed its reverse circulation (RC) drilling program to identify new zones of interest. Results are expected in mid August followed by an update on the mineral resource estimate. The company is proposing a development scoping study. We are waiting on results from further drilling intercepts at its graphite project. Keep an eye on the news flow.

SELL RECOMMENDATIONS

SELL – Flight Centre Travel Group (FLT)

This travel agent giant recently upgraded profit guidance. It now expects to report underlying EBITDA of between $295 million and $305 million for the 12 months to June 30, 2023. Moving forward, we see downside risk in the travel industry on the back of a potentially slowing economy and tighter discretionary spending. The shares have risen from $18.69 on July 7 to trade at $23.32 on July 27. Investors may want to consider cashing in some gains.

SELL – BetMakers Technology Group (BET)

The company provides software and content to the horse racing industry. The company is focusing on reducing costs by restructuring global operations and technology. Executing its global efficiency program is expected to cost between $2 million and $2.5 million. The share price has fallen from 27.5 cents on January 3 to trade at 17.7 cents on July 27. We prefer others.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.