Elio D’Amato, Spotee Connect

BUY RECOMMENDATIONS

OFX Group (OFX)

This global provider of international payments and foreign exchange services is forecasting net operating income (NOI) of between $200 million and $212 million in fiscal year 2023. In its latest full year result, it achieved 25 per cent record growth in NOI to $147 million, which beat expectations by an additional 10 per cent. All divisions generated growth, in particular the lucrative corporate and high value consumer divisions. Net cash grew over the period by 39 per cent to $84.2 million.

Strike Energy (STX)

STX is an on-shore junior gas explorer. Exploration activity is well advanced at its Erregulla and Walyering reserves. Strike Energy’s appeal extends beyond its gas assets given downstream potential at its Project Haber urea fertilizer plant in Western Australia. The company has already announced that a subsidiary of US-based Koch Industries will take 100 per cent of the 1.4 million tonnes per annum of granulated urea when the plant is completed. With geothermal interests as well, STX is diversifying its interests beyond traditional energy.

HOLD RECOMMENDATIONS

Aristocrat Leisure (ALL)

Half year 2022 revenue, EBITDA and profit were above expectations. This gaming company increased the dividend by 73 per cent, while also announcing a buy-back of up to $500 million, using some of the funds obtained from the $1.3 billion capital raising last year. With more cash in the bank, investors yet to consider ALL may want to look now.

National Australia Bank (NAB)

In our view, NAB was the premium bank this reporting season, rating highly across key metrics of revenue and cash profit growth, cost control, balance sheet strength and the dividend rising an impressive 21.6 per cent on the prior corresponding period. With rising interest rates expected to help net interest margins, NAB is well placed to manage potential questions on how Australian consumers and businesses cope in a rising inflationary environment.

SELL RECOMMENDATIONS

ANZ Bank (ANZ)

Our concern from its latest half year report was its more cautious view on the current macro state of play despite the broader COVID-19 recovery. Recent floods, geo-political risks, rising inflation and higher interest rates may lead to a rise in collective provisions. While its transformation strategy will ultimately yield better results, time is still required.

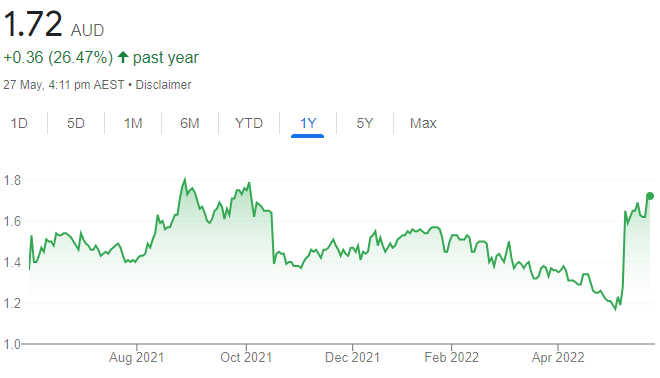

Infomedia (IFM)

This software provider to the automotive industry recently received an unsolicited, non-binding, conditional acquisition offer from TA Associates Management at a $1.70 a share in cash. The offer price was about 33 per cent higher than the closing price on May 12. IFM has since received a further unsolicited, non-binding, conditional proposal from Battery Ventures at $1.75 a share in cash. The risk is the offers don’t proceed. In our view, the offers provide investors who have ridden the share price slide with an opportunity to exit at a higher price.

Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

Northern Star Resources (NST)

The gold producer is facing higher wages and transport expenses. However, the company offers a strong management team and long life mines. Most company operations are in Australia, which also appeals. Higher inflation and government debt in the US means gold will continue to be an attractive store of wealth, in our opinion.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Dexus (DXS)

The real estate group manages high quality Australian property. It sustains high occupancy and rent collection rates of more than 90 per cent, and did so during COVID-19. These metrics are testament to the quality of its assets. Cash flow offers a level of certainty. The company pays attractive dividends.

HOLD RECOMMENDATIONS

Woolworths Group (WOW)

Margins of US retailers have tightened due to rising cost pressures. This fear has spread to our local consumer stocks. WOW is mostly consumer staples, and our markets haven’t been hit as hard by inflation when compared to the US. WOW offers defensive characteristics and we believe valuations should stabilise.

Macquarie Group (MQG)

This diversified financial services group reported a strong full year result in May. The company delivered fiscal year 2022 net profit of $4.706 billion, up 56 per cent on the prior corresponding period. In our view, the company’s conservative outlook is most likely behind a recent share price retreat. The company has a strong track record of performance. The shares closed at $177.81 on May 26.

SELL RECOMMENDATIONS

Treasury Wine Estates (TWE)

Australian wine exports suffered from China imposing big tariffs. Expanding to the US and others markets is a good strategy, but competition is fierce. Cost of living increases in the absence of meaningful wage growth presents more challenges. The TWE recovery story is too long for us to be excited.

Flight Centre Travel Group (FLT)

The share price of this global travel agency closed at $19.78 on May 26. In our view, the company looks fully priced. We do expect travel levels to recover, but the resilience of the rally must extend beyond pre-COVID-19 levels at a time of high crude oil prices and a weaker Australian dollar. Investors may want to consider selling into strength.

Jean-Claude Perrottet, Medallion Financial Group

BUY RECOMMENDATIONS

Aristocrat Leisure (ALL)

The gaming giant recently posted operating revenue of $2.745 billion in its half year result, up 23.1 per cent in reported terms on the prior corresponding period. EBITDA of $970.3 million was up 30.3 per cent in reported terms. Normalised profit after tax and before amortisation of acquired tangibles rose 40.9 per cent to $580.1 million. A strong recovery in North American gaming operations contributed to the result. We expect digital revenue to grow in future years.

Goodman Group (GMG)

This industrial property group recently released a third quarter operational update, forecasting earnings per share growth of 23 per cent in fiscal year 2022. GMG has high quality tenants and an occupancy rate that increased to 98.7 per cent. GMG is a quality business, with about $68.7 billion in assets under management. It has $13.4 billion of development work in progress across 89 projects.

HOLD RECOMMENDATIONS

Vicinity Centres (VCX)

This retail property manager has $22 billion under management across 61 high quality assets. Assets are leased by some of Australia’s biggest retailers, with a weighted average lease expiry of about 3.3 years. VCX maintains a strong balance sheet, with low gearing of 26.3 per cent and liquidity of $1.8 billion. We believe the metrics look positive given a quarterly occupancy rate remaining stable at 98.2 per cent.

Santos (STO)

The gas supplier’s balance sheet has improved in response to a low cost operating model. The company posted record quarterly production, sales revenue and free cash flow for the period ending March 31. These results have reduced gearing to 26 per cent at the end of a March. We expect crude oil prices to ease as supply increases in the 2022 second half. But, in our view, recent price strength and faster than expected deleveraging has put STO in a good position.

SELL RECOMMENDATIONS

Kogan.com (KGN)

The online retailer reported an unaudited 3.8 per cent decline in gross sales for the third quarter of fiscal year 2022 when compared to the prior corresponding period. Further, gross sales of third party brands and exclusive brands also declined, as did gross profit. In our view, gross margins may be impacted by excess inventory. Overall, we believe better growth opportunities exist elsewhere.

Appen (APX)

This language technology and artificial data services company recently received an unsolicited, conditional and non-binding acquisition proposal from TELUS International at an indicative cash offer of $9.50 a share. The indicative proposal has since been revoked. The shares plunged on the news to trade at $6.44 on May 27. Prior to the offer, we were concerned about slowing web traffic outside its own site.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.