Arthur Garipoli, Seneca

BUY RECOMMENDATIONS

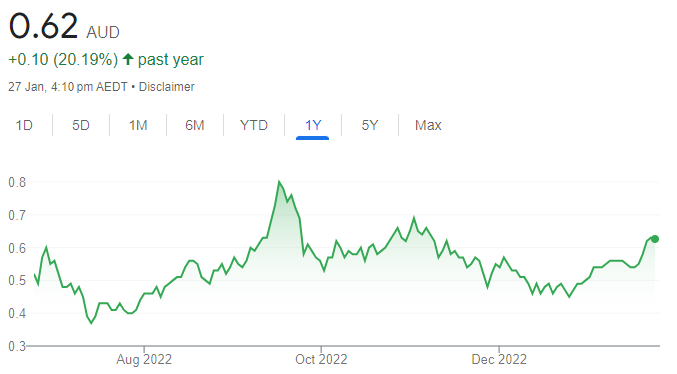

Pilbara Minerals (PLS)

In the December quarter, PLS delivered a 10 per cent increase in spodumene concentrate production compared to the September quarter. Unit operating costs were down 5 per cent and shipments were up 8 per cent. The company’s cash balance rose by 62 per cent to $2.226 billion. In our view, the company offers strong growth potential. It may announce a maiden interim dividend.

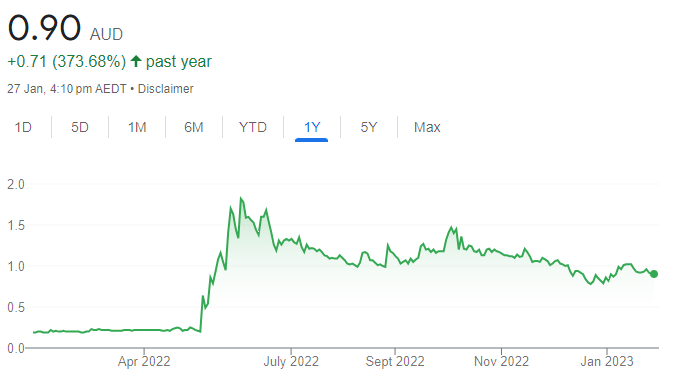

Leo Lithium (LLL)

The company is developing the Goulamina lithium mine in Mali and recently announced a resource upgrade. In our view, this confirms the outstanding scale of a high-grade project. The project is less than 18 months from production. Partner Ganfeng Lithium is providing funding to the project. More drilling results are imminent, but sovereign risk remains.

HOLD RECOMMENDATIONS

Galileo Mining (GAL)

In the December quarter, the explorer posted encouraging results at its Callisto, palladium-platinum-gold-rhodium-copper-nickel discovery. Drilling continues in a bid to expand the resource and prove up commercial potential. The company is sufficiently funded, and may attract corporate activity moving forward.

Syrah Resources (SYR)

Apart from China, SYR is the world’s biggest graphite producer. Sales are ramping up from its Balama graphite operations in Mozambique as shipping constraints ease. The company is expanding anode production at its Vidalia facility in the US. It’s due to be commissioned in the third quarter of calendar year 2023. SYR has offtake agreements with Tesla, and is negotiating agreements with other electric vehicle and battery makers.

SELL RECOMMENDATIONS

JB Hi-Fi (JBH)

Preliminary and unaudited earnings before interest and tax of $479.2 million in the first half of fiscal year 2023 represents a 14 per cent increase on the prior corresponding period. Gross margins also improved for this consumer electronics giant. Our concern is higher interest rates and cost of living increases possibly impacting discretionary consumer spending. Investors may want to consider cashing in some gains.

BlueScope Steel (BSL)

Higher prices and continuing strong demand for steel products drove the company to post underlying earnings before interest and tax of $3.79 billion in fiscal year 2022. However, we expect a slowdown in the global construction sector in calendar year 2023 in response to higher interest rates. We don’t expect underlying EBIT in fiscal year 2023 to match fiscal year 2022. We expect steel margin spreads to narrow. We don’t believe the challenges facing the steel industry are reflected in BSL’s share price.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

Endeavour Group (EDV)

Endeavour operates liquor outlets, hotels and gaming facilities. Recent electronic machine gaming has been strong in Victoria, Queensland and South Australia. Group sales in the first quarter of fiscal year 2023 were up 3.1 per cent on the prior corresponding period. The company offers diversified revenue streams and a bright outlook.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

New Hope Corporation (NHC)

NHC is a pure play coal miner. Asia is expected to remain a relative bright spot for coal demand in coming decades. Near term thermal coal prices remain high on supply concerns, as the war in Ukraine reinforces the need for energy security. High prices have enabled New Hope to generate strong free cash flow and return cash to shareholders via fully franked dividends. We expect an attractive dividend yield this financial year based on the current share price.

HOLD RECOMMENDATIONS

Seek (SEK)

Seek is an employment and education company. We expect attractive earnings growth for the group and forecast an 11 per cent EBITDA compound annual growth rate to fiscal year 2027. Seek is likely to benefit from vacancies in health care, social assistance, accommodation, food services and retail.

Bendigo and Adelaide Bank (BEN)

A trading update for the five months to November 30, 2022 revealed unaudited cash earnings after tax was tracking well ahead of consensus forecasts. The performance was driven by significantly improving net interest margins. This trading update has driven significant upgrades to our forecasts, albeit with a partial offset from higher costs.

SELL RECOMMENDATIONS

Woolworths Group (WOW)

The supermarket giant has entered into an agreement to acquire a 55 per cent equity interest in Petspiration Group, a specialty pet food, accessories and services retailer for $586 million. It builds on the company’s long-term strategic goal to offer an ecosystem for everyday needs. We expect a challenging year for the grocery industry, as shoppers become ever more value conscious. Investors may want to consider taking a profit.

Super Retail Group (SUL)

Company brands include Supercheap Auto, rebel, BCF and Macpac. SUL expects first half 2023 group sales growth of 15 per cent compared to the prior corresponding period. In our view, the stock trades at a significant premium to valuation, reflecting the market’s positive outlook in relation to consumer demand. However, we expect demand to soften as increasing cost of living expenses are likely to impact discretionary spending.

Jed Richards, Shaw and Partners

BUY RECOMMENDATIONS

ANZ Group Holdings (ANZ)

The ANZ is our top pick in the banking sector. Australian banks generate about 90 per cent of their earnings from net interest income. Generally, the higher the cash rate, the greater the net interest. ANZ is the cheapest major bank from a valuation perspective, and was recently trading on an attractive grossed up dividend yield of around 7 per cent.

Mineral Resources (MIN)

MIN is underpinned by its resilient mining services business, holding long-term contracts with some of Australia’s biggest tier-1 miners. The company’s target to double volumes over the next three-to-five years isn’t fully captured in analyst forecasts, nor is the company’s current market valuation. In our view, the business growth profile is appealing.

HOLD RECOMMENDATIONS

PolyNovo (PNV)

The company provides dermal regeneration solutions via its NovoSorb biodegradable polymer technology. I see further upside in PNV in response to strong sales momentum and a healthy balance sheet. Unaudited first half 2023 sales have risen by 67.5 per cent on the prior corresponding period. The company’s recent capital raising will help fund further growth initiatives.

Computershare (CPU)

The share registry and corporate services giant has recently expanded its mortgage servicing business in the US and the UK. The company remains an industry leader, with a diversified revenue base making it resilient to volatile markets. CPU is one of the few companies on the ASX to benefit from rising interest rates, which has been a strong tailwind.

SELL RECOMMENDATIONS

BHP Group (BHP)

The company’s most recent result delivered a strong cash dividend above expectations. Investors will be closely monitoring iron ore, copper and coal prices during the next 12 months. The macro backdrop is still fragile given global growth is slowing. Iron ore prices are now softer than in previous years. Costs continue to increase and port facilities are operating at maximum capacity.

Fortescue Metals Group (FMG)

In my view, the iron ore producer appears expensive at today’s levels. China’s construction market isn’t likely to stabilise in the short term despite easing of COVID-19 restrictions. I believe the outlook for FMG during the next 12 months appears challenging. Company costs have been increasing. The shares have risen from $14.76 on October 28, 2022 to close at $22.48 on January 25, 2023. Investors may want to consider cashing in some gains.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.