Niv Dagan, Peak Asset Management

BUY RECOMMENDATIONS

Avenira (AEV)

The company has signed a non-binding memorandum of understanding with Aleees to jointly develop a cathode battery manufacturing facility in Darwin. This explorer also focuses on gold in Western Australia and phosphate in the Northern Territory. We like the outlook for phosphate. AEV is a speculative buy. The shares were trading at 1.2 cents on September 29.

InhaleRx (IRX)

IRX has been progressing its inhaled cannabinoid-based therapies to possibly treat complex regional pain syndrome and panic disorder. It recently raised capital to back its regulatory work with the US Food and Drug Administration. Investor backing shows positive sentiment. The shares were trading at 6.9 cents on September 29. We were lead manager and corporate adviser to the placement.

HOLD RECOMMENDATIONS

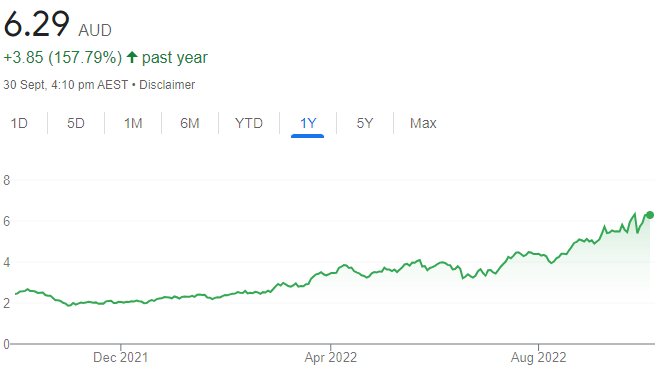

New Hope Corporation (NHC)

The share price of this coal miner has risen from $2.32 on January 4 to trade at $6.29 on September 29. We expect company earnings to remain consistent amid margins improving in response to the increasing price of energy commodities. With low debt and strong cash reserves, NHC is a sustainable investment.

PolyNovo (PNV)

PolyNovo is involved in dermal regeneration solutions via its patented NovoSorb technology. The company is forecasting revenue growth, and we’re optimistic about its projects. We believe the company is undervalued. The shares have fallen from $2.18 on August 17 to trade at $1.42 on September 29.

SELL RECOMMENDATIONS

JB Hi-Fi (JBH)

The share price of this consumer electronics giant has fallen from $55.85 on March 30 to trade at $39.12 on September 29. The company is up against higher interest rates and increasing cost of living expenses. The discretionary retail sector outlook appears challenging. It may be time for investors to consider cashing in some gains.

Peter Warren Automotive Holdings (PWR)

The car dealership group grew revenue by 5.6 per cent in fiscal year 2022. Underlying net profit after tax was up 18.2 per cent. The new car industry is exposed to supply constraints, which clouds the outlook. Other sectors provide more stability. Increasing interest rates is another challenge.

Toby Grimm, Baker Young

BUY RECOMMENDATIONS

GPT Group (GPT)

GPT is a relatively defensive player within the Australian real estate sector. It manages a diversified portfolio of high quality commercial, retail, office and industrial assets in key locations across Australia. Following asset disposals, investment mandate wins and a better-than-expected first half year result, we believe GPT is attractively priced on an earnings multiples basis and discount to net tangible asset backing.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

ANZ Bank (ANZ)

Compared to the other three major banks, ANZ shares were recently trading on the lowest price/earnings multiple and offer the highest prospective dividend yield. The decision to expand core operations via the Suncorp Bank acquisition reduces risk and supports medium term growth. Net interest margin expansion is expected to underpin ANZ’s full year result.

HOLD RECOMMENDATIONS

Amcor PLC (AMC)

This defensive packaging leader delivered impressive quarterly results in August, highlighting its ability to pass on rising costs to customers. The shares have fallen from $18.77 on August 17 to trade at $16.81 on September 29. Recently trading on a dividend yield of around 4 per cent, Amcor appeals for its defensive characteristics in a volatile market.

InvoCare (IVC)

The funeral operator was impacted by COVID-19 restrictions. However, the company lifted operating revenue and operating EBITDA in its first half year result. We expect a structural recovery to continue for this defensive funeral business during the second half and into fiscal year 2023.

SELL RECOMMENDATIONS

MA Financial Group (MAF)

MAF is a well-managed and innovative financial advisory and wealth management business. We’re concerned about potential changes to Australia’s Significant Investor Visa program. In a company update, MAF informed that 85 per cent of gross fund inflows into the asset management business related to non-migration investors in the first eight months of fiscal year 2022. However, we need to see more government clarity regarding the status of the visa program moving forward.

Myer Holdings (MYR)

The department store giant delivered a solid full year 2022 result. Total sales grew by 12.5 per cent on the prior corresponding period. Group online sales were up by 34 per cent. The shares have risen from 29.5 cents on June 17 to trade at 55.5 cents on September 29. The share price leaves little room for error. Our concern is higher interest rates that are likely to weigh on consumer spending moving forward.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

Qantas Airways (QAN)

Our positive view of QAN is supported by a favourable Australian industry structure that should lead to market share gains. Given its superior domestic market structure and share, a restructured and more variable cost base, a strong balance sheet and potential upside from the loyalty program, we believe a premium for Qantas is warranted.

Viva Energy Group (VEA)

Viva Energy has agreed to buy the Coles Express fuel and convenience assets from Coles Group. We expect the balance sheet to remain in a net cash position after the $300 million deal is completed. We believe the deal makes sense, as it offers Viva Energy additional flexibility from a strategic and operational standpoint, while also looking accretive to earnings and value.

HOLD RECOMMENDATIONS

Dicker Data (DDR)

Technology spending in Australia is forecast to exceed more than $100 billion in calendar year 2022. The small business segment, a core customer to DDR, accounts for about $30 billion. Technology is deflationary and drives cost efficiencies, a positive in the current macro-economic environment. Supply chain constraints should start easing in the first quarter of calendar 2023.

ASX Limited (ASX)

Derivatives volumes were up in August 2022 compared to last year’s corresponding period. Total capital raised was weaker. The long term prospects for the ASX remain strong, in our view. We believe the ASX offers relative earnings certainty in the event of any economic downturn.

SELL RECOMMENDATIONS

Lynas Rare Earths (LYC)

The company experienced water supply issues, impacting production at the Lynas Malaysia plant. We have lowered fiscal year 2023 production forecasts by 8 per cent. We have reduced our EBITDA forecasts by 13 per cent. In our view, the current risk/reward remains unattractive.

NIB Holdings (NHF)

The company announced it’s returning an additional $40 million in health insurance claims savings to members. This brings the total support to customers from its COVID-19 package to $145 million. Group underlying revenue grew by 7.2 per cent in fiscal year 2022. However, net profit after tax fell by 16.6 per cent, principally due to investment losses. The shares have fallen from $8.18 on August 31 to trade at $7.45 on September 29.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.