John Anderson, Bell Potter Securities

BUY RECOMMENDATIONS

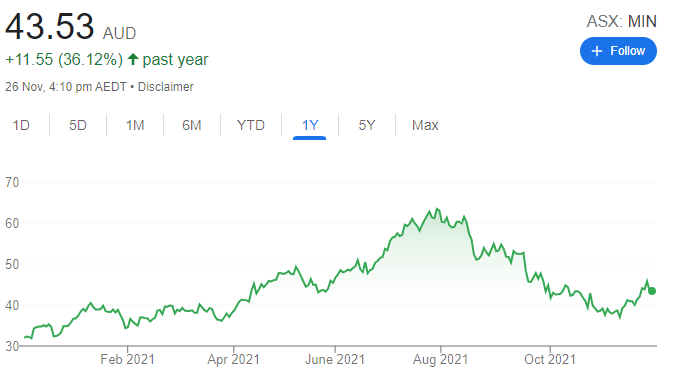

Mineral Resources (MIN)

MIN provides integrated, innovative and low cost pit-to-port solutions across the mining supply chain. MIN also has several iron ore and lithium operations. While we’re forecasting further iron ore price volatility and reductions towards lower long term levels, we believe there’s exciting catalysts in the next 12 months, including the expansion of its lithium program.

DGL Group (DGL)

DGL makes, stores, transports and processes chemicals and hazardous waste. It offers a strong investment outlook supported by improving sector demand and a big cross-selling opportunity underpinned by new heavy vehicle and environmental regulations. DGL is well capitalised after a recent initial public offering and we believe management is more than capable of integrating its recent acquisitions.

HOLD RECOMMENDATIONS

AMP (AMP)

The wealth manger recently announced it has sold its residual 19.1 per cent shareholding in Resolution Life Australasia for $A524 million, which completes AMP’s exit from the life insurance sector. With the transaction expected to be completed in the first half of calendar year 2022, AMP will soon have surplus capital near $1 billion. There are signs of value at this beaten-down wealth manager, although the near term outlook remains challenging.

Catapult Group International (CAT)

CAT is a global leader in wearable athlete tracking solutions, with more than 3425 elite and professional teams as customers. Despite CAT’s leading position, the market remains under-penetrated and offers a significant potential opportunity for growth. We believe the shares are fairly priced at this point.

SELL RECOMMENDATIONS

BWP Trust (BWP)

BWP is an externally managed, conservatively geared, pure domestic trust, offering predominant exposure to bulky goods. Since its formation in 1998, the trust’s portfolio has grown to about $2.7 billion in gross asset value, with more than 80 per cent comprising Bunnings Warehouses. We believe operating risks are rising from a low base, with its key tenant possibly vacating several properties. Subdued rental growth is set to continue.

Western Areas (WSA)

WSA is an independent nickel sulphide producer. It operates two high grade, underground nickel sulphide mines and an ore concentrator. In our view, the recent quarterly update was disappointing, with WSA reporting production of 3804 tonnes of nickel concentrate at cash costs of $4.95 a pound. In our view, WSA is trading at a premium to what we believe potential merger and acquisition activity warrants.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

Tyro Payments (TYR)

Total transaction value between November 1 and 19 this year was up 46 per cent on the prior corresponding period. The increase was driven by easing restrictions in New South Wales and Victoria. Tailwinds on the horizon include Christmas shopping, the return of international travel and the summer holiday season. This payment solutions provider is also acquiring more merchants. We expect further highs in weekly total transaction values during the next few months.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Insurance Australia Group (IAG)

IAG recently estimated that storms stretching between South Australia, Victoria and south-east Queensland in late October cost $169 million, net of the quota share and catastrophe program. This has pushed natural peril costs to $535 million for the first four months of fiscal year 2002 and an estimated $1.045 billion for the full year. However, we have upgraded to a buy recommendation based on valuation and an unchanged price target of $5.35 a share. The shares were trading at $4.475 on November 25.

HOLD RECOMMENDATIONS

Stockland (SGP)

This diversified property group is aiming to grow exposure to residential, office and industrial property from 50 per cent of net funds employed to 70 per cent during the next five years. It plans to reduce net funds employed for retail and retirement exposure from 50 per cent to less than 30 per cent. It also plans to start more than 80 per cent of its $12 billion investment pipeline within five years. Hold for now, as the shares were trading below recent highs on November 25.

Suncorp Group (SUN)

This diversified financial services group lifted total lending by 0.6 per cent in the September quarter. Business lending contracted 0.5 per cent due to a reduction in the commercial loan book, but it was partly offset by growth in agricultural lending. Suncorp’s common equity tier-one ratio of 9.63 per cent was marginally below June’s 10.06 per cent, but still above the target range of between 9 per cent and 9.5 per cent.

SELL RECOMMENDATIONS

Flight Centre Travel Group (FLT)

The company reported an underlying loss of $507 million before tax in fiscal year 2021. The result highlighted the devastating impact of the pandemic in all regions. Historically, FLT has been one of the best retail travel groups in the world. But it faces navigating structural change in the travel agency revenue model in the Australian and New Zealand markets. In our view, the key challenge for the company is to continue reducing costs to protect group earnings.

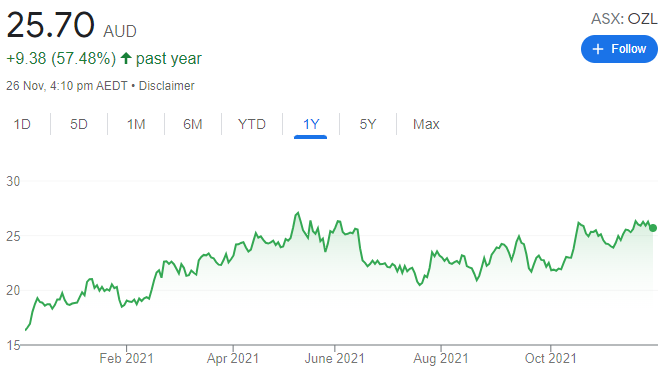

OZ Minerals (OZL)

The copper price recently hit all time highs, but a review of previous cycles indicates elevated levels could be sustained. But we struggle to support OZL’s valuation, even after squeezing our model and boosting our price assumptions by about 45 per cent. OZL was recently trading at a 20 per cent premium to our net present valuation.

Jean-Claude Perrottet, Medallion Financial Group

BUY RECOMMENDATIONS

ResMed Inc (RMD)

RMD makes medical devices and cloud-based software applications that diagnose and treat sleep apnea. First quarter 2022 revenue of $904 million beat expectations and was up 20 per cent on the prior corresponding period. Income from operations increased 21 per cent to $261.9 million. Strong demand for RMD products paint a bright outlook moving forward.

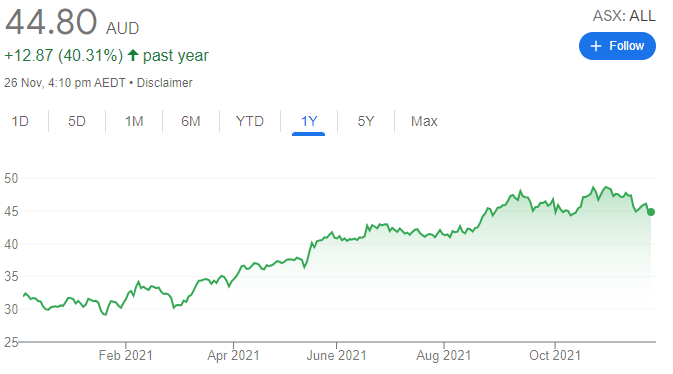

Aristocrat Leisure (ALL)

The gaming machine company posted operating revenue of $4.736 billion in fiscal year 2021, a 14.4 per cent increase on the prior corresponding period. Net profit after tax rose 114.4 per cent to $765.6 million. A strong recovery in North American gaming operations contributed significantly to the result. The company is proposing to acquire gambling software group Playtech, although a potential rival bidder has emerged. The Playtech acquisition could provide significant upside.

HOLD RECOMMENDATIONS

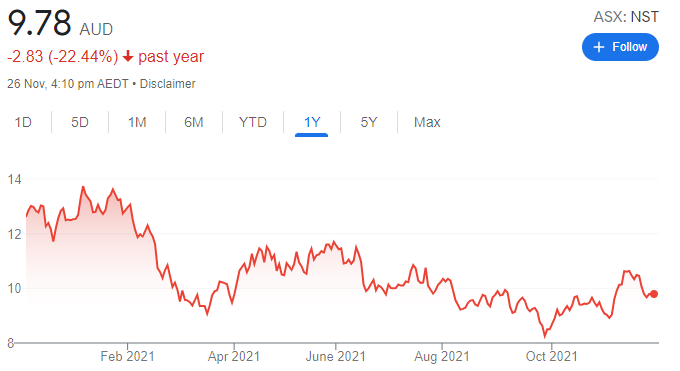

Northern Star Resources (NST)

Gold production missed expectations in the September 2022 quarter, but gold sales were in line. Higher grade results are coming from its Jundee operations. The company has sold its Kudana assets in Western Australia for $400 million. Debt is also falling. The company should enjoy a stronger second half.

Vicinity Centres (VCX)

Vicinity Centres is Australia’s second biggest listed manager of retail property, with $22 billion under management. VCX provides an opportunity to benefit from the re-opening theme in Australia. VCX has reached a conditional agreement to acquire a 50 per cent stake in Harbour Town Premium Outlets, Gold Coast for $358 million. Portfolio occupancy remains high at 98.1 per cent.

SELL RECOMMENDATIONS

PolyNovo (PNV)

This medical device company is involved in dermal regeneration solutions, using its patented NovoSorb biodegradable polymer technology. The share price has fallen significantly in calendar year 2021 and, in our view, continues to remain under pressure. The managing director and chief operating officer have resigned in the past three months. Other stocks appeal more at this time.

AMP (AMP)

Flow and growth trends have remained weak through the 2021 third quarter. Australian Wealth Management net cash outflows of $1.4 billion were marginally worse than market expectations of $1.3 billion. AMP Capital posted big net cash outflows of $12 billion. AMP Bank and New Zealand Wealth Management reported minimal positive growth. The worst may be behind AMP, but better growth opportunities exist elsewhere.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.