John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

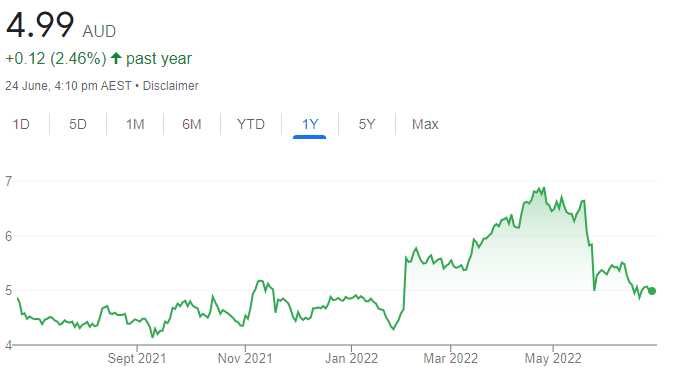

Bubs Australia (BUB)

This infant nutrition and dairy specialist has upgraded fiscal year 2022 guidance. It expects gross revenue to exceed $100 million in the absence of disruption to operations. It expects underlying EBITDA to increase at least 100 per cent on the $1.2 million reported in the first half. We like the outlook, as the company further expands retail distribution of infant formula in the lucrative US market.

Nufarm (NUF)

Nufarm is a global crop protection company. In an environment of rising soft commodity prices, it’s most important that farmers protect their crops. In its recent first half result, the company reported underlying EBITDA of $330 million, up 41 per cent on the prior corresponding period. Statutory net profit after tax of $98.717 million was up 61 per cent. We expect the company to continue growing.

HOLD RECOMMENDATIONS

Dusk Group (DSK)

DSK sells candles and fragrance products from its physical stores and online. The company was impacted by store closures in the first half of fiscal year 2022. It still declared an interim fully franked dividend of 10 cents a share. The share price should recover when interest rates stabilise. In the meantime, investors may want to continue holding for dividend yield.

ResMed (RMD)

This respiratory device maker operates a top business. The company benefited during the pandemic and from competitor Philips announcing a product recall last year. We retain a hold recommendation, as we believe the stock is trading on a lofty price/earnings multiple.

SELL RECOMMENDATIONS

Harvey Norman Holdings (HVN)

Consumers are wary about spending on big ticket discretionary products as a result of higher interest rates and cost of living increases. Those with spare cash are tending to spend on domestic and international travel after long periods of lockdowns. Competition in the discretionary retailer space is fierce.

The Reject Shop (TRS)

The company is assessing whether to conduct an on-market share buy-back. An announcement is expected in July or August. But a buy-back has competing interests, such as preserving capital in this difficult retail environment. Shares in this retail chain have fallen from $5.10 on April 26 to trade at $3.02 on June 23.

Peter Day, Sequoia Wealth Management

BUY RECOMMENDATIONS

Macmahon Holdings (MAH)

Macmahon offers mining services in Australia and South East Asia. MAH client Dacian Gold will suspend operations at the Mt Morgans gold project. We believe positives for MAH could arise from freeing up personnel and equipment to be spread across the remainder of its portfolio. In the medium term, MAH is targeting underground and support services growth, which should result in expanding margins, supported by a strong order book and tender pipeline.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

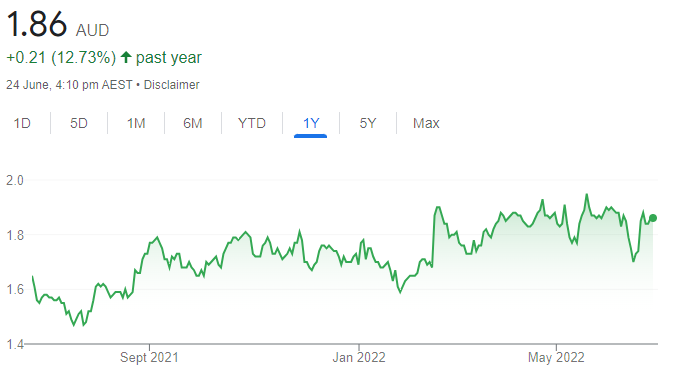

Gentrack Group (GTK)

This software and services business delivers clean technology solutions to energy and water companies around the world. The company was able to navigate its way through the UK energy crisis. In our view, Gentrack is a recovery story that offers appealing value, with net cash and big growth prospects.

HOLD RECOMMENDATIONS

Latitude Group Holdings (LFS)

Latitude is a digital installments and lending business. The proposed sale of the Humm Consumer Finance business to LFS has been mutually terminated. In our view, consumers may reduce discretionary spending in response to higher interest rates. We have moved from an outperform recommendation to neutral.

LaserBond (LBL)

This surface engineering company recently downgraded full year revenue guidance from about $35 million to between $30 million and $31 million, which still represents more than 20 per cent growth over fiscal year 2021. The downgrade was in response to supply chain delays. In our view, the delays are unlikely to have a significant impact. The company may generate deferred sales opportunities.

SELL RECOMMENDATIONS

Dacian Gold (DCN)

We’re bearish about DCN after the gold company suspended open pit operations at the Mt Morgans mine in Western Australia due to rising costs. DCN will suspend operations at its Jupiter open pit by the end of June. The company plans to process about 5 million tonnes of existing stockpiles in the first quarter of fiscal year 2023. Other stocks appeal more for growth.

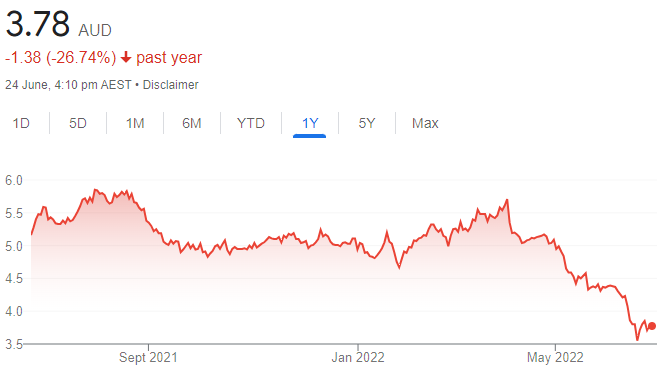

HT&E Limited (HT1)

The media company owns the Australian Radio Network (ARN). On January 4, 2022, ARN announced it had acquired Grant Broadcasters for $307.5 million. The company’s radio network is of significant scale. However, the share price has been trending down from $2.07 on January 4 to close at $1.095 on June 23.

Thomas Wegner, Marcus Today

BUY RECOMMENDATIONS

Computershare (CPU)

This global share registry company expects to benefit from interest rate increases continuing to drive margin income. CPU expects another year of profitable growth in fiscal year 2023. The company also receives a currency tailwind when earnings are converted from US dollars to Australian dollars.

Worley (WOR)

Worley provides project and asset services to the energy, chemicals and resources sectors. Expect increasing capital expenditure in the energy sector during the next few years to leave Worley in a stronger position. Recent guidance suggests a solid finish to this financial year, which offers confidence ahead of the August reporting season.

HOLD RECOMMENDATIONS

NextDC (NXT)

This data centre provider revealed impressive revenue growth and a guidance upgrade in its first half year result. The business is taking advantage of robust demand for data storage. Its sales pipeline remains strong, with positive momentum carried forward into the second half of fiscal year 2022. It’s also on track to bring its third generation data centre campuses into service in the next few months.

Vicinity Centres (VCX)

This retail property group recently upgraded guidance for fiscal year 2022. Sustained strong retail sales amid improvement in negotiating outcomes with retailers are helping performance. The business also showed an increase in preliminary asset valuations.

SELL RECOMMENDATIONS

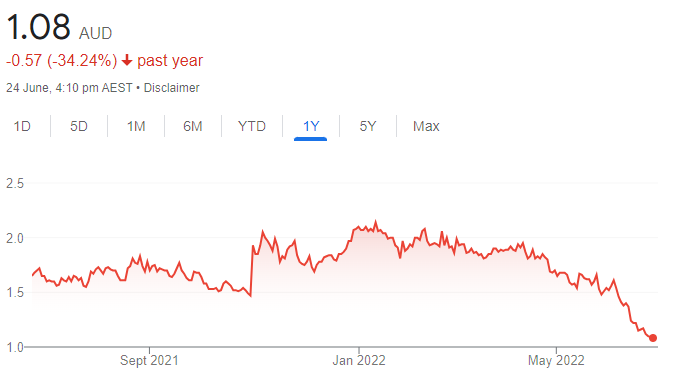

Kogan.com (KGN)

The share price of this online retailer has fallen from $13 on June 28, 2021 to trade at $2.86 on June 23, 2022. The third quarter update showed a decline in gross sales and gross profit on the prior corresponding period. Inventory concerns continue to linger, which, in our view, could put more downward pressure on margins.

Inghams Group (ING)

Labour shortages, higher feed costs, COVID-19 and supply chain issues have been negatively impacting operations in the 2022 second half. The pace of recovery is slower and more variable as a result of external factors. The war in Ukraine is adding pressure to already tight global grain stocks, which is keeping prices at historically high levels. It’s unclear when those pressures will ease for this poultry company.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.