Damien Shaw, Marcus Today

BUY RECOMMENDATIONS

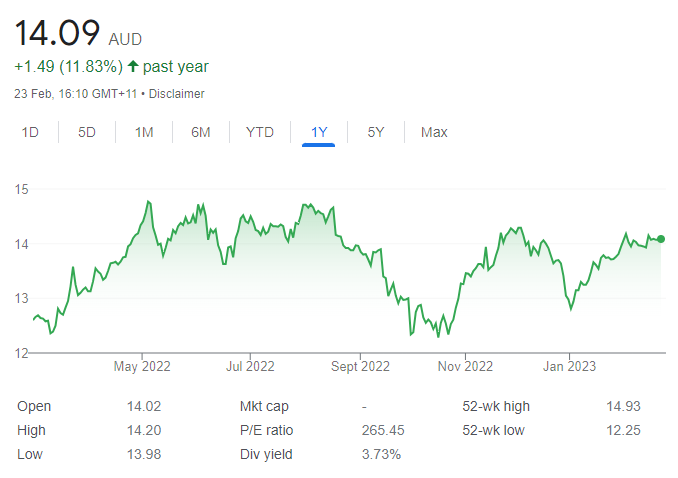

Carsales.com (CAR)

CAR is Australia’s biggest online automotive classified advertising company. First half 2023 results mostly met market expectations. Strong revenue growth across all divisions was assisted by CAR’s dominant market position and investment in technology. Appealing to a huge audience of online automotive buyers and sellers lifts inventory to the detriment of competitors.

Transurban Group (TCL)

TCL owns and operates toll roads in Australia and the US. Its latest financial half-year report revealed record traffic volumes, with average daily traffic exceeding 2.5 million trips. This resulted in record proportional toll revenue of $1.658 billion. Transurban continues to grow and achieve its strategic goals through economic cycles. Consequently, this reflects the quality of its asset portfolio.

HOLD RECOMMENDATIONS

Elders (ELD)

Elders is an Australian agribusiness. While we rate ELD as a hold, the recent share price fall presents an opportunity to buy the stock at a discount. Investor concerns sometimes emerge, as future performance can be determined by unfavourable weather conditions. However, the business has solid foundations and operates in a seasonal industry.

Tabcorp Holdings (TAH)

The gambling and entertainment firm posted group revenue of $1.275 billion in the first half of fiscal year 2023, up 11 per cent on the prior corresponding period. Group EBITDA of $197 million was up 24 per cent. Total revenue market share of 34.8 per cent was up from 31.2 per cent in the 2022 first half. Its wagering and gaming businesses provide TAH with a competitive advantage, in our view.

SELL RECOMMENDATIONS

Magellan Financial Group (MFG)

The fund manger reported first half 2023 statutory net profit after tax (NPAT) of $83.8 million, down 67 per cent on the prior corresponding period. Adjusted NPAT of $98.3 million fell by 60 per cent. Funds performance remains underwhelming. Investors should consider declining earnings as it may reduce growth options.

Corporate Travel Management (CTD)

The company reported a statutory net profit after tax of $15.7 million in the first half of fiscal year 2023. This compares with a $10 million loss in the prior corresponding period due to the pandemic. We expect online business meetings to become a fierce competitor as travel industry costs increase in an inflationary and high interest rate environment.

Elio D’Amato, Stockopedia

BUY RECOMMENDATIONS

Wesfarmers (WES)

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

The industrial conglomerate’s diversified business model is strong, as reflected in its latest half year result. It reported a statutory net profit after tax of $1.384 billion, up 14.1 per cent on the prior corresponding period. Retailers Kmart and Target performed well. The company increased its interim fully franked dividend by 10 per cent to 88 cents a share. It will also address issues with its catch.com.au division. We have a high StockRank rating of 92 out of 100 and regard WES as a premier large market capitalisation business.

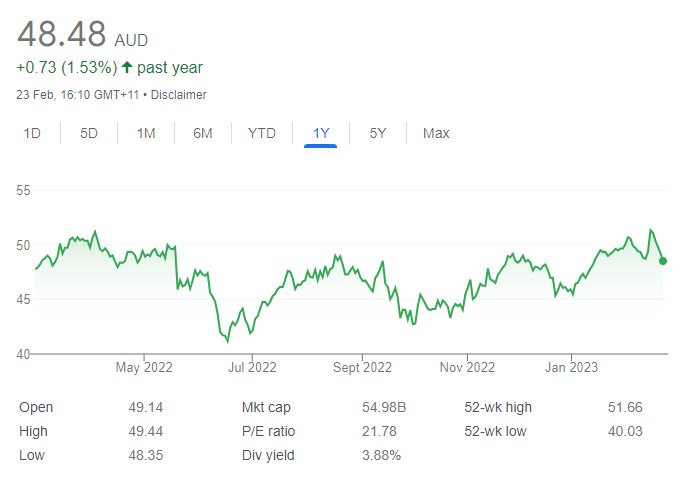

Telstra Group (TLS)

A strategy driven by new management offers a brighter outlook for the telecommunications giant. The first half fiscal year 2023 result delivered revenue growth, improving margins and an increasing dividend. We rate TLS highly for quality and momentum. Appealing fundamentals continue to support a higher share price from here.

HOLD RECOMMENDATIONS

Carsales.com (CAR)

In the first half of fiscal year 2023, this automotive classifieds advertising giant lifted adjusted earnings per share to $34.9 million, up 14 per cent per cent on the prior corresponding period. The interim dividend was up by 12 per cent to 28.5 cents a share. Integration of the Trader Interactive acquisition has gone smoothly. Following its report, we retain a quality rating of 89 per cent.

QBE Insurance Group (QBE)

We retained a hold recommendation on the stock published in TheBull.com.au on December 5, 2022 despite a potential hit to earnings from bad weather pushing up catastrophe costs. We feel vindicated, as QBE delivered a bigger profit, increasing premiums and a higher dividend in fiscal year 2022. The company’s robust outlook statement also appeals. Our momentum rating is 96 per cent.

SELL RECOMMENDATIONS

Whitehaven Coal (WHC)

Sentiment has turned against the coal miner. Factors such as the recent New South Wales coal reserve policy, locally capped sales prices, poor weather and rising costs are all cited as drivers contributing to negative sentiment. We rate WHC as a quality company, but momentum is weakening. The latest breach of technical support at $8 a share offers investors a chance to lock in profits. WHC will be back, but just not now. The shares were trading at $7.31 on February 23.

Domain Holdings Australia (DHG)

This digital real estate listings company reported a net profit of $15.9 million in the first half of fiscal year 2023, down 38.9 per cent on the prior corresponding period. Earnings per share fell 43.5 per cent. The EBITDA margin was thinner at 26.4 per cent. We have downgraded our measures of quality, value and momentum for the stock.

John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

Consolidated Zinc (CZL)

The junior explorer has entered into a binding agreement to sell the Plomosas zinc project to Impact Silver Corp for $US3 million in cash, up to $US3 million in common shares in Impact Silver and a 12 per cent net profit interest royalty. The proceeds will enable CZL to develop its Pilbara Lithium and Wandagee projects, while sharing in the profits if the new owners can turn Plomosas into a success. Investors with an appetite for risk may want to consider buying this junior lithium explorer given it will be cashed up following the transaction.

Sandfire Resources (SFR)

Copper is a dominant revenue stream for SFR. It produced more than 48,000 tonnes of copper in the first half of fiscal year 2023. Copper is a critical element in producing batteries for electric vehicles. We expect continuing strong demand for copper moving forward. The shares have risen from $5.43 on January 3 to trade at $6.415 on February 23.

HOLD RECOMMENDATIONS

Telstra Group (TLS)

The share price of this telecommunications giant has performed well compared to the broader market. Investors are attracted to the company’s dividends. TLS recently raised its fully franked interim dividend to 8.5 cents a share. In our view, upside is limited in the short term, as managing costs in an inflationary environment will be a challenge. Hold for the dividend, but we’re not expecting impressive capital upside.

Nuix (NXL)

NXL provides investigative analytics and intelligence software. The company posted statutory revenue of $87.6 million in the first half of fiscal year 2023, up 4.3 per cent on the prior corresponding period. It reported a statutory net profit after tax of $1.3 million compared to a $2.3 million loss a year ago. On September 29, 2022, the Australian Securities and Investments Commission (ASIC) announced it had begun legal proceedings against Nuix and its board, alleging continuous disclosure breaches and misleading or deceptive conduct. Nuix denied the allegations and intends to defend the proceedings. Keep an eye on the news flow.

SELL RECOMMENDATIONS

Adairs (ADH)

This furniture and homewares company posted group sales of $324.2 million in the first half of fiscal year 2023, up 34.1 per cent on the prior corresponding period. Statutory net profit after tax of $21.8 million was up 23.9 per cent. However, we believe sustaining such a performance will be challenging as higher interest rates impact household budgets.

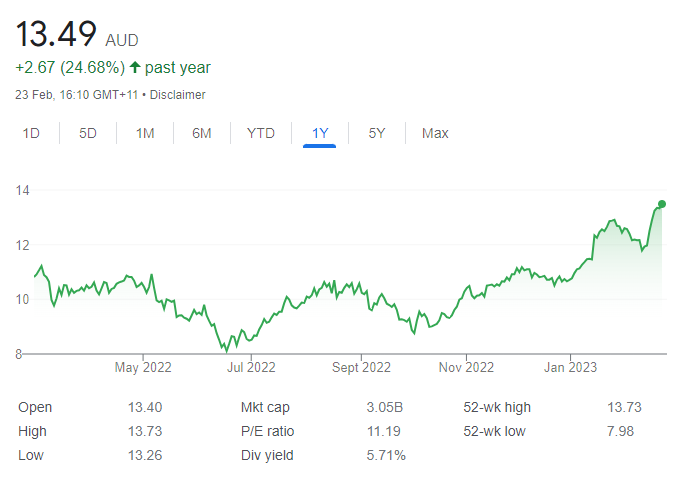

Super Retail Group (SUL)

The retail giant operates a range of high profile brands, including Supercheap Auto, Macpac, Rebel and BCF. First half 2023 group sales were up 15 per cent on the prior corresponding period to $1.96 billion. Statutory net profit after tax of $144 million was up 30 per cent. The shares have risen from $11.79 on February 13 to trade at $13.66 on February 23. Investors may want to consider taking a profit as we expect higher interest rates to impact discretionary spending.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.