Free Knigthsbridge Trading Academy woth $2750 with Axitrader

Simon Herrmann, wise-owl.com

BUY RECOMMENDATIONS

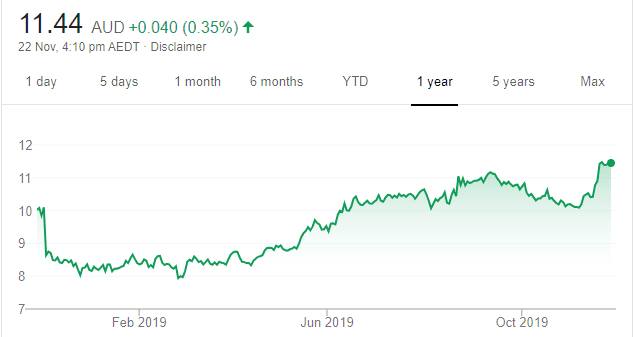

Coca-Cola Amatil (CCL)

Chart: Share price over the year

The beverage maker has delivered single digit revenue and earnings growth in the 2019 first half, while free cash flow generation further enhances the company’s ability to deploy capital strategically. A technical breakout to the upside indicates bullish market sentiment and there’s potential for the stock to reach 2013 highs above $15. We believe the stock is suitable for investors seeking capital growth and income.

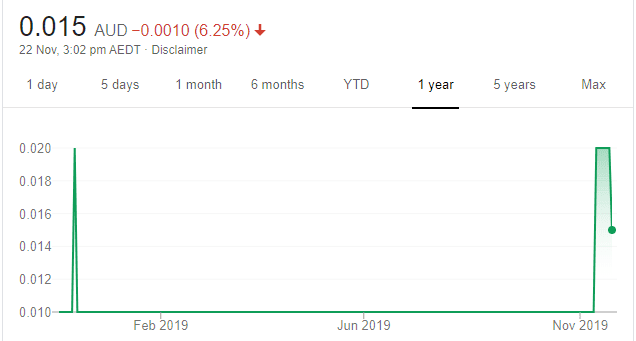

Collaborate Corporation (CL8)

Chart: Share price over the year

Operates in the sharing economy, enabling peer-to-peer renting of assets. Its businesses include DriveMyCar, MyCaravan, Mobilise and Carly. High profile partners are committed to supporting car subscription service Carly. We have increased our medium term guidance to reflect enhanced revenue growth and cost synergies. We see potential for a stock price re-rating if Collaborate can demonstrate the successful execution of its growth strategy. A speculative buy.

HOLD RECOMMENDATIONS

Afterpay Touch Group (APT)

Chart: Share price over the year

Growth and performance continues across all geographies and channels as the Australian technology darling continues to successfully execute its global expansion strategy. While growth is expected to moderate over time, we continue to see value in retaining exposure to APT. It’s difficult to justify buying this buy now, pay later platform provider at the current valuation.

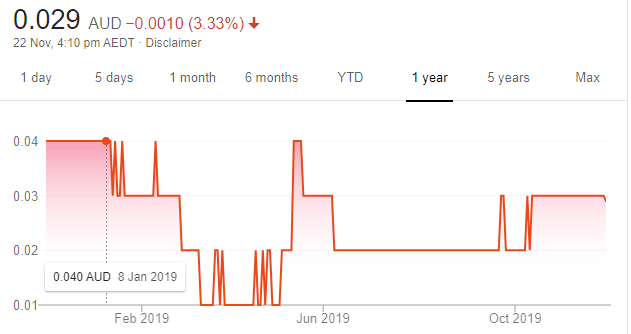

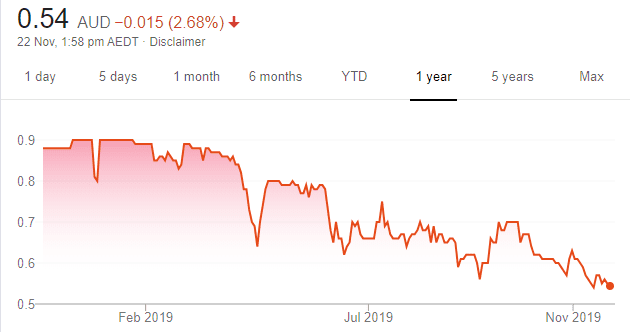

Crowd Media Holdings (CM8)

Chart: Share price over the year

The media and marketing company appears poised to deliver a turnaround as cost cutting initiatives and a strategic alliance with German based industry experts could breathe new life into the company. The primary catalyst is CM8’s undemanding valuation, as we believe the business is effectively priced for failure. Delivery of the proposed new business plan and further strategic partnerships could trigger a re-rating of the stock. The shares were trading at 3.1 cents on November 21.

SELL RECOMMENDATIONS

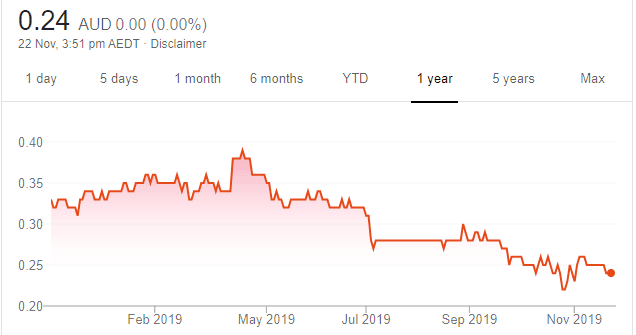

Universal Coal PLC (UNV)

Chart: Share price over the year

The share price has declined this year despite sales and earnings growth. There’s potential for a corporate play, but regulatory headwinds and muted investor sentiment towards the sector presents UNV with challenges going forward. The shares were trading at 24 cents on November 21.

ClearView Wealth (CVW)

Chart: Share price over the year

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

An Australian financial services company focusing on life insurance and wealth management. A challenging operating environment and underperformance due to poor claims delivered a disappointing result for fiscal year 2019. Our research suggests the outlook for the sector is likely to remain subdued and we believe better opportunities elsewhere.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

Sezzle Inc (SZL)

Chart: Share price over the year

The third quarter update from this buy now, pay later company was positive. Underlying merchant sales of $US68.8 million represented a rise of 64 per cent on the June quarter. Active customer numbers continue to climb, with SZL reaching about 645,000 as at September 30, 2019, a 50 per cent increase on the June quarter. As a listed company, Sezzle has started well. We will examine if momentum is continuing to build the business in the December quarter.

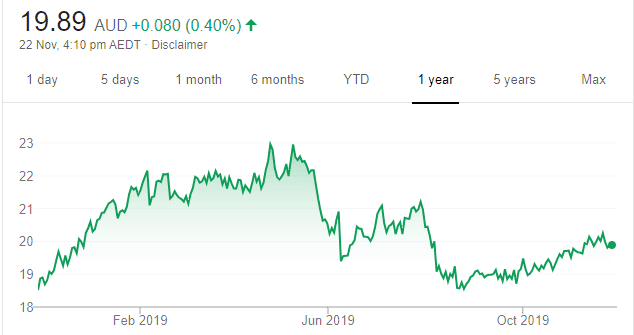

Nine Entertainment Co. Holdings (NEC)

Chart: Share price over the year

We believe management has successfully diversified its revenue base away from its traditional broadcast TV business into new growth areas, with significant potential upside. Streaming company Stan has turned profitable in the latest half year results and real estate website Domain is emerging from the worst listings environment in 20 years. NEC has also acquired the remainder of Macquarie Media. Consequently, we expect revenue and cost upside on top of cross-selling opportunities from Nine’s full suite of media assets.

HOLD RECOMMENDATIONS

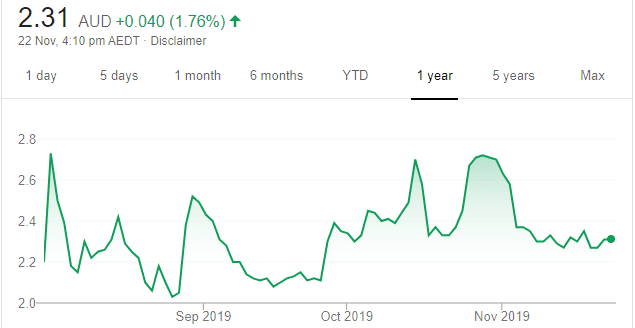

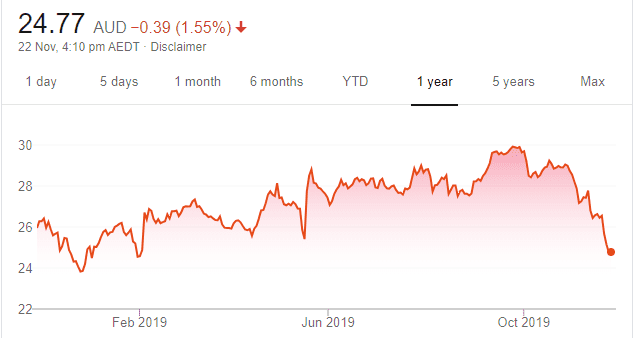

AGL Energy (AGL)

Chart: Share price over the year

We expect AGL’s margins and free cash flow generation to decline over the short term, driven by lower wholesale electricity costs as more renewable capacity comes online. The positives are increasing electricity retail market share and potential for capital returns. The stock price is trading in line with our net present value estimate.

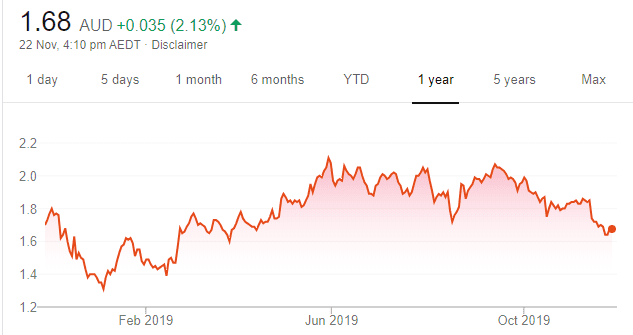

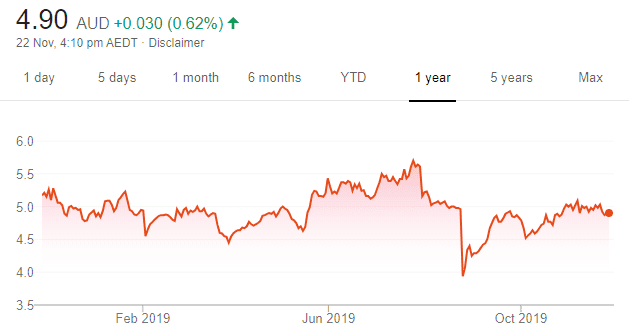

Boral (BLD)

Chart: Share price over the year

We retain a hold recommendation and refrain from a more negative rating, as market sentiment towards the stock already appears week. In our view, the outlook for concrete demand in Australia is underwhelming. But we do acknowledge takeover speculation for this building products maker. The shares were trading at $4.90 on November 22.

SELL RECOMMENDATIONS

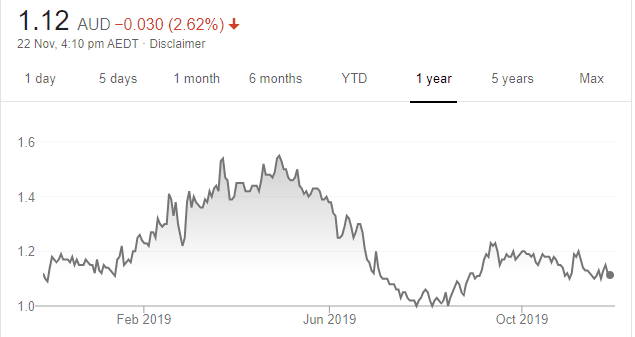

Japara Healthcare (JHC)

Chart: Share price over the year

Following the interim report from the Royal Commission into Aged Care Quality and Safety, we see fewer near term tailwinds for the sector. The report was more critical than expected. JHC posted a 29.6 per cent fall in net profit after tax to $16.4 million for the year to June 30, 2019. The group’s operating and financial leverage should work in its favour if funding improves, although we believe the near term outlook is bleak.

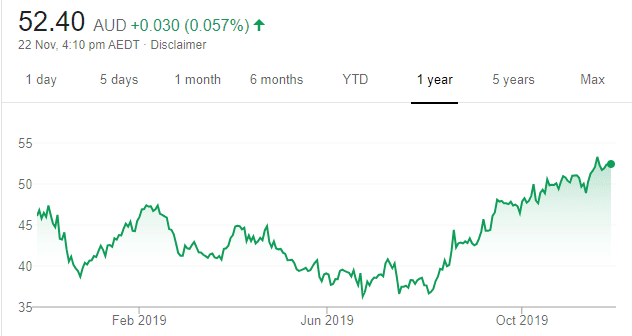

Domino’s Pizza Enterprises (DMP)

Chart: Share price over the year

The core Australian and New Zealand business is mature, in our view. Competition from burgers and chicken is making pizza gains more difficult given DMP’s already significant market share. We believe franchisee profitability is expected to require continuing support, moderating margin expansion. Earnings growth continues to moderate, with the prospect that store growth will be driven at the expense of margins, which, in our view, drives downside earnings risk and reduces valuation support.

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

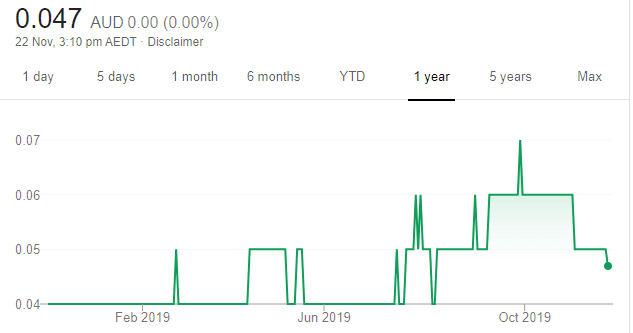

Minotaur Exploration (MEP)

Chart: Share price over the year

MEP has a joint venture with Oz Minerals involving the Jericho copper discovery in Queensland. A resource estimate is likely in the short to medium term. MEP also has a joint venture with Andromeda Metals for the production of kaolin and halloysite, where it will earn 25 per cent of free cash flow. A number of highly prospective targets will also be drilled in search of precious and base metals. A recent placement at 5 cents provides a buying opportunity on weakness for those willing to take risk. The shares were trading at 4.8 cents on November 21.

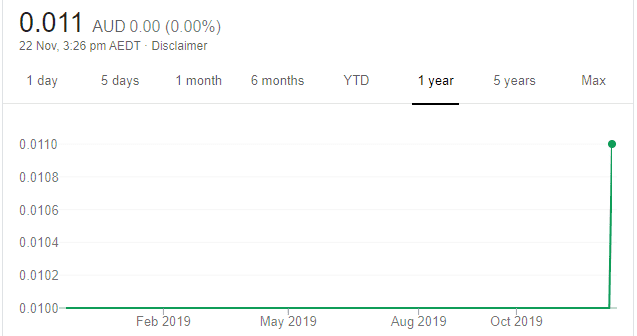

Metal Bank (MBK)

Chart: Share price over the year

MBK has announced that a large gold system is emerging at the 8 Mile project in Queensland, with a strike length of more than 3 kilometres. MBK’s other projects in Queensland offer considerable exploration potential, and could be the subject of a joint venture or sale, which would provide additional funding for an extensive drilling campaign at the 8 Mile project. The share price has fallen back after a rally to 1.5 cents. Trading at 1.1 cents on November 21, the stock offers speculative value for those with an appetite for risk.

HOLD RECOMMENDATIONS

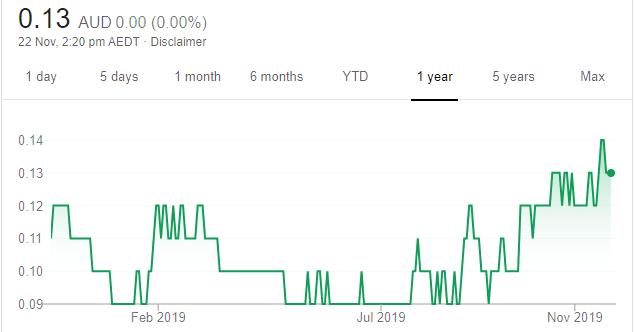

Proteomics International Laboratories (PIQ)

Chart: Share price over the year

Alto Capital was lead manager in raising $3 million for PIQ at 28 cents a share. PIQ has announced it secured CE Mark registration for ProMarkerD as an in-vitro diagnostic medical device. ProMarkerD is a test for predicting the onset of diabetic kidney disease. The company says CE marking is a significant step to licence and sell ProMarkerD throughout the European Union. The price may be volatile due to new shares on the market. But the company provides leverage to further news on ProMarkerD and new licence agreements. The shares were trading at 33 cents on November 21.

Red Metal (RDM)

Chart: Share price over the year

RDM is drilling three 800 metre concept holes at the Nullarbor project in Western Australia to test the potential to host copper mineralisation. Red Metal has $8 million in financial backing from Oz Minerals for two years. RDM’s market valuation is supported by lead and silver resources in Queensland, which require further deep drilling to potentially define a much larger resource.

SELL RECOMMENDATIONS

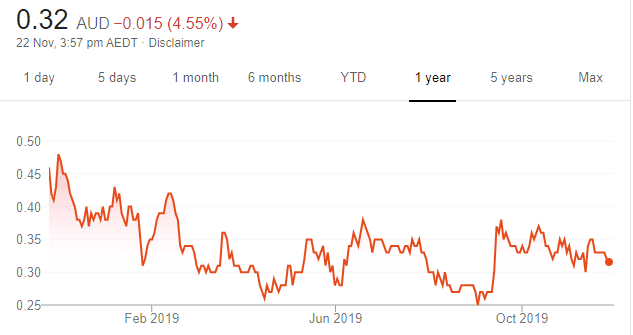

Genworth Mortgage Insurance Australia (GMA)

Chart: Share price over the year

Third quarter reported net profit after tax for financial year 2019 rose 28.1 per cent on the prior corresponding period to $25.1 million. The share price has risen from a 52 week low of $1.806 on December 21 last year to trade at $3.645 on November 21 this year. In our view, the near term recovery in the housing market provides a selling opportunity as the Australian economy continues to weaken and economic headwinds loom large.

Westpac Bank (WBC)

Chart: Share price over the year

The bank stands accused of failing to comply with the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act). Australia’s financial intelligence unit AUSTRAC alleges Westpac contravened the AML/CTF Act on more than 23 million occasions. AUSTRAC has applied to the Federal Court of Australia for civil penalty orders against Westpac. Last year, the Commonwealth Bank agreed to pay a $700 million fine to settle a similar action after AUSTRAC alleged the bank had breached AML/CTF laws on more than 53,000 occasions.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing.

Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.