Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

ALS Limited (ALQ)

This Australian laboratory testing giant posted a strong full year result. Underlying net profit after tax of $264.2 million was up 42.1 per cent on the prior corresponding period and at the top end of guidance. Sample volumes are improving year-on-year, while inflationary pressures are passed onto customers via price rises. Also, we remain optimistic about long-term demand for commodities. We upgrade to an add rating, with a $14.14 price target.

PWR Holdings (PWH)

The company makes quality cooling solutions for the automotive industry. With limited competition, customers are more focused on performance rather than price. The company’s results demonstrated competitive edge and dominant market positions. PWH has been successful at offsetting margin pressure. We have an add rating and a $10.05 price target.

HOLD RECOMMENDATIONS

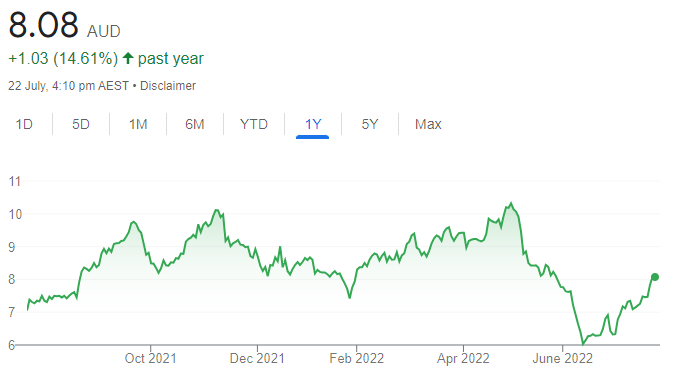

ANZ Bank (ANZ)

ANZ is looking to bulk up its retail banking division with the proposed purchase of Suncorp Group’s banking arm. ANZ plans to raise about $3.5 billion in capital to help fund this acquisition. Addressing the issue of loan growth is a key driver for a favourable outcome. Our price target is $30.

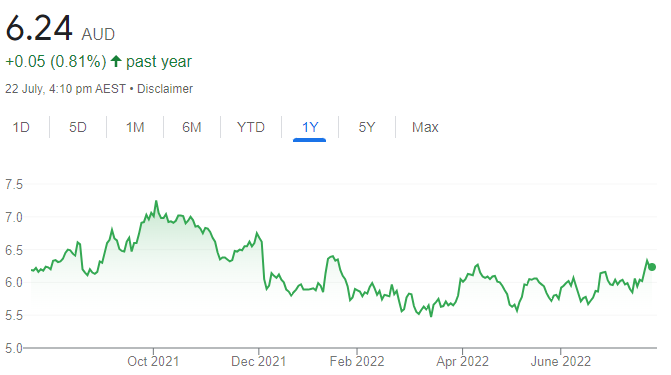

TPG Telecom (TPG)

The return of international travellers is generating more mobile customers. We believe positive momentum is sustainable, as we’re not expecting price increases in the short term. The shares have risen from $5.67 on June 17 to trade at $6.30 on July 21.

SELL RECOMMENDATIONS

Fortescue Metals Group (FMG)

The iron ore producer plans to be carbon neutral by 2030. In our view, it will take substantial capital expenditure to meet the 2030 deadline. The shares are trading close to our fair value target price. We hold a trim rating.

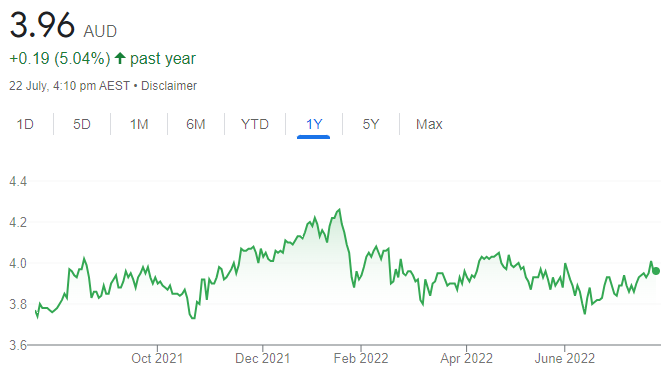

Accent Group (AX1)

The retailer owns Athlete’s Foot, Platypus and Timberland. Retailers are up against inflationary pressures, higher interest rates and deteriorating consumer sentiment, which may weigh on earnings. Recent subdued sales fell short of expectations for AX1 management. We hold a trim rating at this point in the cycle.

Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

Telstra Corporation (TLS)

In uncertain times, the market values defensive stocks due to reliable earnings. TLS is a key defensive stock, recently trading on an attractive dividend yield of around 4 per cent. According to our analysis, the growth rate is between 4 per cent and 5 per cent. The company’s T25 strategy appears to be progressing well. We should see more international roaming in fiscal year 2023. In our view, Telstra offers good value.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Sonic Healthcare (SHL)

The healthcare provider has operations in Australasia, Europe and North America. The company offers a strong balance sheet and defensive core earnings. A strong balance sheet enables acquisition opportunities. We believe a buying opportunity exists, as the shares have fallen $37.12 on May 30 to trade at $34.35 on July 21.

HOLD RECOMMENDATIONS

BHP Group (BHP)

The share price has fallen significantly in response to a slowdown in China, fears of a steel surplus and weaker iron ore and copper prices. The company was recently trading on an undemanding price/earnings multiple and a dividend yield above 10 per cent. The stock appears cheap, but China’s momentum is important to the company’s outlook.

Cleanaway Waste Management (CWY)

The waste management company has downgraded earnings due to floods and higher fuel and labour costs. However, these appear to be temporary issues that we expect will be resolved within a year. We expect the share price to recover.

SELL RECOMMENDATIONS

Challenger (CGF)

Challenger operates a funds management division and provides annuities. An ageing population is a good tail wind. Our main concern is bond yields may have peaked. If so, the company’s recent valuation may be discounting downside risks, in our opinion. Challenger is close to our fair value, so investors may want to consider other alternatives.

Computershare (CPU)

The share price has risen from $22.77 on May 25 to trade at $26.01 on July 21. Rising bond yields have contributed to the company’s rapid price rise, in our view. Given our concerns about potentially peaking bond yields, investors in this share registry company may want to consider cashing in some gains.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

ARB Corporation (ARB)

ARB is a 4-wheel drive accessories company. We expect continuing growth in 4-wheel drive markets in the medium term. We expect the ARB store network to grow in Australia. Company products should also expand in overseas markets. The shares have risen from $25.80 on June 17 to close at $33.26 on July 21.

National Storage REIT (NSR)

The big self-storage provider recently posted a strong market update for fiscal year 2022. Net tangible assets are expected to increase to $2.34 a share, a 13 per cent increase on December 31, 2021. It upgraded underlying earnings guidance to a minimum of 10.5 cents a share. The update, on the back of a strong operating performance, positions it well for growth in the new financial year.

HOLD RECOMMENDATIONS

Platinum Asset Management (PTM)

PTM is an Australian-based investment manger. A recent update revealed funds under management had fallen to $18.2 billion at the end of June 2022 after distributions were taken into account. However, overall performance has improved, in our view.

Austal (ASB)

The global shipbuilder has won a contract to build 11 offshore patrol cutters for the US Coast Guard. The contract has a potential value of $US3.3 billion. The contract will go a long way to re-filling the company’s longer term pipeline of work. The announcement is a clear positive for sentiment.

SELL RECOMMENDATIONS

Bega Cheese (BGA)

The company is forecasting fiscal year 2023 normalised EBITDA of between $160 million and $190 million, which is below fiscal year 2022 guidance of between $175 million and $190 million, which remains intact. In light of persistent cost pressures, we have materially reduced our earnings forecasts.

Challenger (CGF)

Fiscal year 2022 earnings guidance remains at the upper range of between $430 million and $480 million. In our view, Challenger is a high-beta stock, operating in a volatile economic environment. Other stocks appeal more for dividend yield when compared to this investment manger.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.