Nathan Lodge, Securities Vault

BUY RECOMMENDATIONS

BUY – Foresta Group Holdings (FGH)

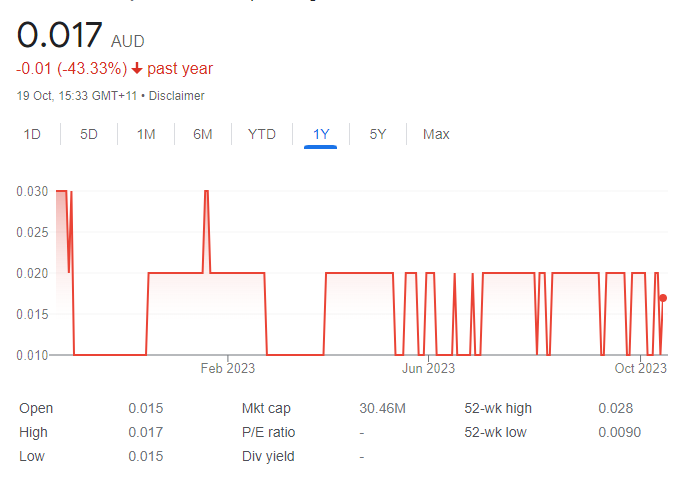

FGH was formerly known as Leaf Resources (ASX: LER). The company is aiming to become a global supplier of natural and renewable pine chemicals and biomass pellets. In the quarter ending September 30, FGH signed a term sheet with Tailored Energy Resources in relation to a proposed offtake agreement for the supply of up to 400,000 tonnes a year of torrefied wood pellets. FGH is speculative, but offers potential. The shares were trading at 1.7 cents on October 19.

BUY – Pacgold (PGO)

PGO owns the Alice River gold project in North Queensland. The company recently announced a four-kilometre extension of the Alice River fault zone defined in the latest IP geophysics, which underpins district growth potential. The prospective fault zone may extend beyond 30 kilometres. The shares have risen from 18 cents on October 3 to trade at 22.5 cents on October 19.

HOLD RECOMMENDATIONS

HOLD – Tennant Minerals (TMS)

TMS is an exploration and development company. It’s copper and gold projects are in the Tennant Creek area of the Northern Territory. A new drilling program aims to triple the strike-extent at the Bluebird high grade copper-gold discovery. Investors can consider holding for further updates on progress of the projects. We like the outlook for copper.

HOLD – Azure Minerals (AZS)

The company is accelerating exploration and development of high grade lithium and nickel assets at the Andover project. The company recently released encouraging metallurgical test results. Management is skilled and experienced at developing projects into longer term operations. AZS has been a strong performer on the ASX in 2023.

SELL RECOMMENDATIONS

SELL – Ballymore Resources (BMR)

BMR is an exploration and development company based in Queensland. It has a portfolio of gold, silver, copper and zinc targets within or adjacent to historic workings. The company recently announced encouraging high grade gold results from soil sampling over the Dittmer prospect. The shares have risen from 8.5 cents on September 29 to trade at 12 cents on October 19. Investors may want to consider cashing in some gains by reducing holdings.

SELL – ENRG Elements (EEL)

The company continues to update the market on its uranium and lithium projects located in the Agadez region following an uprising in the Republic of Niger. In September, the company informed that operations hadn’t ceased, but activities had been adjusted to adapt to the changing environment. The company remains committed to the Republic of Niger. Given the political situation, we prefer other stocks.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

BUY – Dubber Corporation (DUB)

According to management, this cloud-based call recording software company is on track to achieve breakeven cash flow within existing cash reserves during fiscal year 2025. DUB has just launched a new artificial intelligence product enabling users to monitor calls in a far more efficient and effective manner. We believe sales will exceed investor expectations.

BUY – ResMed Inc (RMD)

ResMed makes medical devices to treat sleep disordered breathing. RMD has been oversold on investor concerns that diabetes and obesity medicines will impact future sales of the company’s sleep apnoea products. We believe these concerns are overblown. The cheaper share price provides an opportunity to invest in a blue chip company that offers long term growth prospects.

HOLD RECOMMENDATIONS

HOLD – Bravura Solutions (BVS)

The company provides software solutions to the wealth management, life insurance and funds administration industries. New management is implementing a $40 million annualised savings program, which should result in positive cash EBITDA by the end of fiscal year 2024. We believe it’s worth holding to see if management can meet or exceed expectations.

HOLD – Redbubble (RBL)

Shares in this e-commerce company have risen from 42 cents on September 22 to trade at 59.5 cents on October 19. The share price rally was a response to the company returning to positive underlying cash flow in the last quarter following a loss in the prior corresponding period. The turnaround could be the start of a recovery, so it’s worth holding to see if it continues.

SELL RECOMMENDATIONS

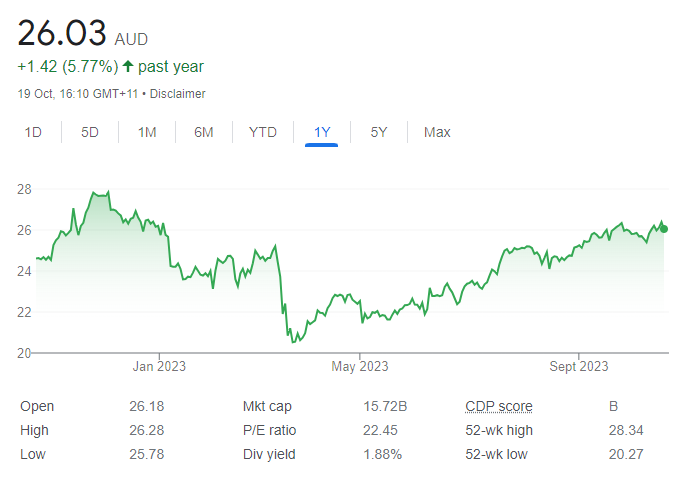

SELL – Computershare (CPU)

This share registry and corporate services giant posted management revenue of $3.3 billion in fiscal year 2023, an increase of 27.2 per cent on the prior corresponding period. Management earnings per share were up 89.3 per cent. The shares have risen from $20.55 on March 21 to trade at $25.86 on October 19. Investors may want to consider cashing in some gains.

SELL – Helloworld Travel (HLO)

The share price of this travel agent has risen from $1.32 on January 3 to trade at $2.66 on October 19. Investors may want to consider taking a profit as pent-up demand for travel eases after COVID-19. Consumers may tighten their travel budgets as they deal with soaring cost of living expenses and higher interest rates.

Philippe Bui, Medallion Financial Group

BUY RECOMMENDATIONS

BUY – Pilbara Minerals (PLS)

The lithium company had $3.3 billion of cash on its balance sheet when announcing its full year results. PLS is trading on an undemanding price/earnings ratio. The company aims to produce a million tonnes by the end of 2025, a significant increase on existing production. The company paid a fully franked full year dividend of 25 cents a share in fiscal year 2023. Provided lithium prices settle in what has been a recent downturn, PLS should be able to deliver.

BUY – ResMed Inc (RMD)

The share price of this medical device maker has fallen significantly since early August. On top of a wider sector sell off, RMD has come under further pressure due to investor concerns about the longer term impact on the ResMed business from new age weight loss drugs. Margins were slightly softer than expected in the company’s last quarterly results. From a long term perspective, we see the recent pullback as an attractive entry point.

HOLD RECOMMENDATIONS

HOLD – XRF Scientific (XRF)

XRF makes equipment and chemicals used in preparing samples for analysis for the mining industry. It delivered a strong fiscal year 2023 result. The company reported sales revenue of $55.2 million, up 38 per cent on the prior corresponding period. Net profit after tax grew 26 per cent to $7.7 million.

Management has indicated that orders for capital equipment products are at record levels. The company has a strong balance sheet and should be able to capitalise on opportunities as they arise.

HOLD – PolyNovo (PNV)

PNV is a dermal regeneration solutions company. The shares have fallen from $1.695 on August 16 to trade at $1.185 on October 19. The consensus share price target is well above $2. In fiscal year 2023, the company delivered strong revenue growth. With a good amount of cash on its balance sheet, the share price could recover quickly if the company can continue to develop and deliver in new and existing markets.

SELL RECOMMENDATIONS

SELL – Magellan Financial Group (MFG)

Fund outflows have continued at an aggressive rate. Total funds under management at September 29, 2023 was $35 billion, which is significantly less than two years ago. In our view, MFG may be subjected to further pressure if the company’s Magellan Global Fund is converted from a closed end fund into an open-ended exchange traded fund after engaging with activist investor Nick Bolton. MFG shares have fallen from $10.42 on August 18 to trade at $6.59 on October 19.

SELL – Woolworths Group (WOW)

We’re concerned about lower operating margins and continuing competition pressures. The supermarket group faces rising wages and possible margin compression in the discretionary retail part of the business in fiscal year 2024. Despite the company’s defensive qualities, there’s many more appealing businesses at lower valuations and higher dividend yields, in our view.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.