Tom Bleakley, BW Equities

BUY RECOMMENDATIONS

Family Zone Cyber Safety (FZO)

This cyber safety software developer has recently acquired UK based competitor Smoothwall. The acquisition provides complementary products to Family Zone, including a market leading offering in school monitoring. There’s a good opportunity to cross sell products, which would enable the combined business to increase gross profit per student during the next four years.

Praemium (PPS)

PPS provides an investment platform to enable financial advisers to manage client accounts. During the past year, the company has generated strong platform inflows of $3.8 billion. Platform funds under administration rose 163 per cent to $23.4 billion. PPS has market leading technology that’s utilised by top industry advisers. The share price has enjoyed a strong 12 months. In our view, the company is attractive to possible suitors.

HOLD RECOMMENDATIONS

Macquarie Group (MQG)

Shares in this diversified financial services company have risen from $140 on January 4 to close at $164.98 on August 19. The company has established a long track record of performance. The business remains strong and attractive to investors. But, in our view, near term growth is already priced into the share price.

Goodman Group (GMG)

GMG develops and manages a global portfolio of industrial property assets. Goodman is leveraged to online retailers through industrial warehouses, and enjoys high occupancy levels. The shares have risen from $17.26 on March 19 to finish at $22.53 on August 19. In our view, Goodman is another strong business trading at lofty valuations.

SELL RECOMMENDATIONS

Breville Group (BRG)

BRG recently reported a strong 2021 fiscal year result. Revenue of $1.187 billion rose 24.7 per cent on last year’s prior corresponding period. Lockdowns contributed to people buying more kitchenware. In our view, repeating 2021 growth rates in fiscal year 2022 will be difficult as economies continue to re-open. In our opinion, the stock appears expensive trading on a trailing price/earnings multiple of about 45 times.

Orocobre (ORE)

Orocobre and Galaxy Resources have merged recently to create the world’s fifth biggest lithium producer. Lithium stocks have traded up strongly in recent months, as investors factor in growing lithium demand for its use in re-chargeable batteries. However, we believe ORE is trading ahead of fair value at this point.

Elio D’Amato, Spotee.com.au

BUY RECOMMENDATIONS

Agrimin (AMN)

The company is developing a big and low cost sulphate of potash (SOP) project in Western Australia. A definitive feasibility study calculates a net present value (NPV) of about $1 billion. The NPV is based on ore reserves of 40 years and 20 million tonnes of SOP. Unlike many other SOP producers, AMN’s current ore reserve is based solely on shallow brine resources. AMN has signed a binding off-take agreement of 150,000 tonnes a year and is actively seeking further agreements.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

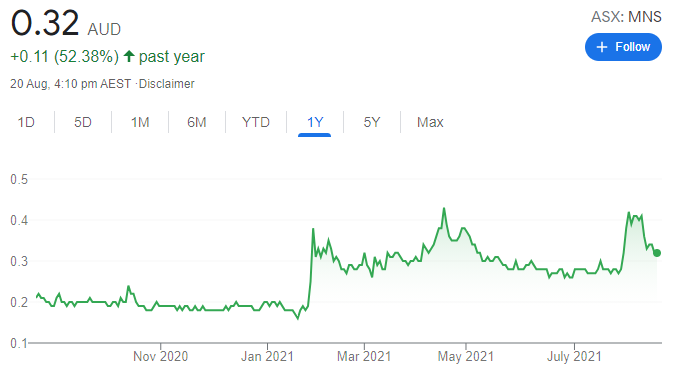

Magnis Energy Technologies (MNS)

The global pursuit of cleaner energy sources has lifted demand expectations for lithium-ion batteries. MNS recently announced it had secured another $US74 million contract from the US Government. The company is building a factory in New York, which is on time and under budget. MNS is receiving the appropriate approvals. Also, the company recently secured $20 million in funding from US institutions, which sparked further interest.

HOLD RECOMMENDATIONS

Pinnacle Investment Management Group (PNI)

PNI delivered a strong full year result, with earnings per share growing by more than 100 per cent. The company declared a fully franked final dividend of 17 cents a share. While the company provided no formal outlook guidance, it expressed confidence in the quality of its managers amid the potential for further business from its institutional book of clients. Although PNI has enjoyed a strong run, it’s still worth holding as an emerging Australian investment house story.

Life360 Inc. (360)

The share price of this US based online family platform has enjoyed a strong run. The shares have risen from $6.68 on June 30 to finish at $8.01 on August 19. The company recently surpassed $100 million in recurring revenue. The number of users and average revenue per user continues to grow. The acquisition of Jiobit, a provider of wearable location devices, appears to be a good fit.

SELL RECOMMENDATIONS

Transurban Group (TCL)

Lockdowns are having an impact on this toll road operator. The company is losing millions of dollars in revenue each week from lockdowns in Sydney and Melbourne. The New South Wales Government’s decision to close the construction industry in the second half of July led to an estimated revenue fall of between $16 million and $18 million a week. The cost blowout on Melbourne’s West Gate Tunnel project is estimated at $3.3 billion.

WiseTech Global (WTC)

This great Australian success story develops and provides software solutions to the global logistics industry. Despite COVID-19, the company has been gaining traction via a quality operating system and the 40 acquisitions it has made since listing in 2016. But the stock was recently trading on a forecast price to cash flow ratio of more than 50 times. It may be prudent to consider locking in some gains.

Thomas Wegner, Marcus Today

BUY RECOMMENDATIONS

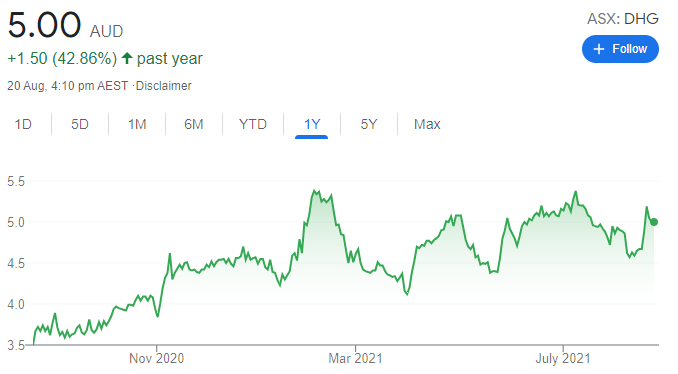

Domain Holdings Australia (DHG)

Full year 2021 net profit for this digital property group was up 66 per cent on the prior year to $37.9 million amid revenue climbing 9.7 per cent to $289.6 million. We believe the better-than-expected result, coupled with strong property market dynamics, positions DHG for a bright outlook in the medium term.

BHP Group (BHP)

The global mining giant reported a full year 2021 underlying profit of $US17.1 billion, up 88 per cent on the prior year. It declared a final record dividend of $US2 a share. We believe the decision to end its dual listing structure, merge its oil and gas assets with Woodside Petroleum (WPL) and pursue global mega trends in de-carbonisation and food security will add value to the share price.

HOLD RECOMMENDATIONS

Breville Group (BRG)

The kitchenware company posted a 2021 full year net profit after tax of $91 million, up 42.3 per cent on the prior corresponding period and ahead of consensus. Revenue also beat market estimates at $1.187 billion. This was a response to more people working from home and successful geographic expansion balancing out the impact of supply chain pressures.

QBE Insurance Group (QBE)

The insurance giant posted a first half statutory net profit after tax of $441 million compared with a net loss after tax of $712 million in the prior period. The rebound in profit reflects a material turnaround in underwriting and investment returns. We believe these tailwinds will continue to benefit the share price. However, heightened catastrophe claims remain a concern.

SELL RECOMMENDATIONS

AGL Energy (AGL)

Full year underlying 2021 net profit after tax was down 33.5 per cent to $537 million. Revenue missed consensus forecasts at $10.94 billion. We expect falling wholesale electricity prices to weigh on the share price in the medium term.

AMP (AMP)

First half 2021 revenue from continuing operations fell 5 per cent to $1.71 billion. Net profit of $146 million fell 28 per cent on the prior corresponding period. No interim dividend was declared as the board continues to maintain a conservative approach to capital management to support the transformation of the business. Better investment opportunities exist elsewhere, in our view.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.