Jed Richards, Shaw and Partners

BUY RECOMMENDATIONS

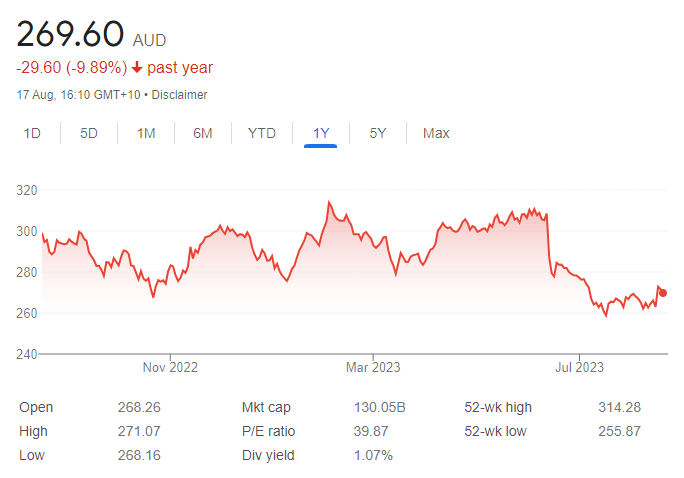

BUY – CSL (CSL)

The biotechnology giant was sold off aggressively in June following a trading update that missed positive market expectations. Investors appear too narrowly focused on CSL’s legacy businesses at the expense of the newer growth opportunities that are showing potential. I see the company as oversold, with potential bad news already priced into the stock. CSL remains a market leader in its field.

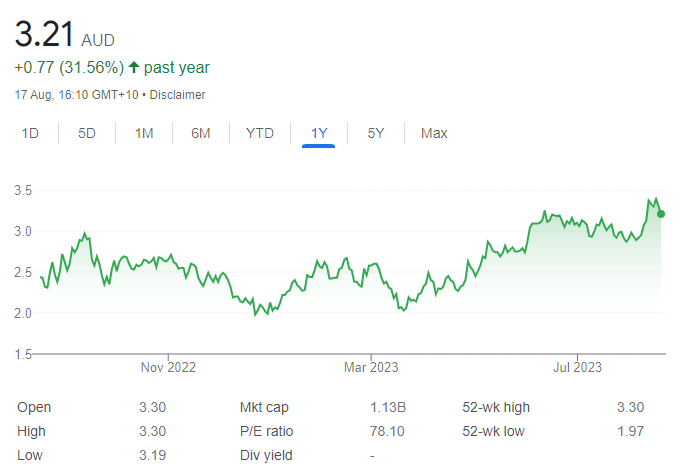

BUY – Pilbara Minerals (PLS)

Demand for lithium is set to grow as decarbonisation efforts gather pace. Analysts don’t see an alternative to the lithium-ion battery in decarbonising the global auto fleet. PLS is our preferred lithium company, as it has a good operation in a stable jurisdiction. The company lifted production and sales in the 2023 June quarter compared to the prior quarter. It pays a dividend from its healthy cash position.

HOLD RECOMMENDATIONS

HOLD – Westpac Banking Corporation (WBC)

The major Australian banks are among the highest quality in the world when it comes to the strength of their balance sheets. I expect WBC share price growth to be limited from current levels, but the dividend yield remains attractive, which supports our recommendation.

HOLD – BHP Group (BHP)

BHP is a diversified mining company in terms of commodities and geographical locations. An experienced and professional management team operate a high quality business. Commodity prices have been weaker this year on the back of slower global growth and recession fears. However, we expect prices to rise again over the next few months, particularly if China reignites its economy with stimulus.

SELL RECOMMENDATIONS

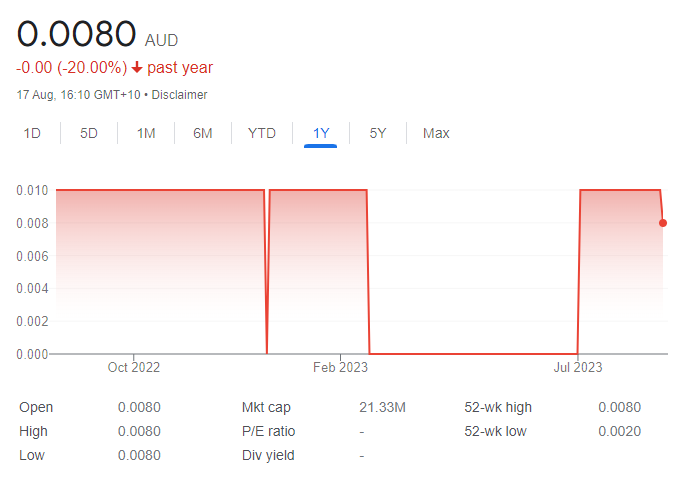

SELL – Alumina (AWC)

Alumina holds a 40 per cent share in Alcoa World Alumina and Chemicals (AWAC). In our view, Alumina has under performed for several years, a disappointing result considering the strength in resources over this period. The Western Australian Environmental Protection Authority opened a public comment period on whether to conduct an environmental impact assessment into parts of Alcoa’s existing and rolling five-year plans for its mines in WA. There is no set time for EPA determination.

SELL – Seven West Media (SWM)

The media giant reported earnings before interest and tax of $238 million in fiscal year 2023, a fall of 23 per cent on the prior corresponding period. Underlying net profit after tax, excluding significant items, of $146 million was down 27 per cent on the previous year. Group revenue, including share of associates, of $1.488 billion fell 3 per cent. The advertising market is moving to a wider array of media platforms, and I see better opportunities elsewhere in the market.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Braden Gardiner, Tradethestructure

BUY RECOMMENDATIONS

BUY – Macmahon Holdings (MAH)

Macmahon provides mining and engineering services. In a June market update, the company was expecting revenue of about $1.9 billion in fiscal year 2023. During fiscal year 2023, the company has added projects to its order book, building a strong foundation for the future. The shares were trading at 15.2 cents on August 17. From a technical perspective, I expect a support level at 12.5 cents to hold, leading to a new bullish trend from here.

BUY – Carnavale Resources (CAV)

This mineral explorer is focusing on strategic minerals for the electric vehicle battery sector. A recent share placement raising $2.7 million and encouraging drilling results at the Kookynie gold project have triggered buyer support. I believe the technical pattern indicates the start of a new uptrend.

HOLD RECOMMENDATIONS

HOLD – Boss Energy (BOE)

Federal Opposition calls to include nuclear power in Australia’s energy mix have stirred optimism in Australia’s uranium industry. BOE is a uranium mine developer focused on re-opening its Honeymoon uranium project. First production is targeted for the fourth quarter of fiscal year 2023. We expect the recent share price rally to continue.

HOLD – Temple & Webster Group (TPW)

Revenue from ordinary activities of $396 million in fiscal year 2023 was down 7.2 per cent on the prior corresponding period for this online furniture and homewares retailer. The group returned to year-on-year revenue growth in the fourth quarter of fiscal year 2023. The company has outperformed its peers in recent months on expectations it can grow revenue despite a likely reduction in consumer spending. Although the technical uptrend remains intact, investors may want to consider trimming their portfolios.

SELL RECOMMENDATIONS

SELL – Emerald Resources NL (EMR)

Emerald Resources is an explorer and developer of gold projects. The company’s key gold producing asset is based in Cambodia. In my view, weakness in the gold spot price will continue over the longer term and pressure the company’s share price. I believe the shares are trading at a premium, so investors may want to consider locking in some gains.

SELL – Kogan.com (KGN)

The share price of this online retailer rose from $4.33 on June 1 to reach $6.65 on July 27. The shares were trading at $5.78 on August 17. The company is up against households struggling to meet higher mortgage repayments, rents and soaring cost of living expenses. The share price may be pressured down from here if consumers reduce their spending.

Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

BUY – James Hardie Industries PLC (JHX)

This building products supplier released a bumper June quarter result. JHX bolstered margins through price rises and cost reductions. Adjusted net income jumped 13 per cent to $US174.5 million to beat guidance on an adjusted EBITDA margin of 29.2 per cent. North America was a standout in the result, which positions James Hardie to be a major beneficiary in any revival in US housing activity, as interest rate cuts appear on the horizon.

BUY – Collins Foods (CKF)

This KFC and Taco Bell operator is showing signs of good momentum in the first months of fiscal 2024. Future earnings should rise in response to customers increasing their average transaction spend. Collins Foods is poised to benefit from improving customer momentum in Australia and Europe on the back of strong value offerings. Management even hinted at inflationary pressures subsiding.

HOLD RECOMMENDATIONS

HOLD – Nine Entertainment Co. Holdings (NEC)

Nine is a diversified media giant and its assets are difficult to replicate. Nine continues to lift market share, highlighting the quality of its assets and solid execution strategies. The digital transition has been impressive, improving the quality of its product delivery. An ongoing share buy-back program is enhancing the long-term value of Nine’s offerings.

HOLD – TPG Telecom (TPG)

Vocus Group has made an indicative, highly conditional and non-binding offer to acquire some of TPG’s enterprise, government and wholesale assets and associated fixed infrastructure assets, including Vision Network, for about $6.3 billion. A successful offer would enable TPG to focus on its more profitable customer offerings, while also reducing debt. Vocus has been granted a period of exclusive due diligence. It’s uncertain whether a transaction will proceed.

SELL RECOMMENDATIONS

SELL – Adbri (ABC)

Adbri produces construction materials and lime. Australia’s commercial property market is under pressure from escalating capital costs and sluggish demand for floor space, leaving investors wary about property developments. Facing higher operating costs amid intense competition for new contracts can potentially put pressure on margins, cash flow and earnings, in our view.

SELL – Magellan Financial Group (MFG)

A fiercely competitive funds under management industry is putting management fees under pressure. Rising bond yields and weaker asset prices present challenges for the industry. In July 2023, MFG experienced net outflows of $400 million. We expect MFG’s share price to remain volatile in the next 12 months. We prefer other stocks at this stage of the economic cycle.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.