Braden Gardiner, Tradethestructure.com

BUY RECOMMENDATIONS

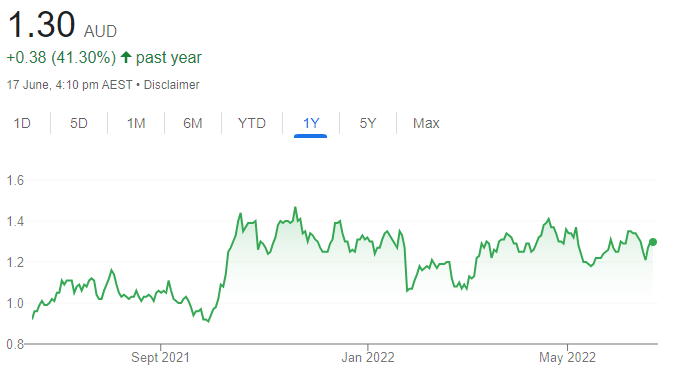

West African Resources (WAF)

This unhedged gold producer is one to watch in this uncertain market, as buyers continue to brush aside recent selling pressure. The share price has risen steadily from lows around 40 cents in March 2020 to trade at $1.265 on June 16. My technical analysis suggests that if it can hold above support at $1.15, then buyers will continue to push the stock higher.

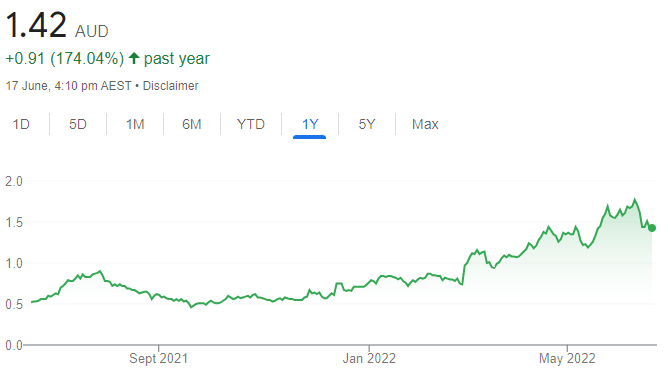

Core Lithium (CXO)

Shares in this emerging lithium producer have risen from 63 cents on January 4 to trade at $1.23 on June 16. I expect recent good news on the company’s advancing Finniss Lithium project near Darwin to provide further buying support. In my view, the long term uptrend looks set to continue if the share price can consolidate and hold above $1.19. Keep an eye on the price.

HOLD RECOMMENDATIONS

Grange Resources (GRR)

Grange produces iron ore pellets. The share price has enjoyed a stellar run, rising from 54 cents on September 13, 2021 to trade at $1.515 on June 16. Some investors may be tempted to cash in gains on what may appear to be an extended share price. But, from my technical analysis point of view, the company’s share price suggests more gains for those willing to accept risk.

Terracom (TER)

This explorer and developer of diversified coal products is forecasting sales of 2.3 million tonnes in fiscal year 2022. The share price has risen from 20 cents on January 28 to trade at 77.5 cents on June 16. The recent surge in coal prices, on the back of several miners experiencing production problems, should support higher prices. Investors could be forgiven if they locked in some profits at higher levels.

SELL RECOMMENDATIONS

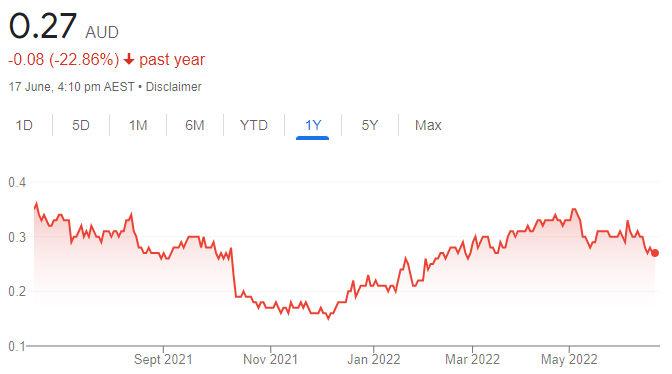

Strike Energy (STX)

The share price of this on-shore gas explorer rose from 15.5 cents on December 1, 2021 to 35 cents on May 4, 2022. The shares have since been struggling to breach 35 cents, so my technical analysis suggests the price will remain under pressure – at least in the short term. The shares were trading at 28 cents on June 16.

Jumbo Interactive (JIN)

This online lottery business has struggled to attract enough buyers since late March this year. The share price has fallen from $19.50 on March 23 to trade at $14.22 on June 16. I expect share price pressure to continue in an environment of rising interest rates and cost of living expenses.

Toby Grimm, Baker Young

BUY RECOMMENDATIONS

James Hardie Industries PLC (JHX)

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

The stock has materially underperformed in 2022 compared to domestic peers that have been favoured on a relatively stronger outlook. Shares in this building materials company have fallen from $56.80 on January 4 to trade at $30.57 on June 16. However, we believe the shares have been oversold, and price weakness provides an opportunity to gain exposure to a global leader at relatively attractive prices.

Aristocrat Leisure (ALL)

This gaming company posted an interim result that was above expectations. Operating revenue of $2.745 billion for the six months to March 31, 2022 was up 23.1 per cent on the prior corresponding period. Net profit after tax of $530.7 million was up 46.5 per cent. A strong balance sheet underpins share buy-backs in a company we believe offers appealing value at current levels.

HOLD RECOMMENDATIONS

Codan (CDA)

Codan makes metal detectors and communication equipment. Codan’s recent update builds confidence that its metal detector business has stabilised under new chief executive Alf Ianniello. Other divisions continued to exceed expectations, so we believe the stock offers growth in information technology.

Pro Medicus (PME)

This medical imaging software provider was recently trading on a lofty price/earnings multiple above 100 times. The high multiple reflects the company’s ability to score new contract wins. PME is susceptible to rising interest rates, but we feel its structural advantages justify the risk of holding at least until there’s a reason to doubt management execution.

SELL RECOMMENDATIONS

Adbri (ABC)

ABC, formerly Adelaide Brighton, is a construction materials and industrial mineral manufacturing company. The company has outperformed its peers, partially in response to a buoyant mining sector earlier this financial year. We expect a softer domestic construction outlook, so investors may want to consider other options at this point in the cycle.

GrainCorp (GNC)

Another bumper winter crop is expected, and supply disruptions are creating trading opportunities in this diversified Australian agribusiness. In our view, the company’s strong performance is likely to continue at least until the end of this financial year. But the agricultural industry is cyclical, so investors may want to consider taking a profit.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

Macquarie Group (MQG)

This diversified financial services group plans to increase the interest rate it pays on everyday transaction accounts to 1.50 per cent, a premium of 145 basis points to the average market rate. After disrupting the home loan market in recent years, this could have an impact on the deposit market if it gains traction.

REA Group (REA)

This digital advertising group specialising in property is targeting double-digit revenue and EBITDA growth through the cycle. This will require higher investment spending. Capital expenditure guidance was increased to between 7 per cent and 9 per cent of sales. The historical average is between 6 per cent and 8 per cent. In our view, listing headwinds are likely to persist, although double-digit yield growth should act as a key offset.

HOLD RECOMMENDATIONS

Tabcorp Holdings (TAH)

This gambling company has agreed to pay Racing Queensland and the Queensland Government a combined total of $150 million to a settle a long legal dispute over betting taxes. The settlement is conditional upon the Queensland Government implementing wagering tax reforms that Tabcorp says will level the playing field between it and online bookmakers.

Wesfarmers (WES)

We noted from a strategy day that its resilient retail divisions can manage inflationary pressures and cost of living increases. We also noted powerful tailwinds to earnings from the chemicals, energy and fertilisers (CEF) division, generated by global gas and ammonia prices. We have increased our CEF sales forecasts by 5 per cent in fiscal year 2022 and by 2.9 per cent in fiscal years 2023 and 2024 to account for the strong near-term earnings outlook.

SELL RECOMMENDATIONS

Worley (WOR)

Positive indicators emerged at Worley’s 2022 investor day. We recognise the improving business conditions, which are reflected in our revised earnings forecasts. But we believe global investors remain reluctant to explore. Production companies are reluctant to commit to large-scale growth projects, which are also incurring a higher cost of debt. This could be detrimental to Worley’s traditional hydrocarbons business, in our view.

Challenger (CGF)

This investment manager recently re-affirmed a pre-tax profit towards the upper end of its $430 million to $480 million range for fiscal year 2022. In our view, Challenger is a high-beta stock, operating in a volatile economic environment. We prefer other stocks at this point in the cycle.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.